Welcome to subprime Britain.

How scared should you be?

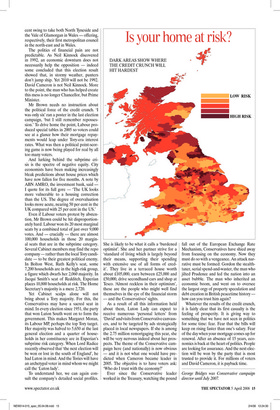

Mining data of unprecedented sophistication, George Bridges unveils a map of future economic pain: the areas where repossessions and negative equity are most likely to bite in the months ahead. The credit earthquake, he says, will be a huge factor in the next election When London radio news is being sponsored by a firm of bailiffs, you know something bad is happening. ‘Helping landlords get what they’re owed’ runs the cheery slogan at the end of the bulletins. As bad as the financial headlines are, this tells a bigger story than anything captured in the headlines — proof that the credit crunch is not an abstraction confined to the financial markets, but a bitter reality, already claiming victims and leaving tens of thousands to wonder if they will be next. All over the country, the borrowed penny is dropping.

It dropped on me about 3.30 a.m. on the day my wife and I exchanged on our first house — the very day, as it happens, that Mervyn King first announced that the winged horsemen of the financial apocalypse would be galloping towards us. I slept for about 20 minutes that night, mulling the consequences. And then something else hit me. If I was thinking this, millions of others would be too. Together, they pack a powerful political punch. And I decided to find out who these people are, and where they live.

I am, you see, a political strategist who has left Westminster, but still loves the odd political ‘fix’. Until last summer I was David Cameron’s campaign director — wired on a daily, hourly drug of rebuttals, focus groups, data and target seats. The arsenal that today’s campaign directors have at their fingertips has been transformed since I worked for John Major ten years ago. Back then, the sophisticated political polling techniques that were commonplace in America had yet to be learned, let alone mastered, here.

To find out who our target voters were, we used what today looks like a blunderbuss — canvassers’ returns, and basic analysis of opinion polls. Now, a new breed of companies has arisen with stunning depth of data. Most voters would be astonished to learn that, if you know whom to ask, with a few phone calls you can find out everything you want to know about which group of people are most exposed to financial pressures. So — in the interests of transparency — this is what I have done for Spectator readers.

I contacted Experian, the credit rating agency. It may not be a household name but it has a vast database about British households. It knows what sort of people live where, how much they earn, what they buy, where they shop, where they holiday, the car they drive, what they eat, and — critically — how much they are in debt. It is a GCHQ for companies who want to target people with various products. And for politicians, on the hunt for potential swing voters.

It also reveals where unexploded subprime bombs are most likely to lie. The Experian map (on the opposite page) categorises them in risk: the deeper the colour, the deeper the trouble. Worst is Sheffield Brightside, David Blunkett’s seat, which Experian categorises with a subprime ‘pen etration’ rate of 75 per cent. This is a list of households which have clocked up enough credit problems to be placed in the company’s ‘subprime’ category. It now covers 5.1 million households. Of these, 3.7 million are in Labour-held constituencies, accounting for at least eight million voters — just under a fifth of the electorate, all living on the faultline of the credit earthquake.

In all, 20 per cent of British households are in the subprime category, but this is very unevenly spread. The average Tory constituency is solvent enough to have just 9 per cent subprime penetration rate. For the average Labour seat, it’s 30 per cent and in the average Lib Dem seat, 12 per cent. These are not welfare-dependent people, or sink-estate prey for loan sharks. Experian’s typical subprime householder has had a county court judgment three or four years ago but is in work, and cleaning up his act. As a result of the credit crunch, however, such people are now at a higher risk of defaulting on their loans.

