ft 't

Investment Notes

By CUSTOS

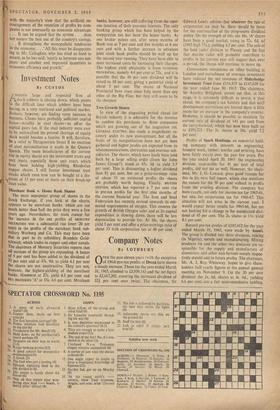

NO1 IIER large and respected firm of tistock-jobbers is closing down, which points to the difficult time which jobbers have been having in a very restricted and political market. Brokers, however, are finding some increase in business. Clients have probably sufficient capital losses-notably in steel shares-to offset the capital gains tax. If the steel industry were ever to be nationalised the present shortage of equity stock would become a famine. It will, therefore, be a relief to Throgmorton Street if no mention of steel nationalisation is made in the Queen's Speech. The main beneficiaries of the current rise in equity shares are the investment trusts and Unit trusts, especially those unit trusts which have been holding high-yielding Rhodesian copper shares. I still favour investment trust stocks which even now can be bought at a dis- lcount of 15 per cent or more on their break-up asset value.

Merchant Bank v. Home Bank Shares The most unpopular group of shares in the Stock Exchange, if you look at the charts, appears to be merchant banks, which are not much better than half the price they were a few years ago. Nevertheless, the main reason for the increase in the net profits of MERCURY SECURITIES was a substantial rise (over 20 per cent) in the profits of the merchant bank sub- sidiary Warburg and Co. This may have been due in part to its subsidiary Brandeis Gold- schmidt, which trades in copper and other metals. The chairman of Mercury Securities reports that all sections of the group are expanding. A bonus of 5 per cent has been added to the dividend of 35 per cent and at 47s. 9d. to yield 4.1 per cent the shares are not unattractive. They are not, however, the highest-yielding of the merchant banks.HAMBROS at 27s. yield 4.3 per cent and RE k BROTHERS 'A' at 55s. 4.6 per cent. Merchant banks, however, are still suffering from the oner- ous taxation of their overseas interests. The only banking group which has been helped by the corporation tax has been the home banks. As one broker points out, after seven months of Bank rate at 7 per cent and five months at 6 per cent and with a further increase in advances joint stock bank profits should be well up for the second year running. They have been able to meet increased costs by increasing their charges. The highest yield obtainable is from NATIONAL PROVINCIAL, namely 4.4 per cent at 72s., and it is possible that the 16 per cent dividend will be raised to 18 per cent, giving a potential yield of about 5 per cent. The shares of National Provincial have risen since July more than any other of the Big Five; but they still seem to be the cheapest.

Two Growth Shares

In view of the stagnating period ahead for British industry it is advisable for the investor to confine his purchases to those companies which are growing out of the stagnation rut. GENERAL ELECTRIC has made a magnificent re- covery under its new management, but all the fruits of its reorganisation have not yet been gathered and higher profits are expected from its telecommunications, electronics and overseas sub- sidiaries. The shares, which have lately been held back by a large selling order (from the (ohn James Group?). stand at 45s. 3d. to yield 3.7 per cent. This is discounting a higher dividend than 81 per cent, but on a price-earnings ratio of about 11 on estimated profits the shares are probably worth buying. Finally, BRITISH OXYGEN, which has reported a 7 per cent rise in pre-tax profits for the first nine months of the current financial year. The Iron and Steel Federation has recently revised upwards its esti- mated requirements of oxygen. This ensures the growth of British Oxygen sales and as its capital expenditure is slowing down there will be less depreciation to provide for. At 10s. the shares yield 5 per cent and offer a price-earnings ratio of about 13 with corporation tax at 40 per cent.

Previous page

Previous page