THE CROWN LANDS.

THE property under the management of the Woods, Forests, and Land Revenues, may be divided into three classes,-1. Estates which yield a rental, like the property of private individuals ; 2. Land which is re- tained for the purpose of growing timber for the use of the Navy; 3. Parks and other pleasure-grounds. To plant timber for public pur- poses, is perhaps one of the few employments in which a State can pro- perly engage, when either the low rate of profit attending the under- taking, or the distant period of the return, deters private individuals from the task. The ?arks which contribute to the personal comfort of the Monarch, or to the benefit of the public at large, few persons would wish to see disposed of. If any do not come under this cate- gory, they should be considered as public property, applicable to public purposes. The following table exhibits a catalogue of " the several Parks and Gardens attached to the Royal Palaces." Whether this in- cludes the whole, we do not know. A statement of the expense for works in 1831 is also added. The salaries, we believe, are nominally. slight; but the lodges, allowances, perquisites, and produce, &c. are of no inconsiderable value. The public income derived from these Parks in 1831, was 5,8761. It chiefly arises from cattle, &c. "taken in to graze."

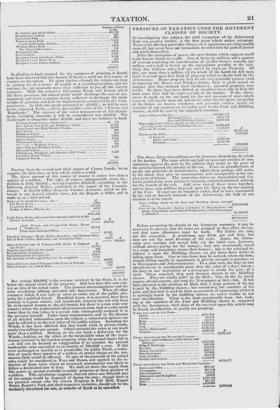

Expense of Works in mat.

St. James's and Hyde Parks £5,745 Kensington Gardens 422 Greenwich Park 690 Windsor Great Park 17,473 Cumberland Lodge Gardens 570 Windsor Home Park . .. 1,030 The Maestricbt Garden 116 Richmond Park 8,630 Kew Gardens

1,8.37

Thunpton Court and Bushy Parks 5,196 Hampton Court Home Park 268 Hampton Court Palace Gardens. 2,630

X44,617

In alluding to land retained for the purposes of planting, it should have been observed that this branch of business need not be a source of expense to the nation. To plant timber-though the returns are long in coming in-is a source of wealth to a second generation, and the cuttings, &c. are generally more than sufficient to ply all the current expenses. With the extensive full-grown Woods and Forests which the State possesses, the annual profit would discharge the cost of ma- nagement, and leave a surplus nearly sufficient to discharge the dead- weight of pensions and debt for improvements contracted by the Coin. missioners. In 1831, this profit amounted to 43,631/. ; as will be seen by the subjoined Table,-which also exhibits a list of the " Forests and Woodlands." The expense of the entire management of this depart- ment, including sinecures, it will be remembered was 23,465/. The deadweight is altogether under 40,0001., and there are balances in hand.

Windsor Forest (Crown Allotments) £ 743 New Forest, New Park, and Parkhouse Forest 18.542 Dean Forest and High Meadow Woods 12,996 Bore Forest 869 Delamere Forest 133 Whittlewood Forest 2,563 Saleey Forest 2,004 Whiehwood Forest ..... ........... ........... 847

Waltham Forest .... . ....... .

782 Alice Ilolt and Woolmer Forest .......... . 1,217 Sherwood Forest.. ...... ......... ..... . ...... ......

Gillingham, Meopham, and Shooter's 11111 Woods......

2,469

Lanercost Priory Woods..

Chopwcll Woods

• • •

464

£43,631

Passing from the second and third classes of Crown Lands, let us examine the first class, or that which yields a rental. The direct amount of this source of income is rather less than a quarter of a million. The sales of estates, unimprovable rents, &c., yielded, in 1831, 89,095/. ; making together 319,6171., according to the following detailed Tables, published in the report of the Commis- sioners. It slightly differs from the Finance Accounts, which we fol- lowed in our general tabular view ; but the Report is fuller, and is made up at a later period.

Rents of the Land Revenue ; viz.-

1451X.760622

Fee Farm Rents 5,602 Leasehold Rents

Profits of Mines, Manors, &c. 4,079

£151,443 Light Dues, Rents, and casual Revenue not included iu Re ceiver's Accounts 13,503 £ 164,951

Quit, Crown, and Composition Rents, Mesno Ireland { Profits, &c 61,900

Fees from abolished Offices 7

61,907

Island of Alderney-Rents, Tithes, Royalties. and Harbour Dues. 79

Isle of Man-Tithes, Quit-rents, and Alienation Fines 3,595

£

230,532

Sales of Estates and of Unimprovable Rents in England £ and Wales 55,092

Deposits upon ditto (to be repaid) 206

For equalizing Exchanges 3,004

Enfranchisement of Copyholds 13.611

On Account of Sales agreed for, but not completed 8.737

80.650

Sales of Estates and of Unimprovable Rents in Ireland 7,554

Sales of Lands, &e., Isle of Man 891

89,095

£319,627

But though 320,000/. is the revenue received by the State, it is far below the annual rental of the property. Still less does this sum con- vey an idea of the actual value. The grossest mismanagement and the

1 most scandalous jobbing pervaded this department. When all other resources failed, it was easy to carve an estate out of the public pro- perty for a political friend. Beneficial leases, it is asserted, have been granted, to a great extent ; and improvable property has not only been let to favoured tenants at the old rentals, but there is a case (not very remote) where the professional valuer assessed some land at a rate much lower than its true value, to a person who subsequently assigned it to the surveyor himself. Under these circumstances, and in the absence of all detailed information upon the subject, a conjectural opinion can only be offered as to the real value of the public estates. Including the Woods, it has been affirmed that they would yield, in private hands, nearly two millions per annum. Others estimate the value at not much more than a million. Making, on the one band, a deduction for the Woods-looking, on the other, at the incalculable value of the rever- sionary interests in the London property, when the ground-leases fall in it will not be deemed an exaggeration if we consider the present marketable value equivalent to an annuity of 700,000/ a year. If this were exchanged as quickly as is practicable for public Stock, a reduc.. tion of nearly three quarters of a million of annual charge,on the per- manent Debt would be effected. Or part of the proceeds of the annual sales might be considered as Ways and Means, and applied to the re- duction of those taxes where an increased consumption was likely to follow a diminished rate of duty. We shall set down the supply from this source at present available to public purposes at three quarters of a million. This calculation supposes, that not above one fifteenth patt of the estates would be disposed of during the year ; though there is no practical reason why the Crown Property in Pall Mall, Regent Street, Regent's Park, and their respective vicinities, should not be inn, mediately advertised for sale, or transfer of Stock to be cancelled.

Previous page

Previous page