Skinflint's City Diary

Young groover John Bentley, the take-over and break-up merchant, and Chairman of Barclays Securities, is having a little temporary difficulty with the National Film Finance Corporation in providing detailed evidence of the critical losses at the Shepperton Film Studios as a condition of the sale of the sixty-acre site for re-development.

This time it is only 350 to 400 workers who will get the sack but no one's to blame since, as Mr Jeremy Arnold, John Bentley's new managing director for British Lion, says, if Shepperton's property is realised by Barclays the profit would be completely fortuitous. Presumably this went with a long slow wink to Bentley.

British Lion's former top men, led by Lord Goodman, Sir Max Rayne and film maker John Boulting, are picking up some useful little subsidiaries at almost peppercorn prices. Lord Goodman's team have bought a documentary film producer, Lion Pace Productions, for the price of repaying an inter-company loan of £20,500. DavisPoynter the publishers have been sold for £40,000 cash to the same consortium. Lord Goodman, Sir Max Rayne and Mr John Boulting have been forced to agree that John Bentley's decision to break up British Lion is the best thing for all (all but 400) concerned. Spectator August 5, 1972 Property people

Ludgate Land, one of Slater Walker's property companies, has let the Regent Street premises of Galeries Lafayette to Waring & Gillow at a rental of £200,000 per annum for the remainder of the nineteen-year lease. It is interesting that Edward Erdman & Co. acted for Slater Walker, since Waring & Gillow was part of Sir Isaac Wolfson's Great Universal Stores Group and Mr Edward Erdman has beer Sir Isaac's property adviser on many important deals (right down to the leaserenewal negotiations for Sir Isaac's Portland Place house with the Lord Howard de Walden estate). The experience of being cap in hand, for once, is said to have made Sir Isaac distinctly uncomfortable, though his sub-tenant, young Selim Zilkha (whose rent Sir Isaac was compelled some time ago to raise) has been especially sympathetic.

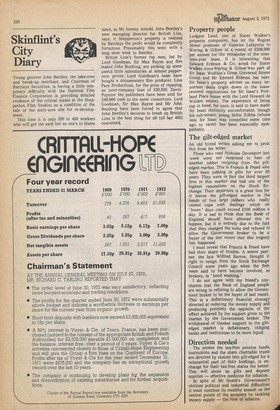

The gilt-edged market

An old friend writes asking me to print this from his letter: Those who read Nicholas Davenport last week were not surprised to hear of another jobber resigning from the gilt edged market. This is Francis & Praed who have been jobbing in gilts for over 50 years. They were in fact the third largest

firm in this market and had one of the highest reputations on the Stock Ex change. Their departure is a great loss for it leaves the gilt-edged market in the hands of two large jobbers who really cannot cope with dealings which on 'boom' days could exceed £100 million a day. It is sad to think that the Bank of England should have allowed this to happen, but it is entirely due to the fact that they changed the rules and refused to allow the Government broker to be a buyer of the last resort that this tragedy has happened.

I must reveal that Francis & Praed have had their share of trouble. A senior partner, the late Wilfred Barron, thought it right to resign from the Stock Exchange Council some years ago when the firm were said to have become involved, as brokers, in bond washing.'

I do not agree with my friend's conclusion that the Bank of England people are wrong in refusing to allow the Government broker to be the buyer of last resort. This is a deflationary financial strategy directed at reducing the money supply and producing precisely the opposite of the effect achieved by the support given to the market by the Government broker. The withdrawal of blanket support to the giltedged market is deflationary, obliging banks and institutions to be more liquid.

Direction needed

The sooner the tax-free pension funds, institutions and the sham charitable trusts are directed by statute into gilt-edged for a substantial part of their holdings, in exchange for their tax-free status the better. This will shore up gilts and depress equities — effective medicine for inflation.

In spite of Mr Heath's Government's obvious political and industrial difficulties it must continue its stealthy assault on the central points of the economy by tackling money supply — the root of inflation.

Previous page

Previous page