The ‘prosperity’ which Gordon Brown has boasted about for the last 11 years was bought on the never-never, a ‘golden age’ on tick. Householders were encouraged to borrow against their inflated house prices — with euphemistic phrases, like ‘equity withdrawal’, making such transactions sound like a visit to a cashpoint. Now, the ten-year debt binge is ending in the hangover which, with each morning’s headlines, becomes that bit more painful. Let’s spell it out: British households are not just more indebted than their counterparts in America, but more than in any other western European or G7 economy.

Repossession, which Mr Brown has portrayed as the trademark curse of Tory years, is back. The Prime Minister last week told the House that there were just 27,000 repossessions last year. He did not say that the figure is forecast to rise to 45,000 this year, as the darker areas on Experian’s map today turn into the bailiff targets of tomorrow. Of the top 200 most at-risk constituencies on the old boundaries, all but 14 are held by Labour MPs. The pain is concentrated in the Midlands and north of England — the areas which David Cameron needs to win to secure a majority.

In politics, of course, each such experience is psychologically amplified. For every householder who actually loses his property there will be many more living in fear of repossession — and rueing the day they believed a Prime Minister who promised ‘the end to boom and bust’. Remember his son-of-the-Manse stricture that ‘we will not build the new Jerusalem on a mountain of debt’? The Brown years have ended up crippling the very people Labour meant to help — those on low incomes, young couples bringing up kids. These are the people, in Labour’s heartlands, who are about to be punched in the financial solar plexus.

If the credit crunch leads voters to reassess their traditional loyalties, it may finally open the bridgehead into traditional Labour territory which the Conservatives have been denied since the Thatcher era. Next month’s local elections may well see this trend underway. The party needs a 2 per cent swing to take both North Tyneside and the Vale of Glamorgan in Wales — offering, respectively, their first metropolitan council in the north-east and in Wales.

The politics of financial pain are not predictable. As Neil Kinnock discovered in 1992, an economic downturn does not necessarily help the opposition — indeed some concluded that this election result showed that, in stormy weather, punters don’t jump ship. Yet 2010 will not be 1992. David Cameron is not Neil Kinnock. More to the point, the man who has helped create this mess is no longer Chancellor, but Prime Minister.

Mr Brown needs no instruction about the political force of the credit crunch. ‘I was only six’ ran a poster in the last election campaign, ‘but I still remember repossession.’ To drive home the point, Labour produced special tables in 2005 so voters could see at a glance how their mortgage repayments would leap under Tory-era interest rates. What was then a political point-scoring game is now being played for real by all too many voters.

And lurking behind the subprime crisis is the spectre of negative equity. City economists have been making increasingly bleak predictions about house prices which have now fallen for five months. A note by ABN AMRO, the investment bank, said — I quote for its full gore — ‘The UK looks more vulnerable to a housing correction than the US. The degree of overvaluation looks more acute, nearing 50 per cent in the UK compared with 25 per cent in the US.’ Even if Labour voters protest by abstention, Mr Brown could be hit disproportionately hard. Labour won its 20 most marginal seats by a combined total of just over 9,000 votes. And — crucially — there are almost 100,000 households in those 20 marginal seats that are in the subprime category. Several Cabinet members may find the repo company — rather than the local Tory candidate — to be their greatest political enemy. In Bolton West, Ruth Kelly’s seat, some 7,200 households are in the high-risk group, a figure which dwarfs her 2,060 majority. In Jacqui Smith’s seat of Redditch, Experian places 10,800 households at risk. The Home Secretary’s majority is a mere 2,720.

Yet Cabinet scalps alone will not bring about a Tory majority. For this, the Conservatives may have a sacred seat in mind. In every election since 1951, the party that won Luton South went on to form the government. This makes Margaret Moran, its Labour MP, perhaps the top Tory target. Her majority was halved to 5,650 at the last general election and a quarter of households in her constituency are in Experian’s subprime risk category. When Lord Radice recently observed that ‘the next election will be won or lost in the south of England’, he had Luton in mind. And the Tories will have an archetypal voter in mind whom we might call the ‘Luton lady’.

To understand her, we can again consult the company’s detailed social profiles.

Previous page

Previous page