Part 1: The Expansionists

Condensed from the book by Martin D. Weiss

The world economy is on the brink of a money panic. The place is every home, business and government. The time is now.

The money panic is not a recession lingering on into the far reaches of the twentieth century. Nor is it the Great Depression returning to haunt us from the depths of the 1930s. The money panic is a boomerang reaction to centuries of accelerated expansion which began with the industrial revolution. It is an explosive outpouring of stockpiled material goods; an almost instantaneous contraction of production; a major reversal in the trend towards urbanisation and industrialisation; a radical shift in values; and most important, a rush for cash by families, corporations and governments in a desperate attempt to prevent bankruptcy. .

Regarding the question of whether or not President Ford and Congress will' succeed in their efforts to engineer a recovery, the answer of this series is 'No'. But to the question of whether there is still hope for the long-term future of the Western world, the answer is 'Yes'.

The money panic is a natural adjustment to imbalances deeply imbedded in the structure of economic society — whether over-developed, or under-developed, communist or non-communist, 'civilised' or 'primitive'. Despite the upheaval, pain and unhappiness, it can also become an opportunity for nations to stop, co-operate, re-organise and adjust their productive systems to the real limits of the earth environment.

The purpose here is to contribute, even if only in a very small way, to this opportunity, by predicting a money panic, I am not shouting 'fire' in a crowded cinema. I am trying to uncover real, material hazards, lurking behind the still strong-looking facades of financial power. Hopefully this will also help prepare readers to react rationally to the panic ahead, and in that way soften its negative impact.

The boom began in 1946 when the euphoria of military victory was converted into the longest era of economic prosperity in American history.

Turn on the boom and inflation is an immediate by-product; turn off the boom and inflation temporarily disappears. Fortunately or unfortunately, depending upon your historical perspective, no one in the past twenty-eight years has had either the power or the courage to turn off the economic boom. Instead we have plunged headlong into the most intense period of expansion, construction and production since the emergence of life on this planet.

Whenever there was a showdown between an inflation-ridden prosperity and an unemployment-ridden deflation, all the post-war presidents chose the inflation-ridden prosperity. All were faced with essentially the same alternatives: recession or inflation; sacrifice the present for the future or sacrifice the future for the present. And with the possible exception of the last two years of the Eisenhower administration, the choice of these politicians was 'prosperity now' and 'the hell with what happens after the next election', let alone what

1 happens to the people who will be living in 1975. But now that the economy is threatening to crumple before our very eyes, we can briefly look back at the twenty-eight years of postwar -growth and see it in a new light. The State of the Union addresses or economic policy ,speeches, all the newspaper editorials and congressional debates seem to merge into one

amorphous blur: Truman IkeKennedyJohnsonNixonFord — one long, long stretch of pro-inflation, anti-deflation expansionism.

Battle against inflation

Truman began the post-war era with "a pledge on the part of the people voiced through their laws that never again shall any sacrifices be laid on the altar of natural economic force". In effect, depressions were branded and stamped 'illegal, immoral, and impossible'. The Eisenhower years marked the midpoint of the boom — a point of equilibrium near which the push of the past and the pull of the future were apparently equally divided. An aura of stability hovered over the entire system. Under the surface, however, the tug-of-war for economic power decisively set the tone of the events to come in the second leg of the boom and the second half of the century.

The moderates wanted to go slow on economic expansion, preserve the dollar, prevent inflation. The expansionists wanted to push ahead, move on, produce more. Anyone who was steadfastly against excessive growth and inflation was dismissed usually as an arch-conservative and was eventually weeded out of the decision-making process at all levels of government and business. Conversely, anyone who moved into the higher echelons of the power hierarchy had to be, almost by definition, essentially in favour of economic 'progress' and 'prosperity'.

