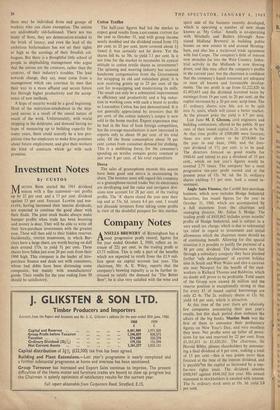

Investment Notes

By CUSTOS

ARTINS BANK started the 1961 dividend season with a fine statement-net profits up by 22 per cent. and a 15 per cent. dividend against 13 per cent. forecast. LLOYDS and BAR- CLAYS, having increased their interim dividends, are expected to continue the good cheer with their finals. The joint stock banks always make bumper profits when trade has been booming and money is dear. They will be able to write off their hire-purchase investments with the greatest ease. These will then add to their hidden reserves. Incidentally, UNITED DOMINIONS, in which Bar- clays have a large share, are worth buying on dull days around 155s. to yield 3f per cent. These shares have fallen just over 20 per cent. from their 1960 high. This company is the leader of hire- purchase finance and deals not with consumers, whose bad debts have been distressing some companies, but mainly with manufacturers' goods. Their results for the year ending June 30 should be satisfactory.

Cotton Textiles

The half-year figures had led the market to expect good results from LANCASHIRE COON for the year to October 31, and with group income nearly doubled and the dividend raised from 17f per cent. to 25 per cent. (now covered about lf times) it was certainly not let down. Yet the shares fell 6s. to 70s. to yield 7.1 per cent. Is it not time for the market to reconsider its cynical attitude to cotton textile shares as investments? The spinning and weaving industry has received handsome compensation from the Government for scrapping its old and redundant plant; it is now receiving grants up to 25 per cent. of the cost for re-equipping and modernising its mills. The result can only be a substantial improvement in efficiency and productivity and a big reduc- tion in working costs with such a boost to profits as Lancashire Cotton has just demonstrated. It is not generally appreciated by investors that 80 per cent. of the cotton industry's output is now sold in the home market. Export experience may be bad in the face of keen foreign competition, but the average manufacturer is now interested in exports only to about 10 per cent. of his total sales. Of the home consumption about 70 per cent. comes from consumer demand for clothing. This is a stabilising force, for the consumer's spending on textiles remains pretty constant at just over 8 per cent. of his total expenditure.

Decca

The sales of gramophone records this season have been good and DECCA is maintaining its share. The investor must still regard this company as a gramophone-record trader but its electronics are developing and the radar and navigator divi- sions now account for 28 per cent. of the trading profits. The 'A' shares closed the year near their top and at 53s. 6d. return 4.4 per cent. I would not dissuade investors from taking some profits in view of the doubtful prospect for this market.

Previous page

Previous page