FINANCIAL AND COMMERCIAL RELATIONS OF OUR PROTECTIVE SYSTEM.

THE following Tables exhibit the effects of the Protective System in a financial point of view ; the different items being classed wider the leading heads of Important or Unimportant in point of revenue. It will be seen by the subjoined summary, that (exclusive of a variety of minor articles, the duties upon which, though they yield but little to the State, involve the necessity of protection to some manufacture

• This Table is compiled from the materials furnished by an able article in the Fo- reign Quarterly, No. XX. Those who wish for a fuller account of the rise and progress of Reciprocity and Free Trade, may consult a series of articles in that publication, Nos. XVIII. XX. XXI. A sketch of the history of the Navization.Laws will be found in. the Supplementary Notes to M'CULLOCieS edition of the Wealth of Nations. The different Reciprocity Treaties will be found in the last edition of EtAts's British Tarfjj:

t Books, first written, composed, or printed in the United Kingdom, were and ant still prohibited unless not reprinted within twenty years. which they injure) the sum of twenty-three millions and three quar- ters is yielded by protective taxes, or by taxes whose existence renders protection to a certain extent a matter of justice. Absolute and un- restricted freedom of trade seems, therefore, in the present financial condition of affairs, impossible.

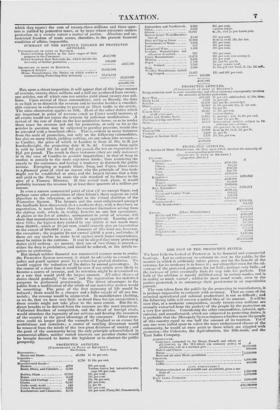

SUMMARY OF THE REVENUE YIELDED BY PROTECTED ARTICLES.

UNIMPORTANT IN POINT OF REVENUE.

Duties levied on Articles in the later stages of their

progress to the Consumer £147,893

Duties levied on Raw Materials, 8ze. which involve the

necessity of further protection 199,209

£347,102

IMPORTANT IN POINT OF REVENUE.

Imported Articles 11,045,584

Home Manufactures, the Duties on which render a countervailing Protecting-duty necessary 12,474,112

23,519,696

£23,866,798

But, upon a closer inspection, it will appear that of this large amount -Of revenue, twenty-three millions and a half are produced from twenty- one articles, out of which sum ten articles yield about twenty-two mil- lions. Upon several of these commodities, such as Brandy, the duty is so high as to diminish the revenue and to involve besides a consider- able expense in endeavouring to prevent an illicit traffic in the article. The same observation applies to Silk. Most of the other duties which are important in point of revenue (such as Corn) would increase, at all events would not injure the revenue by judicious modification. A revisal of the rate of duty on the less productive items, so as to render them taxes for revenue and not for protection, or only so far as the articles in question may be subjected to peculiar pressure, would also be attended with a beneficial effect. This is evident in ninny instances from the scale of protection, not only on the following commodities, but also on many which, yielding nothing, are not taken into account,- as Candles, the price of which in London is from ‘.2/. 10s. to 31. per hundredweight, the protecting duty 3/. 3s. 4d. Common Soap again is sold by retail for 7d. and Sd. per pound, the tax on importation is 9id. per pound. The result in these instances (they are only instances) is in the case of Candles to prohibit importation ; in that of Soap to confine it entirely to the more expensive ]rinds; thus restricting the supply to the consumer, and having a tendency to diminish the public income. Excepting as regards Glass, Soap, and Paper, there exists in a financial point of view no reason why the principle of free trade might not be established at once, and the largest income that a duty will yield to the State be made the sole standard of its fitness in the eyes of a Finance Minister. If this revisal took place, it would probably increase the revenue by at least three quarters of a million per annum.

In even a narrow commercial point of view (if we except Sugar, and perhaps some other productions of slave labour), there appears no valid objection to the relaxation, or rather to the virtual abolition of the Protective System. The farmers and the most enlightened amongst the landlords have discovered, that a moderate duty, with a drawback on exportation, is much better than the constant fluctuation arising from the shifting scale, which, in reality, benefits no one but speculators. A glance at the list of articles, unimportant in point of revenue, will show that manufacturers have as little to apprehend. Leaving out of view Silks, the highest duty yielded by any article is not much more than 30,0001., which at 30 per cent. would scarcely give an importation to the extent of 100,0001. a year. Amounts of this kind are, however, the exception ; the majority do not exceed 5,0001. a year ; and trades, if there are any unable to make head against much larger importations, must be rotten in the extreme. It may be alleged that many protecting duties yield nothing: we answer, then one of two things is proved,- either the duty is prohibitive, and should be reduced, or the article re- quires no protection. But though neither financial nor commercial reasons seem to render the Protective System necessary, it might be advisable to consult pre- judice and guard against panic by a somewhat gradual abolition. We would suggest the reduction of the duties by annual percentages. In the course of a short time it would be seen it' any article were likely to become a source of revenue, and its retention might be determined on at a rate that would yield the largest amount. All other classes of duties should gradually "die out," and the registration for statistical purposes be performed gratuitously. The direct advantages to the public from a modification of the whole of our restrictive system would be something. The price of the first necessary of life would be reduced; there would be a cheaper and a fuller supply of all raw ma- terials ; the revenue would be augmented. In manufactures (holding, as we do, that we have very little to dread from foreign competition), these results might not take place to the same extent. But the in- direct benefits to be derived from the measure are the most important. Unlimited freedom of competition, and the dread of foreign rivals, would stimulate the ingenuity of our artisans and develop the resources of the country to the great advantage of the consumer. Other coun- tries could no longer plead the example of England as an excuse for prohibitions and restraints; a source of rankling discontent would be removed from the minds of the two great divisions of society ; and the good of the community being the only principle acknowledged in commercial affairs, neither vested interests nor peculiar claims would be brought forward to harass the legislator or to obstruct the public prosperity.

