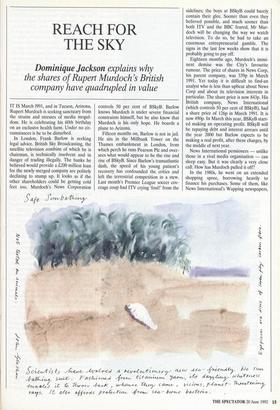

REACH FOR THE SKY

Dominique Jackson explains why

the shares of Rupert Murdoch's British company have quadrupled in value

IT IS March 1991, and in Tucson, Arizona, Rupert Murdoch is seeking sanctuary from the strains and stresses of media mogul- dom. He is celebrating his 60th birthday on an exclusive health farm. Under no cir- cumstances is he to be disturbed.

In London, Frank Barlow is seeking legal advice. British Sky Broadcasting, the satellite television combine of which he is chairman, is technically insolvent and in danger of trading illegally. The banks he believed would provide a £200 million loan for the newly merged company are politely declining to stump up. It looks as if the other shareholders could be getting cold feet too. Murdoch's News Corporation controls 50 per cent of BSkyB. Barlow knows Murdoch is under severe financial constraints himself, but he also know that Murdoch is his only hope. He boards a plane to Arizona.

Fifteen months on, Barlow is not in jail. He sits in the Millbank Tower on the Thames embankment in London, from which perch he runs Pearson Plc and over- sees what would appear to be the rise and rise of BSkyB. Since Barlow's transatlantic dash, the speed of his young patient's recovery has confounded the critics and left the terrestrial competition in a stew. Last month's Premier League soccer cov- erage coup had ITV crying 'foul!' from the sidelines; the boys at BSkyB could barely contain their glee. Sooner than even they believed possible, and much sooner than both ITV and the BBC feared, Mr Mur- doch will be changing the way we watch television. To do so, he had to take an enormous entrepreneurial gamble. The signs in the last few weeks show that it is probably going to pay off.

Eighteen months ago, Murdoch's immi- nent demise was the City's favourite rumour. The price of shares in News Corp, his parent company, was 339p in March 1991. Yet today it is difficult to find-an analyst who is less than upbeat about News Corp and about its television interests in particular. The share price is now 843p. His British company, News International (which controls 50 per cent of BSkyB), had a share price of 126p in March 1991. It is now 490p. In March this year, BSKyB start- ed making an operating profit. BSkyB will be repaying debt and interest arrears until the year 2000 but Barlow expects to be making a real profit, after these charges, by the middle of next year.

News International pensioners — unlike those in a rival media organisation — can sleep easy. But it was clearly a very close call. How has Murdoch pulled it off?

In the 1980s, he went on an extended shopping spree, borrowing heavily to finance his purchases. Some of them, like News International's Wapping newspapers, turned out to be lucrative enough invest- ments to cover lossmakers such as Fox TV in America and Sky in Britain. But the recession has hit advertising-dependent media and publishing hard. News Corp's 150 or so banks began to wring their hands at the prospect of rolling over such a huge snowball of debt. As investors became uneasy, the prices of some of the compa- ny's traded debt fell sharply, sending their yields soaring — to more than 50 per cent in the case of some Swiss-franc bonds, usu- ally a sure sign that default is at hand.

Murdoch had to find a way to rearrange his debt. He had to devise a business plan to back it up and he had to do both things fast. He called in the bankers Citicorp. They found themselves faced with a bewil- dering corporate structure, designed to keep tax to a minimum, and a confusing portfolio of borrowings, from facilities in Hong Kong dollars to an Islamic letter of credit. They enlisted the merchant bank Samuel Montagu and brought in one of their own top men, William Rhodes, hop- ing that his expertise in rescheduling Latin American sovereign debt would come in useful.

A few months later, both banks submit- ted hefty bills of $15 million each, but Murdoch did not complain. The $7.6 bil- lion refinancing — completed in February 1991 — had bought him time. It did, how- ever, impose a financial strait-jacket. When, a month later, Barlow told him he needed to commit another £100 million to BSkyB to keep the satellite broadcaster afloat and maintain his own shareholding, his only option was to use benefits in kind — such as free film rights from 20th Cen- tury Fox — as part of his half of the £200 million package. He is also putting in sev- eral million pounds-worth of loan stock via a drip feed through his private investment company, Cruden, the vehicle through which the Murdoch family controls its 45 per cent stake in News Corp.

This leaves BSkyB clear to do to British television what Murdoch has already done to American television. It was Murdoch who spotted the distress of the ABC, CBS and NBC, the lumbering networks which once dominated American television and set up Fox TV to exploit their weaknesses. The enterprise lost money for years but was back into the black by 1990. It had done this by giving blue-collar Americans what they most want, relying heavily on movies and cornering the market in `tabloid' television. It is a transformation which is about to take place here in Britain.

