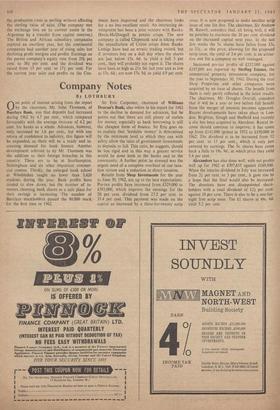

Investment Notes

By CUSTOS

HE gilt-edged market proved to be more sen- I salve to de Gaulle than equity shares. This may seem reasonable, because there are plenty of equity shares not affected by our entry into the COmmon Market and quite a few which might gain if we stayed out (e.g., the less efficient motor-car companies). But the selling of gilt- edged stocks has perhaps been overdone. The idea that sterling is immediately vulnerable and in need of support from a higher Bank rate is surely nonsense. The rise in the dollar invest- ment premium from 6+ per cent. to 8+ per cent. does not mean that there is already a run on the part of the industrialist to transfer his factory abroad. This is a very narrow market which reacts quickly to a little speculative buying. There has been some genuine switching from sterling equities into dollar equities which could well account for this rise.

Woolworth and Marks

I expect some chartists keep plotting figures to show when investors should switch front. MARKS AND SPENCER to WOOLWORTH and back again, but there is no doubt that it has paid recently to be out of Marks and in Woolworth. Last year Marks fell from 100s. 6d. to 79s. and is now 81s. 3d. to yield 2.9 per cent. The range of fluctuation in Woolworth was from 53s to 42s. 6d. and the price is now 49s. 6d. to yield 3.8 per cent. The appalling weather which upset the spring and summer of 1962 must have hit Marks, which is still largely a fashion textile trade, but must have left Woolworth, busily en- gaged in 'up-grading' its merchandise, more or less unaffected. At any rate. Woolworth pre- tax profits for the year have risen by 7.3 pet cent. against 4 per cent. in the previous year, while equity earnings have advanced from 501 per cent. to 541 per cent. The dividend has been raised from 35.8 per cent. to 371 per cent. A property revaluation is promised, but not neces- sarily a scrip bonus. Under its present strong management the shares seem relatively under- valued. It will be interesting to see whether BRITISH HOME STORES, now yielding 3.3 per cent., can produce results as excellent as these.

Liebigs

A food company which is unaffected by the Common Market debate is LIEBIGS. It owns cattle ranches and factories for processing canned meats and extracts in South America, Central Africa and the Sudan, and it has packing fac- tories in the UK, the Commonwealth overseas and the Continent of Europe. (Its main products are Oxo, Beefex, Fray Bentos and Liebigs soups.) It is therefore immaterial to the company whether the UK is a member of the EEC or not. In the year to August last it earned a record trading profit, the pre-tax figures being no less than 46 per cent. above those of the previous year. The 50 per cent. devaluation of the Argentine peso was actually an accounting help, for it reduced

the production costs in sterling without affecting the sterling value of sales. (The company met the exchange loss on its current assets in the Argentine by a transfer from capital reserves.) The British and African subsidiary companies enjoyed an excellent year, but the continental companies had another year of rising sales but declining profit margins and profits. Earnings on the parent company's equity rose from 29f per cent. to 38* per cent. and the dividend was raised from 15 per cent. to 171 per cent. For the current year sales and profits on the Con-

on-

tinent have improved and the chairman looks for a no less excellent result. An interesting de- velopment has been a joint venture with Ranks- Hovis-McDougall in potato crisps. The new company is called Chipmunk and is taking over the manufacture of Cristo crisps from Ranks. Liebigs have- had an erratic trading record, but if investors buy on a dull day when the shares are just below 17s. 6d. to yield a full 5 per cent., they will probably not regret it. The shares have been as high as 21s. 6d. last year and as low as 13s. 6d.; are now 17s. 9d. to yield 4.9 per cent.

Previous page

Previous page