Investment Notes

By CUSTOS

TIIE slide in equities goes on and the constant stream of new issues is as powerful a deter- rent to bullishness as Mr. Khrushchev Of the latest I would pick the ROSS GROUP as the most interesting and speculative. It has been ex- panding at a furious pace, especially in frozen foods, and its recent acquistion of Sterling Products was the cause of the present issue of three for ten shares at 15s. (the fourth rights issue in the last four years). Its diversification seems to be well planned—it is now a group of 125 companies—but it is surely time to settle down now and consolidate. At 20s. the yield Ix 5.4 per cent. The merger planned between VINE PRODUCTS, SHOWERINGS and min-Ewan el'ora is a logical one, but the terms will not Please the shareholders of Vine Products, for their shares fell immediately by 3s. 6d. As Showerings's profits fell sharply last year while VP profits rose, it seems to be a one-sided affair. But together the merger company should do Well and if its new shares start at 15s., offering a dividend yield 5.8 per cent. on the estimated .171 per cent. dividend, they should prove a good Investment.

Bad and Good Reports

Of the recent bad reports the worst perhaps Were NATIONAL CANNING and Pye and E. K. Cole, now merged as BRITISH ELECTRONIC INDUSTRIES. The latter was due to the heavy loss made by E.K. Cole, mainly in television. I suggest a switch from National Canning into WHITBREAD, which has just reported a 44 per cent. jump in gross profits. Its 'A' shares at 31s. yield 4.3 per cent. From BEI I suggest a switch into two 'recovery' shares -----cric and ATV. There may be no hurry to buy GEC, which will be lucky to escape a 'rights' issue in view of its large overdrafts, but the ac- quisition of a first-class management in Radio and Allied should enable GEC to pick up well in the consumer end of its business. On the re- sults for the first four months the directors ex- Peet to see an improvement in the year's profits, which would not be difficult by comparison with the poor results last year. At 29s. Od. GEC yield 7.1 per cent. ATV have just reported a 20 per cent, increase in net profits and raised the divi- dend to 60 per cent. Its business is not confined to the UK and a further expansion this year is expected, particularly on the sale of pro- grammes to USA. The accession of Sir Robert Renwick to the chair may augur well for the future. At 30s. 6d. ATV yield as much as 9.7 per cent. and this seems to discount the worsening Of terms when the Government revises the ITV Contracts in 1964.

Growth Tests

. Brokers are pouring out their special calcula- tions showing the rate of growth for select e_quities. I find them unnecessarily complicated. the latest I have seen takes the past performance .e.t., gross earnings per share and then projects compound rate of growth into the future. Ills final figure gives the number of years it

will take to make up the present share price if earnings per share grow year by year at this compound rate of growth. But how dangerous to project growth into the future when the Government every two years stops growth for the next year or so by dear money and interest squeezes. The sensible course for an investor is to take the earnings yield on the last results and use his common sense. Certainly express this earnings yield as so many years' purchase (what the Americans call the price/earnings ratio). Here are a few examples which 1 believe to be sound purchases, although there is no hurry to buy them in these reactionary markets.

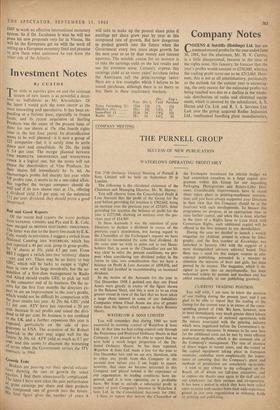

Price Div.%

Div. Yield

Year's Purchase

Times Furnishing 5/- 13/6

Di

5% 134 Distillers 10/. 37/- 144 3.9% 12 Stone-Platt Cl 53/6 16 5.9% 101 Ranks 10/- 28/- 14 4.9% 91

Previous page

Previous page