Account gamble

Buy Higgs ei Hill

John Bull

In some ways, I always feel guilty about selling short. After all, should fears be expressed that a group is going bankrupt, regardless of the hundred of unemployed this might create, it effectively means I should be much better off. The worst news is then always the best news except, of course, if the shares are actually suspended.

Last week's recommendation to sell BP short was thus well timed. God forbid that I do anything but deplore the murder of Israelis at the Munich Games (or anywhere else for that matter) but as a direct consequence of fears of a flare-up in the Middle East, oil shares dropped sharply. I am sure that when BP's figures are commented on such remarks as "the troubles in the Arab world must be worrying for the group" will further depress the shares.

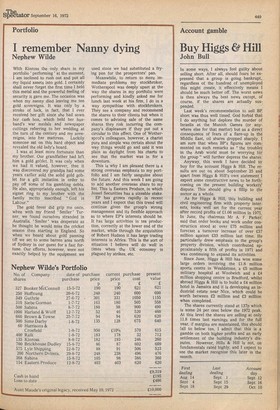

Anyway, this week I have decided to buy for the account Higgs & Hill. The results are out on about September 25 and apart from Higgs & Hill's own statement I expect some constructive news to be forthcoming on the present building workersi dispute. This should give a fillip to the sector as a whole.

As for Higgs & Hill, this building and civil engineering firm with property interests, looks well set for the current year after record profits of £1.06 million in 1971. In June, the chairman Mr A. F. Parker; said that order books and work under construction stood at over £75 million and forecast a turnover increase of over £37 million against £33 million last time. He particularly drew emphasis to the group's property division, which contributed approximately a fifth of profits in 1971 and was continuing to expand its activities.

Since June, Higgs & Hill has won some large orders involving the £1.8 million sports centre in Wealdstone, a £5 million military hospital at Woolwich and a £4 million shopping centre in Bradford, whilst abroad Higgs & Hill is to build a £4 million hotel in Jamaica and it is developing an industrial estate near Nice, which could be worth between £2 million and £3 million when completed.

The shares currently stand at 137p which is some 24 per cent below the 1972 peak. At this level the shares are selling at only 11.8 times last earnings and for the full year, if margins are maintained, this should Fall to below ten. I admit that this is a gamble on both higher profits and an early settlement of the building industry's disputes. However, Hills & Hill is not, on fundamentals rated highly, and I expect to see the market recognise this later in the month.

Previous page

Previous page