In one sense the expansionists and the moderates had a basically similar goal: prevent at all costs the recurrence of that tragic period of prolonged suffering called the Great Depression. But where the expansionists had a short-term perspective and sought to cut off deflation and recession as soon as it appeared, the moderates felt that in the long term the only way to prevent a great bust was to prevent a great boom. They believed that both extremes should be avoided in order to maintain a pattern of balanced growth for the remainder of the century.

One of the classic examples of the mid-century struggles was the Wolfson-Avery battle for Montgomery Ward, America's second largest retail operation. In the winter of 1954, Louis Wolfson, a Florida junk dealer who had risen to the control of an industrial concern with some $200 million in assets, mounted an all-out raid on Montgomery Ward in an attempt to take over management from Sewell Avery.

Avery was vulnerable to an attack because he had been so conservative and refused to plough profits into construction and expansion. He had preferred instead to build up as much as $300 million in cash reserves, and it was this huge bundle of cash that became the prime target of the Wolfson raiders. Wolfson accused management of "hoarding cash", "running a bank with a department store front", and hitching the company's future to the possibility of a postwar depression. The New York Times called it "one of the fierciest battles in the history of corporate finance".

Fortunately for management, however, J. Irving Weiss, the top associate of Avery's business adviser, organised the Businessman's Committee for Seasoned Management, which sponsored a nation-wide media campaign and led the moderate forces to victory. But the real battle was yet to come.

The balanced budget

When Eisenhower entered his last two years in office, the federal budget looked as if it was going haywire. It was then expected that the budget deficit would jump to a whopping $13 billion, the equivalent of a deficit of about $50 billion in today's budget. Eisenhower didn't want to be blamed by economic historians as the president who unbalanced the budget or the man who doomed future generations to the ravages of inflation. So in the State of the Union address of January 3, 1959, he complained about the excessive costs of military hardware and insisted that "we must avoid extremes ... of waste, and inflation which could reduce job opportunities, price us out of world markets, shrink the value of saving . . . To minimise the danger of future soaring prices and to keep our economy sound and expanding ... I shall submit a balanced budget."

At the time, the cold war was a hot issue and Congress was being bombarded by signs of Soviet technological and economic advancement — Mikoyan bragging about Russian GNP and Russian moon rockets zooming off into solar orbit. It was the Wolfson-Avery debate-all over again but on a far grander scale: do we yield to competition or do we invite economic instability?

When Eisenhower finally put together a $77 billion budget, the Democratic Advisory Council charged that the budget was "not an imaginative step toward the future, but a selfish and sullen retreat into the past", and that "inflation is not a present danger". Eisenhower retaliated by going over the head of Congress and making a direct appeal to the public for support. But the appeal was weak. In fact, the headline the next morning in the New York Times said nothing about it whatsoever.

One week passed. The American people remained silent. The press remained silent. No protests. No editorials. No voter appeals to Congress. Could it be that American businessmen actually wanted inflation — not too much but a little? "Heck," they said, "if that's what it takes to make progress, if that's what it takes to get higher corporate earnings, then — sure — by all means — why not. Let's try some of that creeping inflation." As it turned out, however, there were many people who cared about inflation. Several weeks later they raised their voices in the loudest protest against inflation ever recorded in American history.

Sound-dollar committee

When nearly all hopes for a balanced budget had begun to fade, the same individuals who had fought and won the Montgomery Ward battle — led by economist J. Irvine Weiss, attorney Dean Alfange and businessman Jim Selvage — regrouped to form the Sound Dollar Committee.

A full-page ad in the Wall Street Journal, in support of fiscal restraints, merely set off the first sparks. The concept was immediately picked up by the Chicago Tribune, the Los Angeles Times, the New York Daily News and the Reader's Digest. Soon scores of newspapers and magazines joined the Sound Dollar Committee bandwagon in a nationwide mail-in campaign to state legislators, representatives and senators.

Congressmen would walk into their office on a Monday morning and be struck immediately with the clutter of mailbags. It was an avalanche. Twelve million postcards, coupons, letters and telegrams!

