The Present Banking Position

Deposits and Loans Rise Despite Trade Depression

A rosT-WAR phase of British banking which will be long remembered is the manner in which deposits and loans, and especially the latter, rose steadily at a time when our heavy industries were depressed and unem- ployment figures were an outstanding feature. Especially has this phase been noticeable during the past three years. It may be well to. remember, however, that the greatest growth -of all in: the post-War movement in deposits was directly connected with trade activity and high prices. Thus, according to the standard statistics prepared by the Banker's . Magazine—the recognized organ of the banking community—the total of deposits, current accounts and note. circulation of all the banks in the United Kingdom touched high-water mark in 1920, when the figure was £8,019,000,000, having come up from £1,172,000,000 in 1913. From that level there was a gradual descent for three years to £2,728,000,000, but the figure for 1927 had again recovered to :Similarly, if, the totals of bills dis- connted, advances and loans were all lumied together; the highest figure of £1,775,000,000 was reached in 1921, from which there was a fall to £1,548,000,000 in 1923, since when there has been a steady climb up to £1,710,000,000, which was the total reached for 1927.

THE PREMATURE Boom EVIL.

The periods associated with the high levels of deposits and of loans just referred to were years of inflated prices of •CommOilitips and a _premature and artificial boom ch frade—" premature " -because ikssetf on the known requirements of foreign countries rather than upon their ability to pay, and artificial because prices were at an inipossibly high level even _ for home Consumption. I have recalled these abnormal years of 1920-28 because in a sense their influence is with us to-day ; and one of the reasons which have made it difficult to closely connect trade fluctuations with the movement in banking deposits and banking loans lies in the fact that during each year since 1920 the items of deposits and loans have been affected, not merely by the fresh fortunes of trade, but ley the' unfreezing" -a frozen-Credits "On-the=One. hand and the rendering of fresh assistance on the other hand, to industries where depression has still ruled.

WHERE ACTIVITY HAS PREVAILED.

During the last three years, however, there has been -added a further influence which has tended towards a rise in deposits and loans. Those influences have been -the activity and -prosperity of a few new industries (including artificial silk and motor manufacturing), the growth of activity on the Stock Exchange, and great activity in new capital issues.

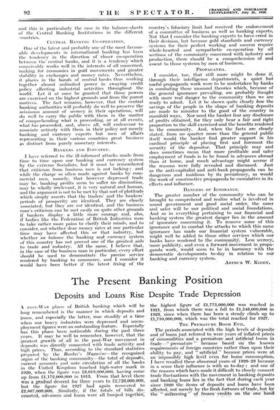

So far as may be judged from the latest figures avail- able, the main tendencies which have been noticeable during .the past five years are still operating, and it may be simpler and easier, perhaps, to give by way of example .just, the deposits and. the loans of the ten " clearing" banks. Three years ago the deposits of these banks had declined to about £1,684,000,000, but two years ago there was a rally to £1,687,000,000, followed the next year by a rise to £1,747,000,0Q0. And now, taking the balinee-sheets of June 30th last, there is a further advance to £1,791,900,000, of which only about £29;000,000 is-to be connected with the inclusion for the first time in the group of the figures of the Lancashire and Yorkshire Bank, now merged with Martins.. The figures are as follOws

DEPOSITS.

June 30th, Dec. 31st, 1927. 1927.

£ June 30th, 1928.

£ Martins Bank 58,881,530 62,890,872 81,058,805*

Baklays-Bank

308,538,672 318,373,471 317,950,893 Coutts & Co. . . 18,175,554 16,996,453 17,216,312 Glyn, Mills & Co. .. 31,849,150 34,875,005 29,563,946 Lloyds Bank .. 53,934,406 357,184,897 348,467,745 Midland Bank.. .. 376,528,502 374,375,146 382,752,859 Nat'l Provincial Bank 258,681,386 273,597,202 268,178,240

National Bank • •

37,162,306 37,162,306 36,889,544 Westminster Bank .. 272,068,407 280,612,019 277,951,060 Williams Deacon's B'k 32,064,318 32,662,566 31,920,019

1,747,884,231 1,788,729,937 1,791,949,423 LOANS AND ADVANCES.

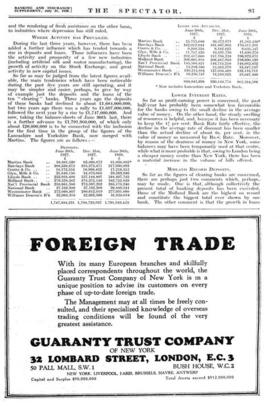

June 30th, Dec. 31st, June 30th, 1927. 1927. 1928.

£ £ Martins Bank .. 35,715,086 36,572,971 41,583,450* Barclays Bank .. 162,012,044 161,867,905 170,511,201 Coutts & Co. — .. 9,209,538 9,182,825

9,631,5;47

Glyn, Mills & Co. .. 11,707,420

10,831,758

11,630,270 Lloyds Bank .. .. 202,417,660 187,798,224 196,923,071 Midland Bank .. 209,661,918 206,487,910 216,690,139 Nat'l Provincial Bank 145,168,821 146,715,210 148,063,652 National Bank • • 15,383,580 15,383,579 15,547,147 Westminster Bank .. 138,312,884 137,054,469 133,116,711 Williams Deacon's B'k 19,256,747 18,249,923 18,687,400

948,845,698 930,144,774 962,384,588 * Now includes Lancashire and Yorkshire Bank. LOWER INTEREST RATES.

So far as profit-earning power is concerned, the past half-year has probably been somewhat less favourable for the banks owing to the small decline in the average value of money. On the other hand, the steady swelling of resources is helpful, and, becayse it has been necessary to keep the 41 per cent. Bank Rate fairly effective, the decline in the average rate of discount has been smaller than the actual decline of about 6s. per cent. in. the value of money as measured by Baii: Rate.. Moreover, by reason of the -dearness of money- in New York, some balances may have been temporarily used at that centre, while what is more probable is that, owing to London being a cheaper money centre than New York, there has been a material 'increase in the Volume of bills offered.

MIDLAND RECORD DEPOSITS.

So far as the figures of clearing banks are concerned, there are perhaps just two comments which, perhapis,, may be made. One is that, although collectively the present total of banking deposits has been exceeded, thOse of the Midland Bank are the highest on record and constitute the biggest total ever shown by one bank. The other comment is that the growth in loans and advances and bills combined is even more striking than the growth in deposits, and the banks are evidently straining a point to meet all requirements _of borrowers, even at the cost of slightly reducing the ratio of cash to deposits. The policy, is, I think, justified by the conditions which call for it but I would make one proviso, namely, that it is up to the banks here, as well as in America, to check any undue speculative activities on the Stock Exchange.

AN IMPROVED POSITION.

There are, however, not wanting points in the banking situation to-day which are of an encouraging character, and which, if speculation is not overstrained, may prepare the way for easier money later on. Since the beginning of the present year the central gold reserve at the Bank of England-has heen increased by £24;000,000, .and now stands at £58,000,000, while the present holding of gold and bullion by the Bank of £175,000,000 consti- tutes the largest, figure On record. At the beginning of the second -half of the year it is true that money rates in New -York are rising and the Ainerican exchange is moving against us, but the cause is neither complex nor obscure. Wall Street speculations have to be checked. If this is done, and done thoroughly, there may be a return to more normal conditions on the other side of the Atlantic, with the additional advantage that some of_he congested stores of gold in New York have been spread over Europe and South America.

Previous page

Previous page