Investment Notes

By CUST.OS OMING back to the stock markets after a k_ishort break, one is. amazed at their firmness in the face of the political shocks overseas. The boom in Wall Street is, of course, a help—the strength of the American market has been largely responsible for our rising exports and fair trade returns—but there is a growing recog- nition that on a comparison of price-earnings ratios many leading British equities compare favourably in price with American. I have before Me a useful brochure from a leading Stock Ex7 change firm giving price-earnings ratios under corporation tax at 35 per cent and at 40 per cent. It is surprising to find many 'blue chips,' selling on a p/e ratio not much over ten.

Hire-Purchase Finance Unlike the joint stock 'banks, whose soaring profits I referred to two weeks ago, the hire-pile- chase finance companies have 'been badly hit dearer money. Although Bank rate came down to 6 per cent in June, this did not result in al equivalent fall .in the cost of their 'deposit' borrowing. In fa" ct, as one firm of brokers poi4 out, they have had to pay up to 71 per cent, fer their 'deposit' money, which now accounts foi' 80 per cent of their total borrowings. And ttfek have not been able to absorb this,steep increases in their finance costs by enlarging their businegl, for ,they have been required by the Bank Of England to limit their expansion in the year 1,0 April 1966 to 5 per cent above the previous yea( The. last returns of hire-purchase debt showed that the total had fallen for the first time in two years. So it is premature to,buy hire-purchise finance shares for recovery until Bank rate comes down to 5 per cent and the government restrict lion on advances is removed.

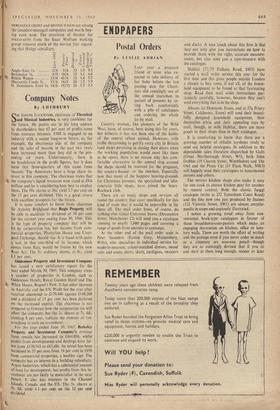

Hire-Purchase Finance Shares The hire-purchase finance companies are, how- ever, surprisingly cheerful, for they found that the recent interference by the Board of Trade in their business did not stop the flow of new business. The down payment on cars was raised from 20 to 25 per cent in June and in July the maximum repayment period was reduced from three to two and a half`years. The adverse judg- ment of the Restrictive Practices Court that trading rule of the RIA code (binding members not to pay more than 20 per cent of the finalce charges in commission to motor dealers) is against the public interest—is not expected to result-in more cut-throat competition. Higher commissioug are likely to be paid only in defending existing business, not in grabbing it, as long as, :thie Callaghan restraint on expansion holds. ,The market in hire-purchase finance shares has seen some recovery, but I still think that investment caution is required. The Bank of England. may yetrtry to limit the ,credits given to finance Coni- pany subsidiaries by their parent joint 'stock banks. The brokers I have quoted believe that MERCANTILE atnorr and BRI I ISI I WAGON are among the soundest-managed companies and worth buy- ing even now. The provision of finance for ANGLO-AUTO from the Isaac Wolfson banking group removes much of the market fear regard- ing that Hedge subsidiary.

.1111aq

2 Anglo-Auto Is. 2/6 Bowmaker 5s. 8/9 British Wagon 33/6 Mercantile Credit .5s. 13/6

U. Dominions Trust 5s 14/6 a'

3/6 10/6 41/6 16/9 18/71

6-

35 15 12 20 20.

!?-1 1.0 1.1 1.4 1,2 -1.5

9.3 6.8 5.7 5.9 5.3

Previous page

Previous page