ANALYSIS OF EXISTING TAXATION.

THE CUSTOMS.

CUSTOM-DUTIES seem coextensive with society. They are levied wherever there is a governor. The presents which the pettiest African chieftain exacts from a traveller, or (as he persists in considering the tourist) a trader, are in reality an arbitrary duty on commodities in- wards. The Customs are amongst the oldest, or perhaps the oldest, of English taxes. As those who are entirely ignorant of the principles of taxation suppose that all imposts fall upon the persons who pay them in the first instance, the "wisdom of our ancestors" delighted in Cus- tom-duties, upon the principle of taxing the exorbitant profits of mer- chants, who were often Jews of no very good conduct, and most as- suredly of indifferent reputation. Owing to this notion, which was equally received by King and People, the nation was willing to submit to heavier and more numerous impositions than they would have borne in any other form. With the growth of commerce additional articles became subjected to duties; and the duties themselves were increased, or rather added to, from time to time ; so that the old Customhouse re- gulations were of the most complex and troublesome kind, one article being subjected to three or four successive imposts of various rates. The propriety of simplifying the laws and reducing the number of ar- ticles subjected to duty, was suggested by ADAM SMITH in his Wealth of Nations; and PITT soon afterwards brought in a bill, by which the former complex duties were abolished, and one duty only imposed upon a commodity. In 1803, the great economist's recommendation (of which WALroLE's celebrated Excise scheme seems to have first sug- gested the idea) as to the establishment of the Warehousing system, was carried into effect. Up to 1812, the principal remuneration of the offi- cers was derived from fees. There were also several noble Do-nothings,* who " took no part in the official duties, but merely exercised the right * The first Earl of Liverpool was Collector Inwards. The late Duke of Manchester was Collector Outwards. The Duke of Newcastle, and afterwards the Earl of Guildfonl. Comptroller Inwards and Outwards. Lord Stowell, Surveyor of Subsidies and Potty Custom. of appointing deputies and clerks." In that year, a great improve- ment was made, patent offices and fees being abolished. A slight mo- dification of the prohibitive plan, and with it several other improve- ments, took place under Mr. Husitissosi and Lord GODERICH. But the first systematic attempt to confine the Customs, like the Excise, to a few articles yielding'a large amount of duty, was made by Mr. POULETT THOMSON, last summer, in his admirable Customs-duties Bill.

That lie will proceed in his career of fiscal reform, is earnestly to be hoped. Though involving much useless expenditure on the part of the public, creating great inconvenience and expense to merchants, and very mischievously interfering with the manufactures of the country,-though diminishing our foreign, and by consequence our home trade, and use- lessly raising the prices of an infinite number of productions,-the chandler-shop system has existed so long, and its ramifications are so extensive and so removed from the public knowledge, that people are in a measure reconciled to the mischief. Nor are the motives to remedy it very considerable. A Minister is assailed by no clamour-he is tor- mented by no deputations upon this subject-a bill to simplify the Customs-duties would gain him nopopularity out of doors, and, in the Unreformed House, scarcely a patient attention within. On the will, therefore, or even on the ability of the Government in general, we have little reliance; our trust upon this matter is in the right honourable Member for Manchester. No one is better acquainted with the evil, no one is more competent to apply a remedy. If he be properly sup- ported by the Trading interests in the House, and not shackled by the ignorance or via inertice of his colleagues, we look forward to a speedy introduction of one of the most important commercial measures that has yet been submitted to Parliament.

As regards Imports, the Customs may be classed into three divisions Articles producing but small amounts; 2. Protective Duties; 3. Commodities in general use, yielding a considerable revenue. The two former divisions have been already discussed at such length under the- heads of the Protective System and the Cost of Collection, that we shall chiefly confine ourselves to CUSTOM-DUTIES IMPORTANT IN POINT OF REVENUE;

Which are embraced in the following Tables, classed under the heads to which they appear respectively to belong.

TAXES ON ARTICLES IN THE LATEST PRACTICABLE STAGE OP THEIR PROGRESS TO THE CONSUMER.

