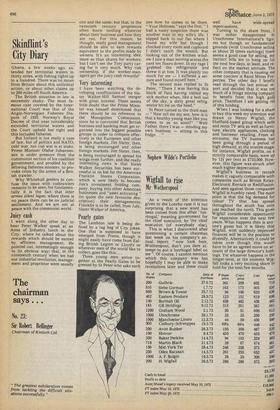

Nephew Wilde's Portfolio

Wigf all to rise

Mr Wotherspool

As a result of the attention given to the Lonrho case it is not surprising that a new word has been coined from this affair ' Ionrhogal,' meaning government for the chief executive, by the chief executive (of everybody else). This is what I discovered after questioning a certain chairman last week on his company's annual report: " now look here, Wotherspool, don't you dare attempt to put a lonrhogal label on me ". Of course, I cannot mention which this company was but hopefully I may be able to make revelations later and these could

,SpTledtatOT 'June 2, 1973 well have wide-spread

repercussions. Turning to the share front, I was rather disappointed in Unochrome International's figu res but though on fundamental grounds (with Unochrome selling

at about 25 times earnings) there seems a good case for selling, my instinct tells me to hang on for the next few days, at least, and reflect on the market attitude. The other company that is causing me some concern is Rand Mines Properties. The other day I briefly read through the last annual report and decided that it was too much of a fringe mining company to benefit from the high gold price. Therefore I am getting rid of this holding.

When I was looking for a share to buy this week my attention was drawn to Henry Wigfall, the Sheffield-based group which sells and rents TV sets as well as furniture, electric appliances, clothing and footwear retailing. From all accounts, the TV business has been going through a period of high demand; at the interim stage, for instance, Wigfall profits, on a strictly comparable basis, were up by 12# per cent at E733,000. However, this figure was struck after much higher depreciation. Wigfall's business in rentals makes it vaguely comparable with companies such as British Relay, Electronic Rentals or Rediffusion. And seen against those companies Wigfall is humbly rated. The main point is that the big demand for colour TV that has spread throughout the south has only just reached the north. This gives Wigfall considerable opportunity for expansion over the next feW years. What happens then is anyone's guess but it is likely that Wigfall, with suddenly improved finances will be in the position to diversify. Alternatively it could be taken over though this would have to be an agreed move on account of the large director's holdings. Yet whatever happens in the longer-term, at the moment Wigfall looks a very exciting share to hold for the next few months.

Previous page

Previous page