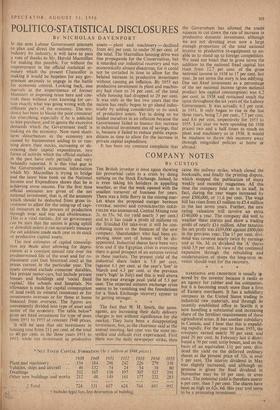

COMPANY NOTES

By CUSTOS

THE British investor is once again showing his proverbial calm in a crisis by doing nething on the Stock Exchange. Indeed, he is even taking his holidays in appalling weather, so that the week opened with the smallest turnover of business for years. There was a little flurry in the mining mar- ket when the proposed merger between CENTRAL MINING and CONSOLIDATED GOLD- FIELDS was announced. Central Mining rose 2s. to 55s. 9d. (to yield nearly 5 per cent.) and as it has made a profit of millions on the Trinidad Oil take-over it will be con- tributing most to the finances of the new company. Shareholders who had been ex- pecting some sort of bonus will be dis- appointed. industrial shares have been very firm and if the Egyptian crisis is overcome there is good prospect of an autumn revival in these markets. The present yield of the industrial share index is 5.8 per cent. (against 6.1 per cent, at the year's `low' in March and 4.3 per cent, at the previous year's 'high' in July) and this is well above the ten-year average peak yield of 5.3 per cent. The expected autumn exchange crisis seems to be vanishing and the foundations for a Stock Exchange recovery appear to

be getting stronger, * * came the railway strike, which closed the bookstalls, and finally the printing dispute, which stopped the publication of many weekly and monthly magazines. All this time the company held on to its staff. In fact, during the year wages increased by over £500,000, or 11.6 per cent. The wage bill has risen from £3 million to £5.4 million in the last seven years. Further, the new rating valuation will involve an extra £140,000 a year. The company did well to weather these storms and show a trading profit of nearly £11 million. After taxation the net profit was £639,000 against £800,000 in the previous year. The 15 per cent, divi- dend was covered nearly twice by earnings and at 50s. 3d. ex dividend the `A' shares Yield 5.9 per cent. In view of the continued expansion through the rebuilding and modernisation of shops the long-term in- vestor should wait for the recovery.

Previous page

Previous page