1. LUXURIES.

The taxes upon the luxuries-or, in some instances, the comforts- enumerated in the following Table, are perhaps the most proper duties that can be imposed. They do not interfere with the process of any manufacture, very little with trade; and, as they undergo no transmuta- tion before they reach the consumer, he pays as few profits upon the duty as is possible in the case of an indirect tax. Many of the rates are, however, much too high ; and should be lowered, not only for the benefit of the consumer, but of the revenue. We have already dis- cussed the question of Spirits and Tobacco. Though Wine is a very proper subject.for taxation, and is not smuggled, yet there is little doubt that a lower rate of duty would yield as large or a larger revenue ; es- pecially if it could be made an ad valorem tax,-for, at present Cham- pagne or Burgundy pays no more than the cheapest or the commonest wines. . The invariable increase or diminution of the consumption of this article with the increase or diminution of the tax, establishes the probability of an increase beyond a doubt. Again, there is no reason why Currants should be subjected to a higher duty than Raisins, or, in- deed, why both should not be reduced ; for even if the consumption on each article did not immediately increase in proportion to tile reduction, the sum yielded by either is too small for a trifling deficiency to be of any importance. The duty on Oranges, when taken by the cubic size of the box, is less than either by tale or value ; but in any way it is much too high, and should be reduced. If the produce fell short, upon the reduction, it bad better be remitted altogether.

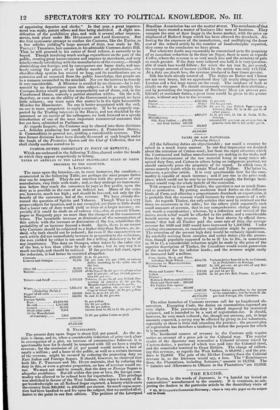

C =tants £330,339 21.4s. 4d. per cwt.

Lemons and Oranges 07,181 751. per cent. 15s. per 1,000, or various

duties according to the cubic size of the box.

Olive Oil 61,241 8!. 8s. per ton. Raisins 173,099 of the Sun, 2/. 2s. Ed. per ewt..or any Miter sort 11. per cwt .. of any British posses- sion 10s. per cv. t.

Tobacco and Snuff 2,960.323 Tobacco, 3s. pet. lb. of any British Pos- . sessions in America Os. Od. per lb., Manufactured or Segars N. per lb.

Wines 1,535,480 5s. 6d. per gallon, the pro lure of the (Protecting Duties.) Cape of Good Hope Os. 2d. pt.r gallon.

Pepper of all sorts 102,638 from Is. to Is. Ed. per lb.

Molasses 156,881 9s. and 1!. 3s. 9d. per cwt.

Foreign Spirits, Ruin £1,629,880 9s. per gallon.

Brandy 1,385,166 22s. Gd. per gallon. Geneva 26,892 22s. 6d. per gallon. Of all other sorts 9,504 various from Ss. Gd. to U. 10s. per gallon. Of the Manufacture

of Guernsey 7,612 7s. Gd. per gallon (same as gin). 3,069,054 £8,452.238

2. NECESSARIES.

The present duty upon Sugar is about 21c1. per pound. As the ar- ticle is cheap, and as, when a considerable reduction of price took place in consequence of a glut, no increase of consumption followed, it is questionable how far it should be tampered with till we have a surplus revenue ; for the remission of .d. per pound would involve a loss of nearly a million ; and a boon to the public, as well as a certain increase of the revenue, might be secured by reducing the protecting duty on East Indian and Foreign Sugars. It should, however, be observed that both Mr. P. THOMSON and Mr. HUME maintain, that by reducing the duty in this, or even a greater proportion, no loss of revenue would en- sue. We must not omit to remark, that the duty or Foreign Sugars is altogether prohibitive. But till within this year or two, the foreign com- modity was allowed to be refined here for exportation. This privilege was abolished in favour of the West Indians, who enjoy a bounty of 8.9. per hundredweight on all Refined Sugar exported, a bounty which costs the country from 300,000/. to 400,0001. per annum. So much vague asser- tion had been bandied to and fro upon the subject, that we omitted all al- lusion to the point in our first edition. The petition of the Liverpool

.4.01,••■

Brazilian Association has set the matter St rest. The mefehants Orthae society have treated a matter of business like men of business. .They

compare the cost of Raw Sugar in the home market, with the price on shipboard of Refined Sugar which has been allowed the drawback. Al.. lowing for the expenses of the manufacture, and multiplying the lesser cost of the refined article by the number of hundredweiyhts exported, they come to the conclusion we have given. But whatever doubt may reasonably be entertained as to the propriety of an immediate reduction in the duty on Sugar, there is none as regards Coffee, where the revenue is so very much less and the certainty of gain so much greater. If the duty were reduced one half, it is very question- able if much loss would follow ; for when the tax was 2s. per pound, the average amount of income yielded by the article was only 144,725/. At a duty one fourth less, the revenue produced is four times greater.

