TOPICS' OF THE DAY.

FINANCIAL STATE OF THE COUNTRY.

THE Reformed House of Commons has again been drao.o

,s,

through the mire. In obedience to the Ministerial mandate,

has resolved that "it is inexpedient to make an extensive Chan

in our whole financial system." It has also rescinded a forn decision, and passed a solemn though not a very deliberate reso' tion, "that the deficiency that would be occasioned in the reveu by a reduction of the tax on Malt to 10s. the quarter, and the repeal of the tax on Houses and Windows, could only be st plied by the substitution of a general tax on Property and

ed it

ge 11 u-

lie

come: An assertion very incorrect in point of fact, inasmuch a Property-tax at a uniform rate of 5 per cent. would yield a si plus of Lb 00,0001.* Weeding the senatorial proposition of its untruth, and putti it in a more distinct and substantive form—as, " Would it be i sirable to impose a Property-tax in order merely to reduce t Malt-duty one half, and repeal the House and Window taxes we answer—No. Because, though the Malt-duty is an improt tax, there are very many taxes much more mischievous ; a granting that the House and Window duties were more partial a oppressive than any of the rest, there is a surplus revenue in( than sufficient to remit either one or the other; and by rev ing the mode of levy, the evils of the one retained might be ob.

ated. Nay, we go further—we doubt whether it be advisable impose a Property-tax for the sake of remitting any one, two, three taxes ; because it is only by taking a comprehensive view

"our whole financial system that any good is to be effibeted. is not by peddling here and pottering there—by remitting t duty on Tiles, yet retaining the worse duty on Bricks, still 511 jetting the manufacturer to the vexations and re,trietions or t: Excise-laws, and the public to the expense of levying this inc expensively collected tax—it is not by reducinsr the l'raction ol halfpenny and retaining the fraction of a halfpenny per pound the duty on raw Cotton, or by petty modifications in taxes whi few will feel, and which, whether felt or not, are in practice u workable—that any extensive benefit or any real relief can ' given to the people. So far from being " inexpedient," it is a.bs lutely necessary, to "make an extensive change in our 'whole nancial system, if the -Reformed House of Commons either i tends to do its financial duty or to fulfil its financial pledges. is only by taking a view of the whole that the prominent evils our " financial system" can be removed,—unless we are preparl to abolish the Monarchy and Aristocracy, and to vote that it " inexpedient" to pay the whole interest of the Debt. tjllfC tunately for the reputation of the Finance Minister, the evi of the system are far more oppressive to the people than pr ductive to the revenue. In what mode and by what means they cc be removed, we have endeavoured to show in our Supplement ( Taxation, now reprinted in an improved form, and with various a ditions, to meet the exigencies of these alarming times. It will 1 seen by the following extracts from our REFORMED B 0 DGET, wh those evils are " which require to be removed." " Heavy duties are imposed upon most articles of food

the importation of some is altogether prohibited. Literature oppressively taxed ; so are trade and transport. The free ph of the national industry, the exercise of individual skill, crippled by taxes on raw materials, and by heavy imposts on lion manufactures, which involving a mischievous interference wii the conduct of trade, dam up tile stream of wealth at its ve: source. A vast number of petty taxes are retained, and a cot plex mode of levying them is adopted, which, independent of tl

effects upon consumption and trade, involve an outlay near

equal to the sums received. High rates of duty are placed up(

articles of consumption ; which diminish the comforts of the pe ple without even yielding, any benefit to the revenue, and in son cases bring considerable evils in their train, by the extensive Mk trading they encourage, and by the expense which is incurred the fruitless attempts to put it down. And finally, the few in posts which are direct in their nature, or are levied upon Property are frequently oppressive, or grossly unequal, or both."

When we say that our financial system should be looked at as

whole, a very important question, however, suggests itself. WI has it not been done already ? The Resolutions of the House and tl organs of Government only talk of rubbing on—for the presen WHY HAVE WE LOST A YEAR? Why have the hopes of the count] been disappointed? Why are its commerce and industry to I kept in suspense and stagnation for twelve months longer ? At where is the policy of habituating the people to a constant state excitement and agitation, or causing the doctrine of passive resi tance to the payment of Taxes to be put in practice, as it is at th moment throughout London. The novelty of the matter cann

be pleaded. Relief from fiscal burdens has been the Whig chola

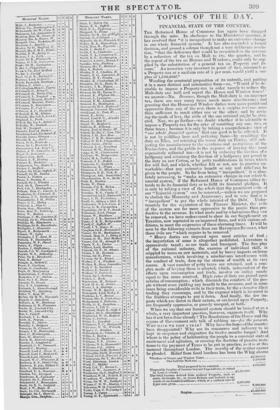

°Produce of House and Window Taxes £2,500,000 .. .. One half the Malt-tax 2,409,000 Total proposed to be remitted 4,990,000 Disposable Surplus of Income beyond Expenditure, as stated

by Lord ALTHORP £1,500,000 The total Income derived from realized Property. such as Tents, dividends, Sze., in Great Britain and Ireland, is up- wards of one hundred millions ; which, at a uniform rate of kper cent, gives 5,000.000

6,500,000

Surplus £1,600,000

as

ir-

ng

e- he

ter nd nil re is-

to or of It he b

st a in .11 n- be

of

is r- ls o-

1-

at

a

le

to

oe

S- kis

of

during the present century; it was one of their pledges on taking office; it was the professed object of the Reform Bill. Time cannot be pleaded. Lord ALTHORP has held office two years and a half; he had previously a very long senatorial experience ; he has had " all appliances and means to boot" fully to master the whole subject ; and he had a majority powerful enough to have carried any measure howeritr comprehensive. What are the results of such peculiar advantages? A Budget which has given general dissa- tisfaction, and which, coupled with the subsequent conduct of the Ministry, has induced a state of feeling that has brought us to the verge of a fiscal rebellion. Holding the convictions that we have arrived at by much pains- taking and patience of inquiry, we must be supposed to hold them with a proportionate earnestness. Those who have taken the same or similar pains to ascertain the truth—and probably none else— will understand the sincerity of the feeling with which we de- clare, that the men who have done so much to provoke, and so little to avert or to meet this crisis, deserve, not votes of confidence, but impeachment.

Previous page

Previous page