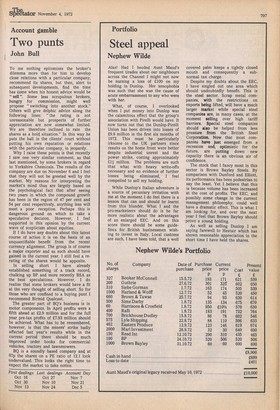

Account gamble

Two punts

John Bull

To me nothing epitomises the broker's dilemma more than for him to develop close relations with a particular company, recommend its shares, but then, alert to subsequent developments, find the time has come when his honest advice would be "sell ". Some less scrupulous brokers, hungry for commission, might well propose "switching into another stock."

Others will give delphic advice along the following lines: "the rating is not unreasonable but prospects of further appreciation are now somewhat limited. We are therefore inclined to rate the shares as a hold, situation." In this way he puts the ball in the clients' court without putting his own reputation or relations with the particular company, in jeopardy.

Why I raise these points is that recently I saw one very similar comment, as that last mentioned, by some brokers in regard to Yorkshire Chemicals. The results of the company are due on November 6 and I feel that they will not be greeted well by the market. My reasons for interpreting the market's mind thus are largely based on the psychological fact that after seeing two years in which the compound growth has been in the region of 47 per cent and 54 per cent respectively, anything less will meet a poor reception. Perhaps this is dangerous ground on which to take a speculative decision. However, I feel supported in this opinion by the current wave of scepticism about equities.

If I do have any doubts about this latest course of action it is on the basis of an unquantifiable benefit from the recent currency alignment. The group is of course a major exporter and as such should have gained in the current year. I still feel a rerating of the shares would be apposite.

In selling short I have already established something of a track record, chalking up BP and more recently BSA as

the best speculations. However, I do realise that some brokers would have a fit

at the very thought of selling short. So for those who are confined to a buying punt I recommend Birmid Qualcast. • The greater part of BQ's business is in motor components. In April profits were a

fifth ahead at £2.9 million and for the full

year pre-tax profits of £7.93 million should be achieved. What has to be remembered,

however, is that the miners' strike badly affected last year's results while in the current period there should be much improved order books for commercial vehicles, tractors and lawnmowers.

BQ is a soundly based company and at 87p the shares on a PE ratio of 12.1 look undervalued. This looks the right time to expect the market to take notice.

First dealings Last dealings Account Day Oct 16 Oct 27 Nov 7 Oct 30 Nov 10 Nov 21 Nov 13 Nov 24 Dec 5

Previous page

Previous page