While it is clear that securing the extra £200 million — not all of which will now be needed apparently — was the key to BSIcyB's survival, Barlow refers enquirers back to the November 1990 merger of Sky and British Satellite Broadcasting as the 'I don't want to go to their party and have a good time. I don't enjoy having a good time.' most significant event in BSIcyB's salvation. At the time Sky was losing £10 million a month. The newly merged company was losing £10 million a week, but cutbacks slashed the overhead bill by nearly half of that within a couple of months. Program- ming costs have also been cut by almost half, but if programme quality has suffered as a result, the rather depressing fact is that the viewers don't seem to have noticed. They appear to be more than happy with a daily diet of cartoons, soaps and sport, including such gems as The Simpsons, Hart to Hart, Chopper Squad and Abbott and Costello.

Much of the credit for trimming the bills must go to Sam Chisholm, BSkyB's gruff managing director who has an impressive Antipodean record of making pay-TV pay and whose nose for a deal is notorious from Heathrow to Hollywood.

The recruitment of Tony Vickers as head of Sales and Marketing was another coup.

In the post-franchise muddle, ITV's adver- tising income is ripe for the picking and Vickers, who holds the dubious honour of rescuing TV-am, has favours to call in from his wide range of contacts in advertising. He reckons he can push advertising rev- enue up by 70 per cent to more than £1 million a week — though that is still a frac- tion of the ITV companies' total £1 billion annual advertising revenue. For BSkyB advertising revenue will remain the cream on the subscription cake.

BSkyB gets some income from cable operators but future success will depend on whether dish-owners decide to 'convert' — to pay the monthly charge to take one or two film channels and the 'Comedy Chan- nel'. While there has been much debate about the size of the dish market — cur- rently around 3 million homes — there is no doubt that conversion is going very well.

About three quarters of dish-owners do decide to pay for the privilege of seeing movies not long after their cinema pre- mieres and way before ITV and the BBC can afford to screen them, and about three quarters of these take both channels for £16.99 a month. This rate has held up despite a recent price hike.

It is a fiendishly clever wheeze and relies on the same astute assessment of human nature as Fox TV made in America. Per- suade the punters to get a dish with the bait of a free package of 'variety', 'news', and top sport — 100,000 dishes were sold on the back of the World Cup cricket deal — and then get them to cough up every month to see movies way before they turn up to fill ITV and BBC bank holiday schedules. It looks like a winning formula. Dish sales are buoyant, rarely falling below 60,000 a month: conversion to monthly subscription is holding up well and already bringing in more than £20 million a month.

If dish sales continue to rise as expected, most analysts expect subscription revenue alone to be well over /30 million a month by the end of this year. Healthy cash flow

projections like these make the recent £304 million deal with the BBC for the rights to top soccer look distinctly afford- able. BSkyB says it is too early to say when programmes like the football will change to pay-per-view but you can bet it will be sooner rather than later.

You don't have to be a mathematics wiz- ard to work out just what the soccer deal could mean for BSkyB; live screenings of top soccer matches can attract up to 10 million viewers. More than a few of these will decide to invest in a dish, many will pay for movies and find themselves paying for sport before too long, meaning serious profit for BSkyB. Some analysts are pre- dicting annual profits of £400 million by the turn of the century.

The remaining dishless will probably head for the nearest pub with a dish where, for a couple of quid or lOp on a pint, they can watch the game. That is the theory of Melvyn Bragg, London Weekend Television's Controller of Arts whose own programmes (such as The South Bank Show) could be threatened by further stretching of ITV resources or by a move downmarket to compete with the satellite stations. He has remonstrated with the BBC for going in with BSkyB on the soc- cer deal. The advantages of that deal to Murdoch or Alan Sugar, whose Amstrad company makes the satellite dishes, are clear, but it is difficult to see what the BBC can gain from an alliance with an organisa- tion which threatens its own existence. Even Channel 4's Michael Grade has called the BBC's move a short-term gain to be measured against long term suicide.

Alas, the telephone at BBC Television rings 19 times before it is answered and obtaining some response from them to this conundrum proved difficult. The BBC's alliance with Murdoch would appear to be the latest manifestation of its identity cri- sis. Morale is at yet another new low before David Mellor's Green Paper on its future. Above all, the BBC has been left firmly behind in the technological revolu- tion — though this is happening so fast it threatens to leave even the Sky pilots behind.

BSkyB may be conventional television taken to its logical conclusion, but conven- tional television may soon be a thing of the past.

Spectator readers with neither the time nor the inclination to keep up with `yoof

culture may nevertheless have heard of the latest cult movie to hit the UK from the

other side of the Atlantic, Wayne's World.

In it, two goofy adolescents broadcast a public access cable TV show from Wayne's basement near Chicago. A senior broad- casting executive assured me solemnly that TV future looks like this: thousands of similar programmes on hundreds of chan- nels. Rupert Murdoch is probably already negotiating to pick up a few score of them.

Dominique Jackson writes for the Guardian.

Previous page

Previous page