Investment Notes

By CUSTOS

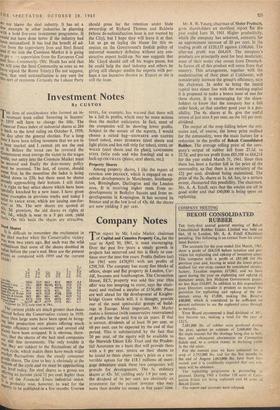

Ttic firm of stockbrokers who formed an in- vestment trust called 'Investing in Success' ',11 1959 will have to change the title. The einancial Times index of industrial shares at 284 Is back to the level ruling on October 9, 1959, ,,the day after the general election. For a long ne I have been telling investors that we are in 4 bear market and I cannot yet see the end of it. Before the trend can be reversed the battle, must emerge the victor in the wages Lank, our entry into the Common Market must be assured and finally the dear-money policy must be reversed. The last, of course, should °note first. In the meantime the index is being talked down to 250, but there must be shares .11. is approaching their bottom. I still think it s right to buy select shares which have been skoially knocked by a new issue. I have given s°111e examples in previous weeks and today I refer to EAGLE STAR, which are issuing one-for- 4 °.,nrr at 50s. The new shares are quoted at fats. 3d. premium, the old shares ex rights at IT. 6d., which is near to a 3 per cent. yield as's. On this basis the shares are attractive. Steel Shares n.11 is difficult to 'remember the excitement in the steel market when the Conservative victory has Won two years ago. But such was the wild enthusiasm that some of the shares doubled in value before the year's end. Here are the present `,;Iees as compared with 1959 and the current Yields: to to ••5 vZCI.

.ter■ •?"0 ": "":

The current yields are much greater than those nsfl. ered before the Conservative victory in 1959. ;Ince then large sums have been spent in bring- 'ng into production new plants offering much greater efficiency and economy and several old p°ants have been scraped. It is obvious, there-

re, that the shares of p the best steel companies

o still fine investments. The only trouble is pat they are subject to the fluctuations of the market cycle, which makes them have much wider '"arket fluctuations than the steady consumer rods shares. The time to buy is obviously at the this of the cycle and we must be approaching oats level today, for steel shares as a group are th °ring an income yield I I per cent. higher than ta! of the Financial Times industrial index. re,sis Probably wise, however, to wait for the "°rls to be published in a few months. UNITED

— cn

�tville* 39/41 52/3 80/3 Wotan Lon 37/- 48/9 80/101 r,_eashire 47/6 32/3 53/- BLit/abut-hum36/- 46/3 61/9

Co. or Wal'es 33/9 41/9 51/3 & Lloyds 38/3 48/- 60/- CA Summers 43/7i 52/6 78/6

TIN Steel 33/II* 44/-1' 67/7'

" Adjusted rot 25 %

issue in

scrip 1961. 81/3 48/9 6.5 43/7; 27)3 7.2 49)101 31/3 7.0 421-

251-

9.5 47/81 33/9 7.3 60/- 4I/3 7.1 68/71

431-

6.9

55/71 40/- 6.1 STEEL, for example, has warned that there will be a fall in profits, which may be more serious than the market anticipates. In fact, most of the companies will be showing lower profits. Subject to the nature of the reports, I would choose a mixed bag—sTEWARTs AND LLOYDS (steel tubes), JOHN SUMMERS (steel sheets and light plates and hot roll strip for tubes), STEEL OF WALES (steel sheets and tin plate), LANCASHIRE STEEL (wire rods and wire fencing) and as a lock-up COLVILLES (plates, steel sheets, etc.).

Property Shares

Among property shares, I like the report of CENTRAL AND DISTRICT, which is engaged on ex- cellent developments in Manchester, Southamp- ton, Birmingham, Darlington and the London area. It is receiving higher rents from re- developments in Berkeley Square and from re- developments in Kensington. It has secured its finance and at the low level of 43s. 6d. the shares are now yielding 3 per cent.

Previous page

Previous page