New York's Governor Rockefeller, who was seeking a large budget involving heavy tax increases, received over 100,000 protest letters. Business Week reported that by mid-March the public attitude throughout the country had switched from apathy to intense interest and all of a sudden Washington was a "city of inflation fighters". One after another congressmen shifted their votes and supported the balanced budget. In fact, for a moment it seemed as if inflation had been licked once and for all. But it was only a short-lived victory.

At Montgomery Ward, soon after the proxy fight, Sewell Avery resigned and the retail company went on eventually to exhaust its cash reserves, accumulating huge debts. Competing retail operations were expanding. Therefore Montgomery Ward had to expand. There was really no el-mice. If they hadn't expanded they would have been left behind, squeezed out of the marketplace, and eventually gobbled up by another giant.

In Congress, the anti-inflationary forces were merely sticking their fingers into an invisible dike, spitting against the wind: the 1959-60 budget was the last balanced budget to date.

There was still so much more room for the American industrial machine to expand, and there were still so many more Candide-like misadventures to come.

Origin of the Superb oom

Lyndon B. Johnson, more than any other modern American president, sought to create the best of all possible worlds. But the guns overheated and the butter melted. It was all too much for the domestic economy and the American people to tolerate. Johnson sought simultaneously to create the heavenly kingdom of the "Great Society" in America and support the hellish war in Vietnam. When Bill Martin refused to co-operate with an easy money policy, Johnson fumed with anger. At the same time, therefore, as the troops were pouring into South-East Asia and the Great Society was being legislated into existence, the putsch was on to take over the Federal Reserve. So by the time Johnson stepped down and Nixon stepped in, guns and butter were in' once and for all. Balancing the budgets, a sound currency, and other such

quaaint anachronisms were 'out'. Under the banner of progress, Democrats and Republicans forces from the left and the right

joined together to pump gas into the fires of inflation and push the economy beyond the point of no return. We had entered an economic no-man's-land in which speculators were to control the marketplace, the marketplace was to control big business, and big business was to control government. So here we are: face to face with one of the most persuasive liquidity problems of all time.

Corporation illiquidity

"Our expansion strategies were all right for the early 'sixties, but this is the space age, the era of nuclear energy, the day of the Great Society. We need a new strategy, a new plan, a new philosophy. We need more rapid expansion," announced the chairman of ABC Corporation with a touch of arrogance in his voice. It was the winter of 1969 and business volume was expanding like never before. Strategy meetings such as these were being held in corporations throughout the country to plan for the biggest wave of growth for any period in human history the superboom of the early 'seventies.

"But sir," queried an assistant to the chairman, "the last plan we called 'project acceleration'. What shall we call the plan this time?"

"Project Explosion! Of course." The financial vice-president was somewhat confused. "But haven't we already borrowed heavily from the banks. Aren't we already expanding as fast as physically possible? What more can we do?"

"The trouble with us," answered the chairman, "is that we imbue liquid assets with a positive value, and liabilities with a negative value. Every youngster has been brought up. with the idea that 'money is good' and 'debt is bad'. But now we must struggle to purge ourselves of the prejudices and fears rooted in experiences of bygone generations. This is a itetv eoinpdny, a new economy --rieW world. Let us declare war on cash and embrace

debt with all our love and devotion.

"Push the commercial paper. Issue more common stock. Issue more preferred stock. Tap the Eurodollar market. Tap the Eurobond market. Float larger and larger debt issues and when I say float, I really mean drown. Drown them in our debt paper."

"But isn't all this a bit risky? Isn't there a big danger involved here?" asked the financial vice-president. "The thin ice of cash, I mean. Suppose there's a strike. Suppose there's a-a-1 don't know something unexpected. I know what you mean by the old prejudices against debt. That's all very true. But there's still such a thing as bad times, you know. We still haven't licked the business cycle completely."

