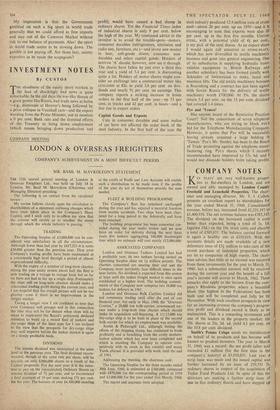

INVESTMENT NOTES

By CUSTOS Fr HE steadiness of the equity share markets in I the face of shockingly bad news is quite remarkable. In the old days the war-like threats of a great power like Riissia, bad trade news at hoine —e.g., dismissals at Hoover's being followed by a price collapse in Vauxhall cars—and the export warning from the Prime Minister, not to mention a 6 per cent. Bank rate and the frenzied efforts of the Treasury to bring down employment (which means bringing down production and

profit), would have caused a bad slump in ordinary shares. Yet the Financial Times index of industrial shares is only 9 per cent. below the high of the year. My continued advice to the investor is to avoid the trouble-spots—motors, consumer durables (refrigerators, television and radio sets, furniture, etc.)—and invest new money in beer, soft-goods stores, consumer non- durables and select capital goods. Holders of HOOVER 'A' should, however, now see it through. The shares have fallen by just over a third this year and a yield of 5.4 per cent. is discounting quite a lot. Holders of motor shares might con- sider an exchange into a commercial motor like LEYLANDS at 82s. to yield 3.6 per cent. on divi- dends and nearly 91 per cent. on earnings. This company reports a striking increase in home orders in the first half of the year—up 53 per cent. in trucks and 42 per cent. in buses—and a fair rise in export orders

Capital Goods and Exports Cuts in consumer durables and some makes of car have not affected the order book of the steel industry. In the first half of the year the

steel industry produced 12.4 million tons of crude steel—about 20 per cent. up on 1959—and it is encouraging to note that exports were also 20 per cent. up in the first five months. UNITED STEEL, with a potential yield of 41 per cent., is my pick of the steel shares. As an export share I would again call attention to STONE-PLATT, which has now diversified its textile machinery business and gone into general engineering. One of its subsidiaries is supplying hydraulic trans- mission equipment to British Railways and another subsidiary has been formed jointly with Schindler of Switzerland to make, instal and maintain lifts. The old textile machinery business is flourishing and a contract has just been signed with Soviet Russia for the delivery of textile machinery worth £700,000. At 55s. the shares return 5.4 per cent. on the 15 per cent. dividend last coverrd 1.4 times.

Pye and `Temco' Has anyone heard of the Restrictive Practices Court? Not the consortium of seven telephone manufacturers, who are trying to block pvE's bid for the Telephone Manufacturing Company. However, it seems that Pye will be successful, having already acquired a large holding In `Temdo.' Pye's Mr. Stanley has been to the Board of Trade protesting against the telephone manu- facturing ring. Pye's shares which I recently recommended have improved to 17s. 6d. and I would not dissuade holders fro'm taking profits.

Previous page

Previous page