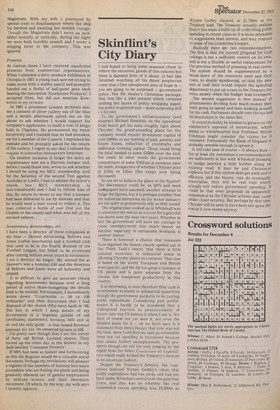

Skinflint's City Diary

I had hoped to bring some seasonal cheer to relieve the recurrent gloom of this column but there is damned little of it about. (I feel like Jeremiah watching all his direst prophecies come true.) One unexpected area of hope is — you are going to be surprised — government policy. Not Mr Healey's Christmas package; that was like a joke present which contains nothing but layers of pretty wrapping paper; but policy in general and — more surprising still — Chrysler.

To the government's embarrassment (and surprise) Michael Heseltine on the opposition front bench got his sums roughly right about Chrysler: the grand-sounding plans for the company would require investment capital of over £200m, to say nothing of past, present and future losses, reduction of overdrafts and additional working capital. Those could bring the total needed to some £350m over the next few years. In other words the government commitment of some £1621/2m is nowhere near the mark, irrespective of whether Chrysler puts in €10m or -E35m (the range now being. discussed).

So are we to believe the plans or the figures? The discrepancy could tie, as MPs and most newspapers have assumed, another attempt to fudge the figures, but it is perhaps possible that the industrial intentions on the motor industry are not quite as gratuitously silly as they sound.

The original plan cooked up in Whitehall was to announce the rescue as a cover for a graceful run-down over the next two years. Whether in fact the government will have the courage to cause unemployment that much nearer an election, especially in nationalist Scotland, is another matter.

There is however a chance that ministers have digested the lesson, clearly spelled out in the Think Tank's report, that there is little rational economic or industrial sense in allowing Chrysler plants to continue. This case is based on the world. European and British overcapacity, and the far too great a number of UK plants and is quite separate from the chronic low manpower producitivty in this country.

It is interesting to note therefore that cash is nevertheless available in substantial quantities though the government purports to be cutting public expenditure. Considering past performance it is hardly to be wondered that a widespread reaction to announcement of future cuts was I'll believe it when I see it. We have of course not yet seen it, nor even the detailed plans for it — all we have seen is a statement from Denis Healey that now was not the time, since Lord Keynes said governments must not cut 'spending in recessions because that causes further unemployment. The prospects though are not too rosy judging by the report from the Select Cuiniiiii.Lee on Expenditure which really kicked the Treasury's bottom in no uncertain fashion.

Despite the Treasury's defence, the committee believed Wynne Godley's claim that public expenditure had run away and had not been under Whitehall control over the past four years, and this was so whether the real unintended excess spending was 0,500m as

Wynne Godley claimed, or £1,700m as the Treasury said. The Treasury actually realises that it has made a balls-up of controlling public spending in recent years so it is more amenable to suggestions than normal, and may respond to some of the committee's report.

Basically there are two recommendations. The first is that the current proposal for cash ceilings is not a sufficient control on its own, and is not a flexible or useful replacement for the previous method of planning in real terms. The system should be supplemented by a break-down of the resources used and their costs, to enable monitoring, so that the new sort of cash limit would require the spending department to put up a case to the Treasury for extra money when the budget was overspent.

The second suggestion is that instead of governments deciding how much money they were going to spend and then looking around for the cash, Parliament should vote the tax and its destination in the same Bill.

It would probably be kindest to gloss over the committee's espousal of monetarism, which seems so wholehearted that Professor Milton Friedman might consider the claims for it excessive. Fortunately the Bank of England is probably sensible enough to ignore it.

It will take time of course — it always does but at least the committee's recommendations are sufficiently in line with Whitehall thinking to nudge practice a little further along an existing road. It may be just Christmas euphoria but if this system does get used and is effective, and the Healey cuts do eventually materialise, they will be real cuts which actually will reduce government spending. It could be that even proposals as apparently nonsensical as the Chrysler scheme may come under closer scrutiny. But perhaps by that time Chrysler will be seen to have been not quite the rescue it now seems anyway.

Previous page

Previous page