Silk has been already treated of. The duties on Butter and Cheese are not very heavy, but we apprehend they fall nearly altogether upon London and a few large towns on the coast. The incidence of both is chiefly on the poor. We should strenuously recommend their abolition ; and by permitting the importation of Butchers' Meat (at present pro- hibited) at moderate duties, a great boon would be given to the poorer clases, without any loss to the revenue.

Butter £121,255 1/. per cut Cheese 68,224 10s. Gd..per cwt. Coffee. 583,750 W. roe lb. any British Possessions in America, from 9d. to Is. 3d. per lb. of other places.

Sugar 4,650,538 IL 4s. per cwt, 11. 12s. E. India, 31.3s.,

Manufactures. Foreign. Silk, East Indian ... £24,331 intended 301. per cent. on average but, is

.. not East Indian 140,216 practice front 301. to 501. or 601. per et. 164,547

£5,588,368 TAXES ON RAW MATERIALS. (Protecting Duties.)

All the following duties are objectionable ; nor could a revenue be raised in a much worse manner. In our first impression we doubted about the retention of Cotton-wool; but from the rapid advances which the Continental and Indian manufacturers are making in the trade, and from the circumstance of the raw material being in many states ad- mitted duty free, and Cotton in others being an indigenous product, we should earnestly press the propriety of its repeal. In which case, it seems scarcely worth while to retain Wool and Tallow. The-latter is, however, a peculiar article. It is very questionable how far the com- modity is capable of much increase ; and if any rise in time price took place, which could not be met by an increased supply, the foreign land- owner would reap the whole benefit of the remission.

With respect to Corn and Timber, the question is not so much finan- cial as protective. By putting moderate fixed duties on the different kinds of Corn, and allowing a proportionate drawback on exportation, it is probable that the revenue would increase by three quarters of a mil- lion. As regards Timber, the only articles that need be retained are the three we enumerate in the table ; for the others yield separately such small amounts of revenue, that in any comprehensive change they are not worth a consideration ; whereas, by a reduction and revisal of the duties, much relief would be afforded to the public, and a considerable benefit accrue to the revenue. It has been shown by official docu- ments,* that had all Timber paid the same rate of duty, the average revenue for 1828 and 1829 would have increased by 1,500,0001. Under existing circumstances, an immediate equalization might he premature. The retention of the present high duty would be certainly injudicious. By carefully revising these complex and unfair duties (for the protec- tion, though popularly supposed to be as 2l. los. to 10s., is sometimes as 10 to 1), a considerable reduction might be made in the price of the superior description of Timber, the Canadians would retain possession of the market for the inferior kinds ; and the revenue might easily be increased half a million

Corn, Grain, Meal, and Flour,

including Buck Wheat £544,791 Various duties from Gd. to 5s. on Colonial, MATERIALS OF MANUFACTURES IS. to Prohibitive on Foreign.

Cotton Wool 363,537 5s. 10d. per cwt., 4d. per cwt. of any Bri• tish Possession.

Sheep and Lambs' Wool.. 113.142 id. and Id. per lb. Tallow 144,894 3s. 28. per cwt. Brit. Posses. is. per cot.

Timber-

Batten & Batten.entls.£109,834 Deals and Deal-ends.. 530,639 Fir Timber 8 in. square ' or upwards 465,606

1,106329 The other branches of Customs revenue call for no lengthened ob- servation. Excepting Coals, the duties on commodities exported are vet)' slight. The percentage-duty is indeed imposed for statistical purposes, and is intended to be a sort of registration-fee. It should, however, be very much reduced; for, though not onerous, yet, in large amounts exported, a saving may be effected by giving in low valuations, especially as there is little risk attending the practice : the present plan of registration has therefore a tendency to defeat the purpose for which it is imposed. The Incidental sources of revenue in the Customs only require notice on account of a gross job in the Colonial way. The regular reader of the Spectator may remember a Colonial revenue raised by Custom-duties, a portion of which was paid into the Colonial chest, and the remainder remitted to Great Britain. The charge of collect- ing this revenue, as regards the West Indies, is 68,0001. ; and the pro- duce is 75,0001. The gain of the Mcther Country from the Colonial revenue is, as the Irishman would say, a loss. The " Remittances from the Plantations, including Seizures," amount to 13,2761. The " Salaries and Allowances to Officers in the Plantations" are 19,0101.

Various duties, according to the nature of the commodity, but the basis 21. 151.

4E2,272,493 per load Foreign, 10s. Canadian.

Previous page

Previous page