MR. GOULBURN'S NEW WAY TO PAY OLD DEBTS.

IT is; not a little curious to mark by what different plans an individual and a nation seek to manage their difficulties. The former makes it a regular study to pay nothing. at all—or as little as possible, if the pleasanter way be impracticable ; but the latter has quite another guess mode of doing business. Having got fairly over head and ears beyond all possibility or prospect of emancipation, the nation gallantly resolves, if it cannot be honest, at least it will not be wise ; and there- fore, while it leaves ninetv-nine hundredths of its debtors unsatisfied, it hands over to the remaining fraction twenty-five shillings in the pound. The Chancellor of the Exchequer gave us a fine example of this process the other day. There were two objects to be compassed —to fund three millions of Exchequer Bills, and to pay oft' three mil- lions of Funded debt. One might have thought that the easiest plan was to buy the bills at once ; • and so it was; but if the direction of the state were gone about in such a way, what credit would accrue to the directors ? Any man may do an easy thing, and understand it also. Besides, buying the bills would have been attended with no ex- pense; and not to spend, is of all things the most ungenteel in a Finance Minister. The Chancellor has properly avoided this vulgarity. As in these cases the expense and the honour are equal, it is but fair to show the exact amount of the one, that the other may be properly estimated.

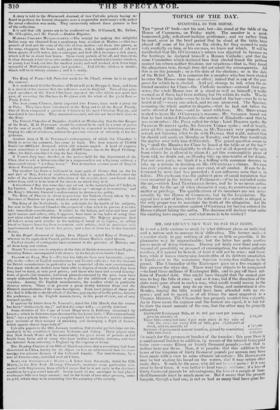

£3,000,000 Exchequer Bills, at 31. 10t1. per cent per annum,

give an annuity of 91,250

These bills converted into * 4 per cent stock at the rate of

1011. 10e. steel; for every 100/. of bills, give £3,013,000 of

stock, and an annuity of . . . . . £ 121,800 Increase of permanent annual taxation, gained by converting

bills into stock

',c) much for the permanent burden of the transfer: this year 'til0;efis a small casual burden in addition, by reason of the interest being paid twice over—some fifteen or twenty thousand pounds ;—but that. is neither here nor there. Now, it is possible that this addition to the taxes of the kingdom of thirty thousand pounds per annum may have been made with a view to some ultimate advantage : Mr. GOULBURN may be but casting his bread on the waters, that it may return after many days. If such be the case, why did not he ceist more ? If it was good to fund three, it was better to fund twenty millions; if a loss of thirty thousand pounds be advantageous, the loss of a couple of hun- dred thousands must be much more so. But it seems that the present bargain, though a bad one, is not so bad as many that have gone be- fore it: here there was but. a bonus of thirty shillings, and formerly the bonus used to be three times thirty I—Oh, John Bull ! John Bull !

otrowling grumbling John Bull! if thy heart be not as hard as heart e of oak, and thy pate as soft as thy paunch, down on thy marrow-

bones, and bless the Lord that the present Chancellor of thy Exche- quer is not so great a fool by full two-thirds as the last was!

Previous page

Previous page