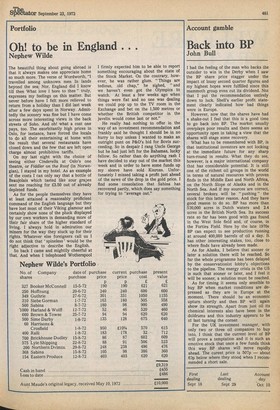

Account gamble

Back into BP

John Bull

I had the feeling of the man who backs the outsider to win in the Derby when I saw the BP share price stagger under the impact of lousy second quarter figures and my highest hopes were fulfilled since this mammoth group even cut its dividend. Not that I put the recommendation entirely down to luck. Shell's earlier profit statement clearly indicated how bad things were in Europe.

However, now that the shares have had a shake-out I feel that this is a good time to go back into BP. The market usually overplays poor results and there seems an opportunity open in taking a view that the shares will stage some recovery.

What has to be remembered with BP, is that institutional investors are not looking at the immediate future for any sharp turn-round in results. What they do see, however, is a major international company that has considerable potential. It is still one of the richest oil groups in the world in terms of natural resources with proven finds in the Middle East and North Africa, on the North Slope of Alaska and in the North Sea. And if my sources are correct, several brokers will be " pushing " the stock for this latter reason. And they have good reason to do so. BP has more than 530,000 acres in Dutch waters and 2.4 acres in the British North Sea. Its success rate so far has been good with gas found in the West Sole field and, of course, in the Forties Field. Here by the late 1970s BP can expect to see production running at around 400,000 barrels of oil a day. It has other interesting stakes, too, close to where finds have already been made.

As for Alaska, I believe that sooner or later a solution there will be reached. So far the whole programme has been delayed by the conservationist lobby's objections to the pipeline. The energy crisis in the US is such that sooner or later, and I feel it will be sooner, a solution must be reached.

As for timing it seems only sensible to buy BP when market conditions are depressed as they are in Europe at the moment. There should be an economic upturn shortly and then BP will again show its strength. Apart from just oil its chemical interests also have been in the doldrums and this industry appears to be at last turning the corner.

For the UK investment manager, with only two or three oil companies to buy into, I think that the current level of BP will prove a temptation and it is such an emotive stock that once a few funds think this way BP shares will move rapidly ahead. The curent price is 507p — about 63p below where they stood when I recommended a short sale.

First Last Account

dealing dealing day Sept 18 Sept 29 -Oct ie

Previous page

Previous page