THE MONEY MARKET.

STOCK EXCHANGE, FRIDAY EVENING.—Wednestilly last being the day fixed for the shutting of Consols, was looked forward to with •consider- able anxiety ; and the scarcity of money having increased on Monday and Tuesday, some fall in prices was apprehended. contrary, however, to very general expectation, prices did in fact advance ; and Consols, which' on Saturday were sold at 86* for the opening in January, were actually

latter times it is not safe to act on any theory ; and in the present in- stance, the speculators who sold their Stock in the expectation of getting it back at a cheaper rate on Wednesday, were totally disappointed. As we do not pretend to be in the secret, we merely mention the circum- stance, without attempting to account for it. It is true that it has been proposed to the Bank of France to reduce the rate of discount to 3 or 34 per Cent. and that the prospect of such a measure had occasioned a rise of 1 per Cent. in the French Funds on Monday. Of course, this rise, although not published here until Thursday, must have been known by many of our speculators on Wednesday, and they may have been induced to purchase Consols on the strength of it ; but still there must have been something more powerful than this cause to counteract the effect of a pressure for money, which was and still is unusually severe. —Towards the close of Wednesday, the price of Consols gave way a little ; but the demand was renewed yesterday morning ; and 8Th, was paid in many and 87f in some instances, although the same stock was afterwards done at 87k. It being understood that the Bank had discounted very liberally this week, hopes were entertained of money becoming more abundant, and in fact it was so yesterday, but to-day it is again scarce; and there has been a demand for loans on stock to a very considerable extent, which is far from being a favourable indication.

The market opened this morning at 874 to tl, and was steady for some time at these prices ; but it was thought a bad sign, that it began to droop immediately after a purchase of 50,0001.3 per cent. Reduced Annuities by the Chancery Broker; and this inference proved correct, as the price very soon fell to 87f, and one bargain was mentioned at 874. The closing price was 874, 'buyers. During the week there have been a variety of rumours of expected failures ; to which we only now allude in order to express our hope and belief that they will' prove groundless. Such ru- mours, first whispered from malice or design, and afterwards circulated by gossiping credulity, are sure to occasion general distrust, and do often, like prophecies, work their own fulfilment. The conduct of any public journalist who should give them a body and a shape, cannot be too sharply censured.

There has been but little variation in the heavy Stocks this week. The lowest and highest prices of 4 per cents., 1826, have been l031, and 1044. Exchequer Bills were done on Monday at 61, and to-day at 70.

In the Foreign market, the only transaction of importance has been a

large purchase of Colombian Bonds for Dutch account, which has ad- vanced the price to 24. The amount of this purchase is stated at 150,0001. (not of cash, but of Bonds) ; and it has been very useful in clearing the market of floating stock ; but if the rise in price should induce the gene- rality of holders to bring their Bonds to market, the purchase in question is but a trifle of the whole debt, which is about 7,000,0001. Some of the other South American Bonds have benefited by the rise in Colombian : Mexican are now 32k ; Peruvian 19f, 20 ; Chili 27 ; Brazil 64. Russian Stock is steady at 96.1 ; Portuguese is about 55; but scarcely a bargain has been done in the last for a week past.

The Share market has suffered from the scarcity of money, and the prices of all are lower ; but there has been little or no business done.

SATURDAY, ONE O'CLOCK.—The market has been dull all the morning. The opening price was S'if to and then 83 to a ; afterwards sellers at 87.1, and now buyers at that price. Nothing doing in the Foreign or Share market, and all the prices are nominal.

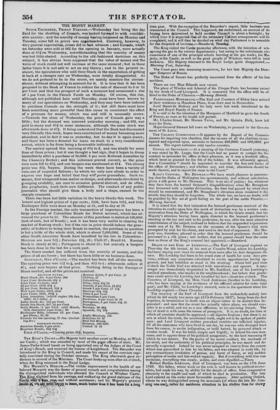

BRITISH FUNDS.

Bank Stock, div. 8 per Cent. 209 3 per Cent. Reduced, 86} } 3 per Cent. Consols, shut 34 per Cent. 1818, 954 4 31 per Cent. Reduced, 954 } New 4 per Cents. 1822, shut - 4 per Cents. 1826, 104} Long Annuities, (which expire 5th Jan.

1860) 19 7-I6ths.

India Stock, div. 104 per Cent. South Sea Stock, div. 34 per Cent.

India Bonds, (4 per Cent. until March,

1829, thereafter 3 per Cent.) 68 Exchequer Bills, (interest 2d. per Cent.

per Diem,) 67, 65

Consols for the opening, 21 Jan. (includ- ing div.)

FOREIGN FUNDS.

Austrian Bonds, 5 per cent. Brazilian Bonds, 63} 64} Buenos Ayres, 6 per Cent. 47

Chilian, 27 Colombian, Ditto, 1824, 231 24

Danish, 3 per Cent. 63 634 Greek 5 per Cent. 17 174

Mexican 32} 324 Ditto 6 per Cent.

Neapolitan 5 per Cent. Peruvian, 6 per Cent.19 20

Portuguese, 5 per Cent. 541 55

Prussian, Russian, 96 964 Spanish, 104 104 SHARES.

Anglo-Mexican, 251.

Brazilian 65 67

Real Del Monte.

Bolanos, 380 390!.

United 15 16

FOUR o'CLocx.—Closing price 86f. buyers.

Previous page

Previous page