INVESTMENT NOTES

By CUSTOS

ITIHE attempt in some quarters to kill the very I selective bull market in equity shares has not succeeded, for a new Stock Exchange account has opened with impressive firmness. The gilt-edged market, which is the main support of the bull movement, has actually moved up in spite of the rise in the Treasury bill rate to 3i per cent. The fact that IMPERIAL CHEMICAL INDUSTRIES strictly scaled down its interim dividend to 2-I per cent to allow for the one-for-two scrip issue last May and that the SHELL and ROYAL-DUTCH interim dividends were unchanged had a good deal to do with the temporary pause in markets, but only the wildest bulls could have expected these dividends to be increased before the current trade recession had been checked. There are signs that the easier credit terms now being offered to consumers are having a stimulating effect upon domestic trade. If the Montreal conference resolutions for in- creased economic aid to Commonwealth countries —through cheaper export credits and Exchequer loans—is followed up by New Delhi resolutiom to boost international reserves and World Bank resources the bulls may reasonably look forward to a trade expansion next spring.

Cementation and the Big Contractors The Montreal resolutions should also direct more attention to the shares of the large Contract- ing companies. The Ministry of Works recently gave figures of the increasing overseas construe. tional work done by British contractors last year. The value of orders in hand at the end of March

last was £122 million-an increase of 10 per cent. over that outstanding a year previously. In the sterling-area countries the total value of contracts obtained last year rose by 55 per cent. to £84 mil- lion. Foreign contracts outside the dollar and OEEC countries were also sharply higher. George Wimpey obtained a £12 million contract for a hydro-electric scheme in Brazil, and Cementation an £850,000 contract for the construction of the first bridge over the River Karun in Persia. Tay- lor Woodrow had a repeat contract for a textile mill in Persia worth £250,000, and this firm is still busy on the £24 million contract for the extension of the Nadi airport in Fiji, which will be completed by the end of next year. Easier and cheaper loans fbr overseas Commonwealth deyelopment should certainly increase the civil contractors' order books, but against this must be set a fall in the value of contracting work in this country. The shares of the leaders are not cheap, yielding under 4 per cent. for RICHARD COSTAIN, and under 3 per cent. for GEORGE WIMPEY, but there is scope for TAYLOR WOODROW, which has just announced that it hopes to main- tain the current dividend rate of 20 per cent. on the capital to be increased by the forthcoming one-for-two free scrip issue. At 26s. cum bonus the shares give a potential yield of 54 per cent. CEMENTATION 5s. shares I recommended when they were yielding 8 per cent. : they are now quoted at lls. to yield 5.6 per cent. on the 124 per cent. dividend which was last covered 2.3 times.

Options

I do not suppose that many readers of this page will be gambling in Stock Exchange options, deal- ings in which are due to start next Tuesday, but a word of caution will not be out of place. For so many shillings per share a dealer will sell you the right to 'call' or `put' or 'call-and-put,' for the period of one or up to seven Stock Exchange accounts, any share which enjoys a free market. The list of option, prices which the jobbers have published as a basis for negotiation suggests one immediate snag. Unless the market is to move very decisively up or down there will be little chance of making a profit for the option prices are pretty expensive. For example, a three months' put-or-call option on ICI at 34s. 6d. is priced at 2s. Add the stamp and br4erage on the full price and you will see that the share has to move 3s. or nearly 10 per cent. before you have covered your expenses. If markets are running into a period of consolidation-with prices, as it were, marking time-there will be little chance of coming out with a profit. Another snag is that if you do see a profit before the option expires, you cannot secure it by actually buying or selling the share as the case may be. You can, of course, deal but you would have to chance being able to contango the shares until the option period expires. The best policy for the speculator is to choose the market with the biggest swings, for example, the oil share market. A three months' call on ULTRAMAR at 67s. 6d. would have cost 4s. 3d., but this share has risen on BP take-over rumours no less than 15s. to 82s. 6d. in three days.

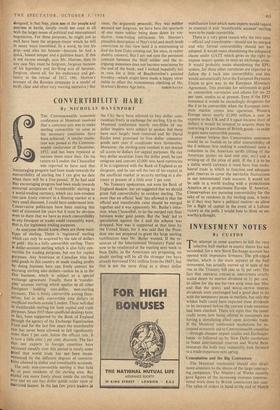

Woodgate Investment

I had no space last week to give details of the WOODGATE INVESTMENT TRUST, which seemed to be a useful haven for those cashing-in profits from the unseemly property share boom. Dealings began in the 5s. shares this week at 9s. 9d. and rose quickly to 10s. 9d. The company is half a property company and half an investment trust, and in view of the current yields in these markets, I think the shares are entitled to sell on at least a 5 per cent. yield basis, which would put them at 12s. 6d. Taking first their asset cover, the value of their investments gives about 6s. to 6s. 3d. and the valuation of properties a further 4s. 9d. Other assets add about 2s. 2d., so that the total assets cover is about 13s. 2d. As regards earnings cover the company's profit estimate gives earnings of 13.9 per cent. on the issued capital to cover the divi- dend of 124 per cent. which is forecast. This is in line with the customary high rate of distribution in this market An interim dividend of 5 per cent. is due in November and the final in June. The shares are in letter form, free of stamp, up to the end of this month.

Previous page

Previous page