Finance

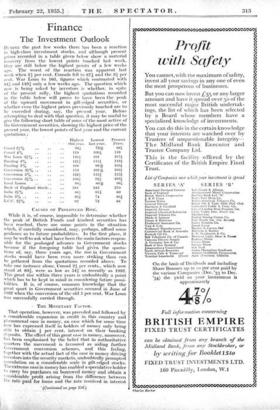

The Investment ' Outlook DURING the past few weeks there has been a reaction in highLclass investment 'stocks, and although present prices. 'recoided: in a table given below show a material recovery from the lowest points touched last - week, they are still below the- highest points of a. few weeks ago.- worst of the .reaction was apparent last week when 21 per cent. Consols fell to 87f and the 31 per cent. War Loan to 105, figures' which contrasted with 941 and 1161 only a few 'weeks ago. The question which now is being asked by investors is whether, in spite of the present rally, the highest quotations recorded in the table below will prove to have been the - peak of the upward movement in gilt-edged securities, or whether even the highest prices previously touched are to be exceeded during, say; the present year. Before attempting to deal with that question, it may-be Useful to give the following short table of some of the most active of the Government securities, showing the highest price of the present year, the lowest points of last year and the current quotations : . Consol 21% Highest this year.

,. 941 Consol /% .. 119 War Loan 31% .. 1101 Funding 4% ., 1211 Funding 3% .. l06 Conversion 31% .. 113 Conversion 5% - .. 1241- Conversion 24% .. 1031 Local Loans , . ... .. .. 984 .

Bank of England Stock.. .. 381 India 21% .. 861 India 3% . , .. 951 L.C.C...21% .. 92

CAUSES OF PROLONGED RISE.

While it is, of course, impossible to determine whether the peak of British Funds and kindred securities has been reached, there are some points in the situation which, if carefully considered, may, perhaps, afford some guidance as to future probabilities. In the first place, it may be well to ask what have been the main factors respon- sible for the prolonged advance in GoVernnaent stocks because if the foregoing table had given the quota- tions of, say, three years ago, the rise in Government stocks .would have been even more striking than can be gathered from the quotations recorded above. To take one instance alone, Consol 21 per cents., which now stand at 89, were as low as 541a re-cently as 1932. This great rise within three 'years is Undoubtedly a point which has to be kept in mind in considering future possi- bilities. It is, of course, common knowledge that the great spurt in GciVernment securities °mired- in June of 1932 when the conversion of the old 5 per cent. War Loan was successfully carried through.

THE MONETARY FACTOR.

That operation, however, was preceded and followed by a considerable expansion in credit in this country and Phenomenal ease in Money, an ease which for some time now has expressed itself in holders of money only being able to obtain 1 per cent, interest on . their banking deposits. The effect of this great ease in money, moreover, has been emphasized by the belief that in authoritative quarters the movement is favoured as 'aiding further Government - - conversion schemes, and this feeling, together with the actualfact of the ease in money driving investors into the Security niarkets; undoubtedly prompted- Speculation on .a. Considerable scale in gilt-edged stdcks. The extreme ease in money bai. enabled a speculative holder to carry his purchases,- on borrowed money ind'obtain a considerable profit arising frond the difference between the rate:-*-kaid for leans and:fife:rate received in interest • icontintted-on'pdge 318.) Lowest last year.

' 73* Present Price.

894 ' 1094 116 101 1071 1111 1191 98* 1051 .

101* 1031 1151 1224 ' 921 1031 86* 96i

345 370 - 611 80

74 881

73 . 88

Finance

(Continued from page 315.) on his holdings. -Moreover, a further circumstance which has aided the rise in gilt-edged securities has been the stringent precautions taken by the authorities to prevent. any great rush of new trustee securities. It is truethat these issues have been fairly numerous, but most of them have been in the nature of conversions and have not involved any actual raising of " neW " MoneY,- while until quite- recently 'every precaution has been taken to avoid overlapping of these issues to the endangering of their success. In view, • therefore, of these combined influences, it is scarcely surprising that trustee securities should have experienced such a prolonged advance.

• THE RECENT REACTION.

To 'what, then, must be attributed the fairly substantial reaction of the past , few weeks ? In the first place, 'and after a prolonged series of successful flotations of new capital issues giving good profits to the premium hunters, there came a succession of failures compelling under- writers to take up very.large -amounts of stock. Almost pan i passu with the conVersion operation by the Common- wealth of Australia Government, involving , some £22,000,000, came an issue of about £10,000,000 in a Con- version Loan by the London County Council, and under- writers were left with very large amounts of both stocks, while the comparative failure of these Loans was followed by a poor response to some other issues, so.that it became known that underwriters had probably to dispose of some fifteen to sixteen million pounds in unplaced stocks.

Misfortunes, however, seldom come singly; and at the moment when stocks were beginning to weaken on the partial failure of the- Capital issues referred to, came first the unexpected announcement of the" failureof Strauss and Co. Limited, in the grain. trade, which in turn was followed almost immediately by the crisis in the pepper market. All kinds of- adyerse rumours began to circulate, and these combined, influences quickly revealed the weakness of the gilt-edged market in the matter of specu- lative positions. Realizations were on a fairly large scale, and the "shake-out" was sufficiently severe to give a tem- porary shock to the market. - THE PRESENT RALLY.

Already; however; these adverse influences are begin- ning to subside; sad it Must be 'remembered that whateVer May be the ultimate disclosures with regard to the pepper pool, the losses sustained are scarcely on a scale . per- manently to disturb the equanimity of the Stock Markets. Nevertheless, the, shock given will serve as a reminder that eVell -British Government stocks can be vulnerable to unfavourable, influences, and so we .come, back- to the question of Whether the Peak of high prices in that direc- tion has or has not been passed. Personally, in the absence of some serious disturbance to credit or some adverse political. de,yelopments—for in addition to the factors I have already enumerated it must not be for- gotten that premature rumours- of an early General Election in this country were partly responsible -for -the set back in stocks—I am inclined to believe that the high level recorded, in. the foregoing table may again ,be reviled. The main file.* responsible for the previous rise, namely, cheap money, seems likely to operate for some time to come. New capital issues will, no doubt, be restrained for a time until the undigested stocks already referred to have been -absorbed, while it must. not be for- gotten that the partial failure 'of the two Conversion Loans to Which. I.haVe referred, namely, the L.C.C. Loan and the :Commonwealth Of Australia Conversion operation, ,means that a, number of those holders of the Maturing .stocks who did not convert will in due Course be receiving large amounts of capital which will have to be reinvested. 'But while I am disposed to anticipatea complete recovery in British Funds and kindred stocks, I am equally inclinea to think that when the final peak of prices is reached, that peak May not, be very much higher than the highest Points

(Continued on page 317.) -

Finance

(Continued from page 316.)

recorded in the table given above. _ Moreover, if a still higher level is established it-seems probable that it will be in the earlier part of the. 'year, for by the beginning of 1936 we. shall be well in sight of that most disturbing influence—a General Election. That is, if it has not then ARTHUR W,

Previous page

Previous page