COUNTY REFORM.

THE establishment of County Boards, elected by and responsible to the rate-payers, has been repeatedly recommended in this jour-

nal, in order to relieve Parliament from the Private Bill business, which is so fruitful a source of jobbing, and a grand cause and apology for neglecting the duties properly belonging to the Impe-

rial Legislature. If the proposed Councils served no other pur- pose besides this, it would be worth while to establish them ; but the truth is, that they are required nearly if not quite as much for the management of that portion of the county business which now devolves upon the Unpaid Magistracy. It is generally allowed that the present, system needs reform. Its abuses are familiar to most of our readers; but a few facts will serve to refresh their memory, and perhaps quicken their exertions to obtain redress.

County-rates are levied for a variety of purposes,—for the con- struction and repairs of shire-halls, bridges, gaols, and houses of correction; for the prosecution and support of prisoners; for main- taining the families of militia-men; for payment of salaries to treasurers, clerks, chaplains, and • other county officers ; for the erection of lunatic asylums, and other matters specified in about fifty Acts of Parliament.* County rates arc imposed, and their proceeds managed, by the Magistrates at Quarter-sessions. These functionaries are virtually irresponsible, and act as if they were so. The public has no con-

trol over them. It was said by Lord ELDON, that if a Justice abstained from giving a reason for his acts, it would be almost

impossible to make him accountable. The expenditure is checked by the Magistrates; whose signature is all that the County Trea- surer need require to his annual statement of receipts and pay- ments. The rates are voted and their disposal regulated by a coterie sitting when it suits their convenience, generally with closed doors.

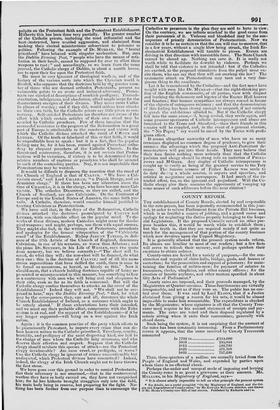

Such being the system, it is not surprising that the amount of the rates has been constantly increasing. From a Parliamentary return it appears, that the sums received by County Treasurers amounted

In 1793 to £18-1,080 1803 235,844 1813 .510,730 18:23 571,108 1833 757,238 Thus, three-quarters of a million are annually levied from the People of England and Wales, and expended by parties upon whom there is no effectual check.

Perhaps the.unfair and unequal mode of imposing and levying

the County-rates is as great a grievance as their amount. Mr. MULLINS, in his Magistracy of England, says- " It is almost utterly impossible to tell on what principle the present system • For details, see a useful pamphlet "On the Magistracy of England, and the Ori- gin and Expenditure of County-rates," by Mr. EDWARD MULLINS, solicitor, and drawer of Dlr. Ileux's County-rate Bill of last session. Published by Richards and Co.

of rating rests. It ought, however, to be upon the annual value of property for the time being; but it will be seen that the valuations now acted upon are by no means uniform throughout the country, as appears from the Report of the Com- mittee of last year on County Rates, whereby it may be seen that the valuation

Is made in

18 counties on the Property.tax, 20 ditto on the actual value, or some proportion thereof, 13 ditto not known,

1 ditto on the 12 Geo. II. c. 29.

52 counties.

"The valuation upon which the County-rate islevied varies extremely in slit% ferent counties. In some it is so ancient that its origin and date are lost ; in others it was fixed more than a century ago, and bears with most unequal pres- sure on different parts of counties. " It appears (said Mr. Hume, in his place in Parliament), by all the evi- dence taken before the Committee, that thete are no regular rules as to the mode of assessing in various counties, and that it varies in each, and very often there are several methods pursued in the same county.'

"6 Under the general provisions of the statute .7s.) Geo. HI., or tinder Local Acts, valuations have at different times been made in several of the counties. of England and Wales, with the view of equalizing the proportions in which the property of the different parishes should be assessed to the County-rate. " In seven counties of Wales there is no valuation ; but the assessment is ac- cording to an apportionment to each hundred, made from forty to ninety years ago. In one of those counties, it is staled, that many thousand acres of land have been enclosed since the period of valuation, but that no alteration has been made in consequence of such enclosures.

" It often happens (continued Mr. Hume), that in many counties large masses of property are never assessed for the purpose of local taxation ; and that while the owners of such property detived all the benefits from the County- rates which the persons who contributed to it did, they did not pay any thing to it. It was utterly impossible that justice could be done under such a system, when inequality prevailed to such an extent. This inequality prevailed to a great extent in the County of Middlesex, and also in all the parishes in the neighbourhood of the Metropolis.' As an illustration of this, the honourable Member read the following statement of the unequal assessments of the Metro- politan districts. Acton contributed two-thirds of rack rent.

Barnes net value.

Battersea full, or rack-rent.

Chelsea ditto.

Christ Church, Sorry two-thirds of ditto. Clerkenwell something less than rack-rent.

Fulham five-sixths of assessment.

Greenwich four-fifths of rack--rent.

Kensington nine-tenths of ditto. Mile-end Old Town three- fourths of assessment.

Paddington four-fifths of ditto. Penge "c. Gd. on 1/. on assessment. Poplar seven-tenths of rack-rent. Putney between three-quarters and seven-eighths of rack-rent.

Ratcliff seven-eighths of rack-rent. St. Anne, Litnehouse two-HM(1s small and four-fifths large houses.

St. Anne, Westminster four-fifths.

St. Mary, Stratford Bow seven-eighths."

Room would fail us if we attempted to exhibit the details of mismanagement of expenditure ; which, however, we recommend those who take an interest on the subject (and it nearly concerns every rate-payer) to examine in Mr. MULL INs'S pamphlet. The Commissioners appointed in 1834 for Inquiry into County- rates, recommend, in a Report published on the 16th of June last, that the power of Magistrates at Quarter-sessions to try prisoners on indictment, shall be transferred to local courts, with ambula- tory judges, who shall go circuits every six weeks ; that payment by fees shall be abolished; that a rigid system of checking the expenditure shall be adopted, a new valuation of rateable property be made, and County Councils established. This plan, or some- thing like it, appears to be approved of by Sir CULLING EARDLY SMITH, Chairman of the Hertford Board of Guardians ; who has recently addressed some letters on the sujbect of County Reform to the Hertford Reformer. Mr. Humes bill of last session pro- poses that the rate-payers shall elect an independent Council in every county, for the better management of County-rates.

But, when legislating on this subject, we think that the busi- ness should not be done by halves. It would be far better to establish County Councils elected by the rate-payers, not merely to manage County-rates and perform many other functions of the existing Unpaid Magistracy, but also to relieve Parliament from the Private Bill business. The time, we think, is fast corning, when the public will see the necessity of some such system of local legislation as prevails in the United States. There would be little difficulty in avoiding the disadvantages and securing all the bene- fits which the State Assemblies in America confer upon the people of that country.

Previous page

Previous page