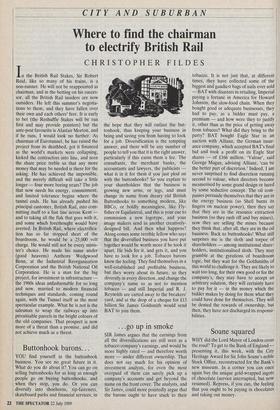

...go up in smoke

SIR James argues that the earnings from all the diversifications are still seen as a tobacco company's earnings, and would be more highly rated — and therefore worth more — under different ownership. That does not say much for his opinion of investment analysts, for even the most overpaid of them can surely pick up a company's accounts and get beyond the name on the front cover. The analysts, and Sir James, could more pointedly argue that the barons ought to have stuck to their

tobacco. It is not just that, at different times, they have collected some of the biggest and gaudiest bags of nails ever sold — BAT with disasters in retailing, Imperial paying a fortune in America for Howard Johnson, the slow-food chain. When they bought good or adequate businesses, they had to pay, as a bidder must pay, a premium — and how were they to justify it, other than as the price of getting away from tobacco? What did they bring to the party? BAT bought Eagle Star in an auction with Allianz, the German insur- ance company, which accepted BAT's final bid and took a profit on its Eagle Star shares — of £166 million. 'Valour', said George Magan, advising Allianz, 'can be the better part of discretion.' Indeed, I am never surprised to find discretion running second to valour, when directors become mesmerised by some grand design or lured by some seductive concept. The oil com- panies persuade themselves that they are in the energy business (so Shell burns its fingers on nuclear power), then they say that they are in the resource extraction business (so they rush off and buy mines), now they are selling the mines because they think that, after all, they are in the oil business. Back to buttonhooks! What still surprises me is the sloth and torpor of shareholders — among institutional share- holders, institutionalised sloth. They may grumble at the gyrations of boardroom logic, but they wait for the Goldsmiths of this world to challenge it. They are likely to wait too long, for their own good or for the company's, they may have to accept an arbitrary solution, they will certainly have to pay for it — in the money which the bidder makes by doing for them what they could have done for themselves. They will be denied the rewards of ownership, but then, they have not discharged its responsi- bilities.

Previous page

Previous page