Investment Notes

By CUSTOS

THE end .of a Parliamentary session left the share markets, as it usually does, in a more hopeful frame of mind. Jabbers are short of stock and a little buying should now put the market better. Bargain hunters are about. The poor gilt- . edged market is still worried by the balance of payments which, as Mr. Callaghan said in the House of Commons this week, is now running into a seasonally bad quarter. The gold reserves went down by £50 million to £947 million, but this means little, as any drawing upon the American facilities ($1,000 million) need not be disclosed.

Share Casualties

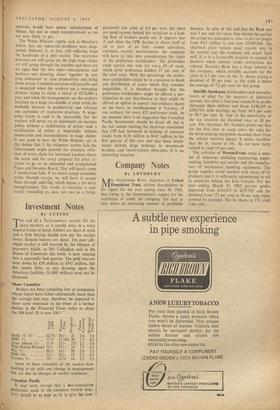

Brokers are busy compiling lists of companies whose shares have fallen substantially more than the average and may, therefore, be expected to show some resistance in the event of a further decline in the Financial Times index to about the 300 level. (It is now 316.) '

too iv ft —tu rZ)

o

o U q>4 Rank 'A' 5/- 42/7+ 20/- 21 2.6 5.2

BMC 5/-

17/9 11/101 20 1.7 8.3 Cope Allman 5/- 31/6 25/- 274 2.3 5.4 West Riding Worsted 71/- 51/- 18 1.7 6.8 PYe 5/- 26/3 14/- 20 2.0 7.1 EMI 10/- 31/- 22/- 15 2.3 6.7 Cerebos 5/- 18/- 12/6 14 1.5 5.5 Some of these casualties of the market have nothing to do with any change in management but are due to changes in market sentiment.

Canadian Pacific

It may seem strange that a non-cumulative preference stock of the CANADIAN PACIFIC RAIL- WAY should be as high as 61 to give the com- paratively low yield of 6.4 per cent, but there are good reasons behind this valuation as a lead- ing firm of brokers points out. It appears that if and when the CPR decides to divest itself of all or part of it fully owned subsidiary, CANADIAN PACIFIC INVESTMENTS, the company will have to take into consideration the rights of the preference stockholders. The preference stock carries one vote for every £5 of stock, which gives preference holders 27 per cent of the total votes. With this percentage the prefer- ence stockholders might be in a position to block any distribution of assets which they consider inequitable. It is therefore thought that the preference stockholders might be offered a par- ticipation in any distribution or they might be offered an option to convert into ordinary shares on the basis, as foreshadowed in Toronto, of one ordinary for every £25 preference stock. At the moment there is no suggestion that Canadian Pacific Investments should be hived off, but at the last annual meeting the chairman mentioned that CPI had increased its holding of common stocks from $126 million to $142 million in the first quarter of this year and that these invest- ments include large holdings in MACMILLAN BLOEDEL and TRANS-CANADA PIPELINES. It is an interesting situation.

Previous page

Previous page