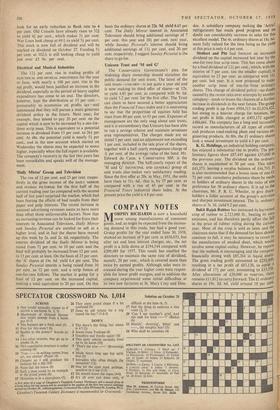

COMPANY NOTES

MORPHY RICHARDS is now a household name among manufacturers of consumer goods, and, as might be expected from the increas- ing demand in this trade, has had a good year. Group profits for the year ended June 30, 1958,' showed an increase of 9 per cent, at £656,033, but after tax and loan interest charges, etc., the net profit is a little down at £194,544 compared with £209,489 for 1957. This result has enabled the directors to maintain the same rate of dividend, namely, 20 per cent., which is covered more than twice by earned profits. Although sales were in- creased during the year higher costs were respon- sible for lower profit margins, and in addition the company experienced some initial difficulties at its two new factories at St. Mary Cray and Dun- dee. A subsidiary company making the 'Astral' refrigerators has made good progress and no

doubt can considerably increase its sales for this excellent model. The 4s. ordinary shares at 18s. 6d. seem fully valued for the time being as the yield at this price is only 4.4 per cent.

Stothert and Pitt had forecast an increased dividend on the capital increased last year by the one-for-two free scrip issue. This has come about by a final dividend of 121 per cent., which, with the interim of 5 per cent. (on the smaller capital), is equivalent to 25 per cent. as compared with 113 per cent, last year. It is now proposed to make another scrip issue of one-for-three ordinary shares. This change of dividend policy-no doubt caused by the recent take-over attempts by another company-tends to lessen the chances of a further increase in dividends in the near future. The group trading profit is up from £904,311 to £1,024,422, but owing to a heavier charge for taxation, the net profit is little changed at £493,172 against £486,661. The company has a long and successful record as manufacturers of all types of cranes, and produces road-making plant and various en- gineering products. At 80s, the £1 ordinary shares look a sound investment to yield 6.3 per cent.

K. G. Holdings, an industrial holding companY, has enjoyed a substantial rise in profits. The pre- liminary figures show £87,445 against £55,000 in the previous year. The dividend on the ordinary shares is maintained at 30 per cent. This takes £43,373, leaving a surplus balance of £46,793. it is also recommended that a bonus issue of one 71 per cent. cumulative preference share be made to holders of ordinary shares in the ratio of one preference for 50 ordinary shares. It is up to the chairman, Mr. P. R. U. Wheeler, to give share- holders a fuller account of the group's activities and sharpen investment interest. The Is. ordinary shares at 3s. 3d. yield 9.2 per cent. . Ilukit Rajah Rubber has increased its harvested crop of rubber to 2,723,000 lb., beating its own estimates, and has therefore partly offset the fall in the price of rubber ruling during the current year. Most of the crop is sold as latex and the chairman states that if the demand for latex should continue to fall, it may be necessary to revert to the manufacture of smoked sheet, which would involve some capital outlay. However, he reports that the outlook is encouraging and the companY financially strong with £85,264 in liquid assets. The gross trading profit amounted to £231,44 resulting in a net profit of £83,120, to cover a dividend of 174 per cent, amounting to £33,558' After allocations of £20,000 to reserves, the remains £11,812 to carry forward. The £1 ordinary shares at 19s. 3d. xd. yield around 18 per cent'

Previous page

Previous page