Company Notes

THOMAS TILLING LTD., the industrial holding group, has once again had a success- ful year. Preliminary figures show a substantial increase in profits of £580,465, bringing gross profits before tax to a new peak of £4,896,408. Last year the capital was increased by a one-for- nine rights issue; the 20 per cent. dividend, covered 2.2 times by earnings, is maintained. The 4S. ordinary shares have improved to 28s. 3d., Yielding 2.8 per cent., and arc an excellent and promising investment. Perhaps the chairman, Mr. Lionel Fraser, may give shareholders at the annual general meeting reasons to hope for a higher dividend payment in 1963.

'The Ross Group (trawling, poultry and frozen food producers) has produced results for the Year to September 30. 1961, which are not quite Up to the forecast of million pre-tax profits, Made at the time of the one-for-four rights issue last year. Over the past few years Mr. Carl Ross has enormously expanded the group's interests, Which can now be broken downs as follows, in terms of 'turnover: landed fish 10 per cent., mer- chanting and distribution of fish 26.6 per cent., frozen and other foods 36.6 per cent., day-old and broiler chickens 14.3 per cent:, other in- terests 12.5 per cent. Last year the fishing returns Were disappointing and in the poultry division a loss of £80,000 was made by one of the new sub- Skliaries---this will be non-recurring. Immediate prospects are not very exciting, as gross profits or the current year may well be lower than

osc of £1,088,418 for 1961. However, the chair- man suggests that it should be possible to main- tain the 22 per cent. dividend. The 5s. shares have fallen from this year's high price of 24s. 9d. to 18s. 9d.. at which level they yield 5.8 per cent.

Jeyes Sanitary Compounds suffered a setback In pre-tax profits in " 1961; they fell from £261,887, to•£226,499. The chairman states that rising costs, keener competition and a small amount of bad debts trouble were responsible. However, prospects for the current year are more encouraging. The company's marketing position in New Zealand has been strengthened and its Products will be on sale in twelve European countries by the end of this year: Plans are being Made to acquire, if possible, an interest in the Australian and West African markets. Sales and Profits for the first ten weeks of the current year are said to be satisfactory, so that some im- provement can be expected in the future. The dividend of 20 per cent. has been maintained.

he 5s. ordinary shares at 20s. 6d. yield 4.8 Per cent.

Lubok Investments Ltd. records a 19 per cent. increase in gross income for 1961 at £23,538 over the previous year, advantage being taken of the high interest rates available on fixed-in- terest stocks. Since the reduction in Bank rate,' the chairman, Brigadier F. C. Hopton Scott, ad- vises that fixed-interest investments have been reduced and those in equities increased, par- ticularly in investment trusts, which now repre- sent 53,9 per cent. (and commercial and industrial 24.3 per cent.) of the portfolio. The net profit for 1961 shows a very satisfactory in- crease of 38 per cent. over the previous year. !lie company has an issued capital of £48,000 la• shares of 6d. each, on which a dividend of Japer cent. has been paid.

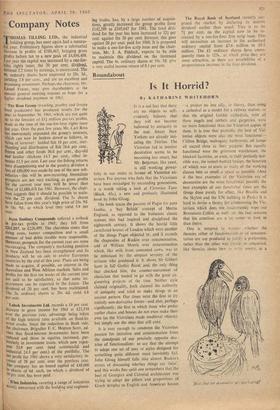

Winn Industries, covering a range of industries mostly concerned with the building and engineer- ing trades, has, by a large number of acquisi- tions, greatly increased the group profits from £142,599 to £349,647 for 1961. The total divi- dend for the year has been increased to 321 per cent. against the 30 per cent. forecast; this goes against 20 per cent. paid for 1960. It is proposed to make a one-for-five scrip issue and the chair- man, Mr. J. A. Pidduck, expects to be able to maintain this dividend on the increased capital. The 4s. ordinary shares at 19s. 3d. give a very useful income return of 8.1 per cent. The Royal Bank of Scotland recently sur- prised the market by declaring its interim dividend earlier than usual. This is to be 71 per cent. on the capital now to be in- creased by a one-for-four free scrip issue. This will necessitate an increase in the authorised ordinary capital from £7.6 million to £9.5 million. The £1 ordinary shares have conse- quently risen to 125s., at which price they are most attractive, as there are possibilities of a proportionate increase in the final dividend.

Previous page

Previous page