(UNIMPORTANT TN PoiNT Net Prothals.

Necessaries- Bacon and Hams £1,834 Luxuries-

G inger 2,799 Manufactured Goods- Baskets £970 Boots, Shoes, and Calashes 3,548 Bottles, Glass 10,916 Boxes 3,456 Cables and Cordage 226 Clocks 6,132 Corks ready made 143 Cotton Manufactures 3,233 Earthenware and Chinaware 5.176 PROTECTED ARTICLES, OF itEvErtnE.) Date of Duty.

11. 8s. per cwt. Si. 13s. per cwt.

201. per cent.

Various duties, but intended to ave- rage 301. per cent.

25/. per cent.

201. per cent.

10s. 9d. per cwt.

251. per cent. 7s. per lb.

BM per cent. 151. per cent. Plain,30/. Ornamented. Embroidery and Needlework 5,902

Glass 5.637

Gloves 21,847 Hair or Goats' Wool,Manufac- t are of 2,842 Hats of Chip or Straw 27,054 Instruments of Music 1,624 Lace 327 Lacquered Ware 1,104 Leather, Manufactures not otherwise described 797 Linen Manufactures 21.672 Matting. 5,534 Paper 1,793 Stained 1,240 Soap 1,050 Woollen Manufacture, includ- ing Carpets 11.037 X147,893 PROTECTED ARTICLES, (1.TRIMPO1iTANT IN POINT OF REVENUE.) Being materials used in sane manufacture, and whose existence consequently involves. the necessity of further protection.

Bees' 'Wax £10.259 3/. per cwt. unbleached, 41.10s. blea..

Mack Lead 2,029 4s. per cwt.

Bristles 26.470 20. per lb . sorted 345.

Hides 32.513 4s. Sd. per cwt. dry, 2s. 4d. wet.

▪ Tanned 1.1121 t;d. per lb.

Iron in liars 20,467 1/. 10s. per ton. ▪ of all other sort s 816 various duties.

Madder and -Madder Roots 15.613 per cwt., root Is. 6ci. per cwt.

Platting of Chip and Straw 13,317 D. ;111,1 175. per lb. Skills 18,5;8 from various articles subject to 90s di tll.rent rates of duty.

Spel ter 10.194 1.0s. per ewe., 2s. in cakes.

Thrown Silk 35,999 from ls. 6d. to 5s. 2d. per lb,

Verdigris .. 4,509 Is. per lb. Vinegar or Acetous Acid 1,376 181.15s. per ton.

£109,209

PROTECTED ARTICLES, Or Articles of Home Manufacture, the Duty upon which involves the necessity of a corresponding protection. (IMPORTANT IN PoiNT OF REVENUE ) Cucroms. (Imported Articles.) ecessaries-

Butter £11,045,584

EXCISE. (Helix ..VinVitclures)

Bricks and Tiles £363237

British Spirits 5,105,121

Glass 531.493 Hops 145.394 Malt 4 ,t59,:mt Pm oer 677,103 Printed Goods 54.965 Soap 1,134,261 £12.174,112 SO/. per cent. various duties.

5s.. and 7s. per dozen pair.

30/. per cent. from 1/. to 61. 16s. the doz.

201. per cent. 301. per cent. 301. per rent.

30/. per cent. 40/. per cent. (on average). 20/. per cent. 3d. and 9d. per lb.

Is.per square yard. 41. 10s. per cwt. hard, 31. lls. 3d. soft..

15/. and 20/. per cent. 143,260

£

£121,235 Cheese 68.228 coffee 583,750 Corn 514.791 Sulzar 4.650,55S Luxuries- -- 5,963,612 Molasses £156.811

PForeigepper 1112.638

n Spirits 3,321,573 3,062,054 Raw Materials- Seeds £153.451 Sheep and Lambs' Wool 113.537 'Callow 114,894

Timber 1,078,070

Manufactured- 1,690,552 Silk Manufactures 164,547

Previous page

Previous page