Banking and Democracy

Greater Publicity Desirable

I SHALL make no excuse for attempting to deal in this article with a rathar difficult and, in some respects, a somewhat delicate matter, namely, the charge which is sometimes levelled against our banking institutions, from the Bank of England down to the smallest bank, of undue and unnecessary secrecy with regard to banking operations and banking policy generally. The man in the street knows very little about either banking or finance, and time was when, in spite of, or perhaps it might be more properly said as a result of, this profound ignorance bankers were rather held in awe, as individuals concerned in a profession of considerable mysticism, but with which the interests of the community were supposed in some unexplained manner to be intimately bound up. Ignorance, however, even on the part of the -masses, in matters in which, after all, .they have a. rather close concern, is always a dangerous thing and; indeed, that truth must have been forced upon the minds of a good many thoughtful people during the last quarter of a century, when we have seen a vast amount of industrial chaos and enormous financial losses inflicted upouthe entire community simply because in a war against capitalisni by the process of 'strikes -there has been a complete failure by Labour extremists to comprehend the elements of political economy and the interdependence, of all classes of the community upon each other.

_ THE SYSTEM ATTACKED.

This same ignorance, as we know, has been taken the utmost advantage of by the extremists in the Socialist Party, who have, with more, or less success, persuaded a large section of labour that the capitalist system, in which banking is included, is in some way detrimental to the interests of the rank and file of the community. And especially has the extreme Socialist of- the day fastened upon the central idea, which has, of course, a strong element of truth in it, namely, that our banking system, including, of course, and indeed especially, the Bank of England itself, holds a control over the entire liquid credits of the country and, as a consequence, is able to exert a powerful influence upon financial developments from month to month and from year to year. That such control has been held and has been exercised with vast advantage to the whole nation for very many years— and before Socialist legislation impeded, as it were the general workings of economic laws—is more or less disregarded, and, in particular, the notion is often pressed by the. Socialist or Labour extremists that, if only the State had the same measure of control through owning the liquid resources of the country in the shape of banking deposits, it would be possible to stretch credit to an almost Unlimited fashion, with a great stimulus to consuming power, and, according to the Socialist view, to the advantage of the country generally, and of labour in particular.• That it was to the wise control of these credit powers we owed much of the prosperity of the tears preceding the Great War is ignored because it is not understood.

BOLDER RESISTANCE NEEDED.

As one who is a firm believer not only in our banking System, but upon the way it has been administered to the henefit of the country as a whole over some two centuries, do not think I shall be misunderstood when I say that I think it behoves bankers,at-hong whom I am, of course, including those responsible for the control of the Central Banking Institution, to pay somewhat greater regard to the attitude of the new democracy towards our banking system and its administration. And by that I am not suggesting that there is need for any apologetic attitude on the part of the banks. Quite the contrary. The banking system, like the capitalist system, has done good, not harm, to the general community, but because in both cases the reward of profits has also accrued to the capitalist and the shareholder, whether in industrial or banking concerns, that fact seems in some quarters to impair the argument for the usefulness of the banker or the capitalist. A quiescent attitude on the part of the capitalist and the industrialist during a period when labour has been active in organizing conditions detrimental to the wealth-producing activities of the country must, I think, be held responsible in sonic measure for the depression from which we are suffering to-day. Similarly, those who are best instructed know well that if Socialist desires concerning the conduct of our banking business were to be carried out the results would be disastrous to the whole country. Therefore, I maintain, bankers are responsible not merely for continuing to conduct their business on its present sound lines, but for demonstrating as far as may be possible the positive advantages to labour and industry resulting therefrom and the evils which would- be produced by State control.

A GREAT. RESPONSIBILITY.

Moreover, although there may be • much to object to in the antagonistic attitude of the Socialists towards the banks, it is well perhaps to acknowledge the correct- ness of the attitude of democracy towards finance and towards banking in particular, in one respect, namely, in its recognition of the fact that as custodians and controllers of the liquid resources (as expressed in banking deposits) and the credit system of the country, bankers have great responsibilities which have to be discharged just as in the case of other- great undertakings which have to do with the prime necessities of life, such as water, light, heat and transport. And the difficulty of the situation seems to lie in the fact that while it is not difficult to explain to the community just how the organizations connected with most of the great utility services are functioning, it is less easy to demonstrate the working of the currency and banking system. Never- theless it can be demonstrated, and to that end I suggest two matters to which bankers might do well to direct attention. The first is to dispel as far as may be possible the atmosphere of unnecessary secrecy which sometimes seems to surround banking operations, and the other is to sec whether an educational propaganda on the service of the currency and banking system to the general community might not come within the functions of the splendidly organized and highly efficient intelligence and publicity departments of our leading banks. It goes, of course, without saying that secrecy in many matters is an essential of banking. The con- fidential relations between banker and customer must be maintained at all costs, while there is no need I think for bankers even to feel obliged to disclose, as has been voluntarily disclosed in some instances, the proportion of advances made to various forms of borrowers over a given period. At the same time balance-sheets are often of too meagre a kind to be sufficiently informative, and this is particularly the case in the balance-sheets of the Central Banking Institutions in the different :font) tries.