"If there's a recession coming, we'll know ahead of time. That's what our computer surveys of consumer buying plans are for. Don't you see? This is no longer the hit-andmiss market system of the old days. Now we know what the customer is going to do well in advance, even before he himself knows in certain cases. When you've got that kind of information you don't need as much cash lying around as you used to. What you used to call illiquid in the old days is damn liquid in this new system."

To a certain degree the chairman of the ABC corporation was correct. -Proper" or "normal" liquidity was no longer in the same range as it used to be and corporations could get away with much less cash. Yet, there were two problems associated with such a rationale.

First, it was usually assumed that the economic system was depression-proof; that business declines are gradual and slow; and that even if there were to be a recession there would also be time to retreat. Second, after the corporations went through all the motions of setting up new lower limits for their liquidity ratios, they simply went ahead and ignored them anyhow, letting their cash positions drop still further and current debts pile up even more. Hyperexpansionist strategies produced record sales and earnings for most corporations. But they also dragged them to the brink of financial insolvency.

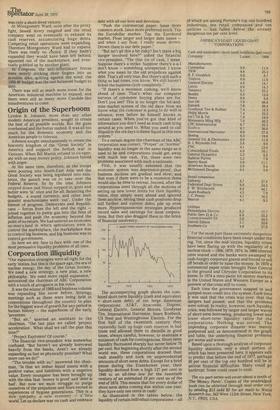

The accompanying graph shows the combined short-term liquidity (cash and equivalent v short-term debt) of ten large American corporations: AT&T, Anaconda, Dupont, General Electric, General Motors, Goodyear Tire, International Harvester, Sears Roebuck, US Steel and Westinghouse Electric. For the first half of the twentieth century they repeatedly built up huge cash reserves in bad times and allowed them to dwindle in good times, always careful, however, to maintain a minimum of cash for contingencies. Short-term liquidity fluctuated sharply but never below 70 per cent. But beginning shortly after the second world war, these corporations drained their cash steadily and took on unprecedented amounts of short-term debts. Except for a brief pause during the Eisenhower year, their liquidity declined from a high 127 per cent in 1946 to an all-time low for the twentieth century of an estimated 10 per cent as of the end of 1974. This means that for every dollar of short-term debts coming due within one year, they have only ten cents in cash! As illustrated in the tables below, the liquidity of certain individual corporations all of which are among Fortune's top one hundred industrials, ten retail companies and ten utilities has fallen below the already dangerous ten per cent level.

For the most part these extremely dangerous financial conditions have been swept under the rug. Yet, since the mid-'sixties, liquidity crises have been flaring up with the regularity of a nuclear clock -1966, 1970, 1974. In 1966 interest rates soared and the banks were swamped by cash-hungry corporate giants and forced to sell off bonds in order to raise the money. In 1970 a commercial paper crisis brought Penn Central to the ground and Chrysler Corporation to its knees. In 1974 a mini-panic hit money markets in the United States and Western Europe as a preview of the crisis still to come.

Each time the government stepped in and pumped more credit into the system. Each time it was said that the crisis was over, that the dangers had passed, and that the problems were solved. In reality, however, each liquidity crisis, was followed by larger and larger waves of short-term borrowing, producing lower and lower short-term liquidity ratios for the corporations. Nothing was solved. The impending corporate disaster was merely postponed and, as demonstrated in the graph and table, the underlying financial problems got worse and worse. Based upon a thorough. analysis of corporate liquidity statistics, only a small portion of which has been presented here, it appears safe to predict that before the end of 1977, perhaps 50 per cent of the top one hundred will be in serious financial difficulties. Many could go bankrupt. Some could cease to exist.

The six-part series will cover about a tenth of The Money Panic'. Copies of the unabridged book can be obtained through mail order only by sending $15 (add $2 for air mail) to Weiss Research Inc, 542 West 112th Street, New York, N.Y., 10025, USA.

Previous page

Previous page