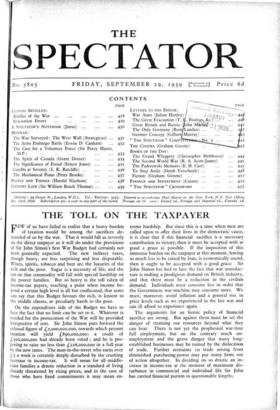

THE TOLL ON THE TAXPAYER

FEW of us have failed to realise that a heavy burden of taxation would be among the sacrifices de- manded of us by the war. That it would fall as severely on the direct taxpayer as it will do under the provisions of Sir John Simon's first War Budget had certainly not been generally expected. The new indirect taxes, though heavy, are less surprising and less disputable. Wines, spirits, tobacco and beer are the luxuries of the rich and the poor. Sugar is a necessity of life, and the tax on that commodity will fall with special hardship on the poorer families. But so heavy is the toll taken of income-tax payers, reaching a point when income be- yond a certain high level is all but confiscated, that none can say that this Budget favours the rich, is lenient to the middle classes, or peculiarly harsh to the poor.

On the expenditure side of the Budget we have to face the fact that no limit can be set to it. Whatever is needed for the prosecution of the War will be provided irrespective of cost. Sir John Simon puts forward the colossal figure of L2,000,000,000, towards which present taxation will yield L890,000,000; a credit of £500,000,000 had already been voted ; and he is pro- posing to raise no less than £226,000,000 in a full year by the new taxes. The man-in-the-street who earns over £3 a week is certainly deeply disturbed by the crushing increase in income-tax. It will mean for all middle- class families a drastic reduction in a standard of living already threatened by rising prices, and in the case of those who have fixed commitments it may mean ex- treme hardship. But since this is a time when men are called upon to offer their lives in the democratic cause, it is clear that if this financial sacrifice is a necessary contribution to victory, then it must be accepted with as good a grace as possible. If the imposition of this immense burden on the taxpayer at this moment, leaving so much less to be raised by loan, is economically sound, then it ought to be accepted with a good grace. Sir John Simon has had to face the fact that war manufac- ture is making a prodigious demand on British industry, and that there must be a reduction in the civilian demand. Individuals must consume less in order that the Government war-machine may consume more. We must, moreover, avoid inflation and a general rise in price levels such as we experienced in the last war and can ill afford to experience again.

The arguments for an heroic policy of financial sacrifice are strong. But against them must be set the danger of straining our resources beyond what they can bear. There is not yet the prophesied war-time full employment, but on the contrary much un- employment and the grave danger that many long- established businesses may be ruined by the dislocation of trade. Further restraints on trade arising from diminished purchasing-power may put many firms out of action altogether. In deciding on so drastic an in- crease in income-tax at the moment of maximum dis- turbance in commercial and individual life Sir John has carried financial purism to questionable lengths.