CENTRAL BANKING CO-OPERATION. .

One of the latest and probably one of the most favour- able developments in international banking haS. been the tendency in the direction of closer co-operation between the central banks, and it is a tendency which conceivably works well in the interests of all concerned, making. for economies in. gold movements -and greater stability in exchanges and money rates. Nevertheless, it places in the hands of central banks thus working together almost unlimited power in swaying credit policy affecting industrial activities throughout the world. Let it at once be granted that those powers are exercised on the highest grounds and from the purest motives. The fact remains, however, that the central banking authorities will probably do well to preserve the minimum amount of secrecy in their operations, will do well to carry the public with them in the matter of comprehending what is proceeding, or at all events, what has proceeded, and, above all, will endeavour to associate actively with them in their policy not merely banking and currency experts but men of affairs representing in their various countries great business as distinct from purely monetary interests.

BANKERS AND INDUSTRY.

•

I have referred to the ill-informed attacks made from time to time upon our banking and currency system by -the extreme Socialists, but it must be remembered that criticism from business men is not lacking ; and while the charge so often made against banks by com- mercial men, namely, that however depressed trade may be, banking profits seem to suffer no diminution, May be wholly irrelevant, it is very natural and human, and the argument is not to be met by that sort of platitude which simply asserts that the traders' and the bankers' periods of prosperity are identical. They are closely associated, but they are not identical, and the business man's criticism can be met easily on quite other grounds if. bankers display a little more courage and, also, it 'bodies like the Fe-de-tation of British sIndastries Were to take rather more pains to clarify their minds, and to consider, not whether dear money rates at one particular time may have affected this or that industry, but whether on- balance the banking and currency system of this country has not proVed one of the greatest aid& to trade and industry. All the same, I believe that,: in the case of the business man in particular, every effort should be used to demonstrate the precise service rendered by banking to commerce, and I consider it would have been better if the latest fixing of the country's fiduciary limit had received the endorsement of a committee of business as well as banking experts. Not that I consider the banking experts to have erred in their decision, but because gold standards and currency systems for their perfect working and success require whole-hearted and sympathetic co-operation by all sections• of the community concerned with industry and production, there should be a comprehension of and assent to those systems by men of business.

PROPAGANDA.

I consider, too, that still more might be done if, through their intelligence departments, a quiet but useful propaganda work were to be undertakedby -banks in combating those unsound theories which, because of the general ignorance prevailing, are probably fraught with more real danger to the community than we are ready to admit. Let it be shown quite clearly how the savings of the people in the shape of banking deposits are made to minister to the good of the country in manifold ways. Nor need the banker fear any disclosure of profits obtained, for they only bear a fair and right proportion to the skill exercised-and the benefits rendered to the community. And, when the facts are clearly stated, from no quarter more than the general public itself would the banker find greater support in his cardinal principle of placing first and foremost the security of the depositor. That principle may and does sometimes mean that more profitable and safer employment of funds is to be found in advances abroad than at home, and much advantage might accrue if the reasons were fully revealed and discussed. Just as the anti-capitalist and anti-bank propaganda can be dangerous and insidious by its persistency, so would the work of constructive propaganda be cumulative in its effects and influence.

DANGERS OF IGNORANCE.

The greater number of the community who can be brought to comprehend and realize what is involved in sound government and good social order, the surer and safer will be our political and social foundations. And so in everything pertaining to our financial and banking system the greatest danger lies in- the amount of ignorance concerning it. To remove some of this ignorance and to combat the attacks to which this same ignorance has made our financial system vulnerable, might well be added to those other services which our banks have rendered to the. community. Less secrecy, more-publicity, and even a forward-Movement in propa- ganda work, would seem to be- in harmony with the democratic developments to-day in relation to our banking and currency system.

ARTHUR W. KIDDY.

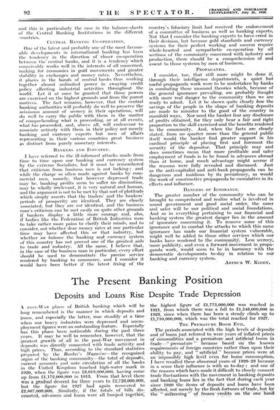

Previous page

Previous page