COMPANY NOTES

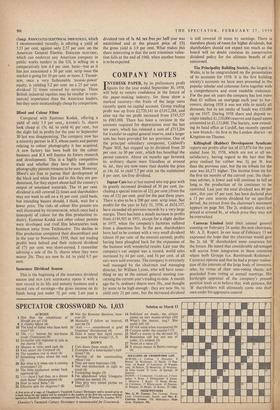

'figures PAPER, by its preliminary profit

'figures for the year ended September 30, 1958, will help to restore confidence in the future of the paper-making industry, for these show a marked recovery-the fruits of the large sums recently spent on capital account. Group trading profit was up from £2,720,141 to £3,012,288, and after tax the net profit increased from £745,527 to £983,988. There has been a revision in the amounts required for depreciation over the last ten years, which has released a sum of £713,206 for transfer to capital general reserve, and a larger sum has been provided for tax provision. One of the principal subsidiary companies, Caldwell's Paper Mill, has stepped up its dividend from 20 per cent, to 30 per cent., which has benefited the parent concern. About six months ago Inveresk 6s. ordinary shares were friendless at around 6s, 6d., they are now more than double the price at 14s. 6d. to yield 5.7 per cent, on the maintained 8 per cent. tax-free dividend.

Jaguar Cars has at last moved into top gear with its greatly increased dividend of 30 per cent. (in- cluding a special interim of 124 per cent.) from the rate of 124 per cent. paid for the past three years. There is also to be a 200 per cent, scrip issue. Net profits for the year to July 31, 1958, at £624,337, have exceeded all previous records by a very large margin. There has been a steady increase in profits from £149,505 in 1951, except for a slight decline in 1957, when the company's factories suffered from a disastrous fire. In the past, shareholders have had to be content with a very small dividend (about 10 per cent. of the amount earned), profits having been ploughed back for the expansion of the business with wonderful results. Last year the company's car output was a record, world sales increased by 44 per cent., and 54 per cent, of all cars were sold overseas. The company is extremely well managed by the chairman and managing director, Sir William Lyons, who will have some- thing to say at the annual general meeting con- cerning the current year's trading to date. A month ago the 5s. ordinary shares were 38s., and thought by some to be high enough : they are now 56s. to yield only 24 per cent., but the increased dividend is still covered 10 times by earnings. There is therefore plenty of room for higher dividends, but shareholders should not expect too much as the board will no doubt continue its conservative dividend policy for the ultimate benefit of all concerned.

The Principality Building Society, the largest in Wales, is to be congratulated on the presentation of its accounts for 1958. It is the first building society's accounts we have seen presented in the popular tabular and columnar form together with a comprehensive and most readable statement. For the past six years the company has lent more than £1 million on mortgage each year to bor- rowers; during 1958 it was not able to satisfy all demands, but its net intake of funds was £18,000 up on 1957. During 1958 share and deposit re- ceipts totalled £1,110,000 reserves and liquid assets amounted to £1,133,000. The Society, now extend- ing its head office at Cardiff, has recently opened a new branch-its first in the London district-at Kingston-on-Thames.

Killinghall (Rubber) Development Syndicate reports net profits after tax of £15,874 for the year ended June 30, 1958, which are not at all un- satisfactory, having regard to the fact that the price realised for rubber was 34 per lb. less than the previous year, but the tin tribute for the year was £6,171 higher. The income from tin for the first six months of the current year, the chair- man advises, is lower and will continue to fall so long as the production of tin continues to be restricted. Last year the total dividend was 80 per cent., this year 65 per cent, has been declared plus a 15 per cent. interim dividend for no specified period. An extract from the chairman's statement appears on page 304. The 2s. ordinary shares are priced at around 8s., at which price they may not be overvalued.

Carreras Limited held their annual general meeting on February 24 under the new chairman, Mr. A. E. Rupert. In our issue of February 13 we expressed the hope that the chairman would give the 2s. 6d, 'B' shareholders some assurance for the future. He stated that considerable advantages will accrue from integration in those countries where both Groups (i,e. Rembrandt/ Rothman / Carreras) operate and that he had a proper realisa- tion of the interests of the large body of investors, who, by virtue of their non-voting shares, are precluded from voting at annual meetings. His forthright appraisal of the company's present position leads us to believe that, with patience, the 'B' shareholders will ultimately come into their own under his aggressive control.

Previous page

Previous page