MONEY-MARKET.

STOCK EXCHANGE, SATURDAY MORNING, HALF-PAST TEN—The shutting of the new 4 per Cents. and Consuls for the Dividend, which took place, the first on Tuesday, and the other on Wednesday last, discovered a greater scarcity of money in the Stock Exchange than has been experienced for some months. 'this has been variously attributed to the sales for savings banks, to the unwillingness of capitalists to luck up their funds for fear of some emergencY) and to other causes, But however this may be, there did not appear any want of confidence in the stability of present prices; for most of the parties who sold Stock for money, bought at the same time for the account, and submitted to a sacrifice of from 7-16th to 4-16th per cent on the operation. The scarcity of money still continues to a considerable extent, but prices have not given way more than I to 3 per cent.; Consols for Account having never been below 88i to 4, while the highest prices were 881 to At present they are 881 buyers. Exchequer Bills were done yesterday at 70, and this morning at 67; the medium price is about 68. India Bonds were last done at 55. The Stock is shut for the Dividend, but was sold on Thursday for the opening, dividend inclusive, at 230e. In the Foreign Market, all the Continental Bonds maintain their ground ; hut the principal Inisiness has been in Brazil Stock, which has fluctuated from 58.1 to 56i during the week, and is now at above 57, with a flat market. The new loan, which is as complete a confession of poverty as can be, and the Emperor's speech, have deterred the public from buying this Stock ; and as the late purchases by which the price was raised were purely speculative, we have great doubts of the stability of the present price, unless the contractors of the new loan make great efforts to support the Market. Portuguese Stock, which on this day week was worth nearly 47, fell on Tuesday, when the result of Sir James Mackintosh's motion was known, to 44, and even lower, and has not since recovered. French Stock is rather on the advance, and has again touched 80 this week.

Most of the Mining Shares are in greater demand, and fetch better prices; but the business is still, comparatively speaking, inconsiderable.

SATURDAY, TWELVE O'CLOCK.—There is nothing doing in either Market. Consols for Account 88i, alternately buyers and sellers all the morning.

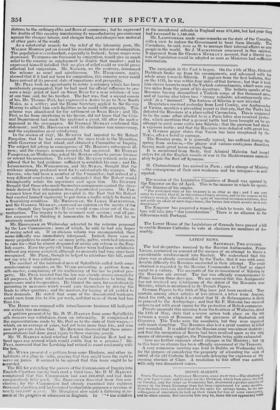

BRITISH PONDS. Chilian, 6 per Cent. 171 183 Bank Stock, div.8 per Cent. about 214 Colombian, 11; 17

3 per Cent. Reduced, 871 Ditto, 182-1, 6 per Cent. 3 per Cent. Consols, Danish, 3 per Cent. 653 66 33 per Cent. 1818, 961 French 5 per Cents.

se per Cent. Reduced, 94 Ditto 3 per Cents.

New 4 per Cents. 1822, Greek 5 per Cent.

4 per Cents. 1826, 1031 104 Mexican 6 per Cent 213 211

Long Annuities, (which expire 5th Jan. Neapolitan 5 per Cent.

1860) 195 7-16 Peruvian, 6 per Cent. 19 Is India Stock, div. 103 per Cent. Portuguese. 5 per Cent. 431 44

South Sea Stock, div.33 per Cent. Prussian, 1023

India Bonds, (4 per Cent. until March, Russian, 96i 97

1829, thereafter 3 per Cent.) 54 56 Spanish, 03 93 Exchequer Bills, (Interest 2d. per Cent. SHARES.

per Diem,) 67 Anglo-Mexican, 351. 37/. 10s.

Consols for Account 853 Brazilian, Imperial. 881. 99/. FOREIGN FUVDS. Real Del Monte, 110/. 1201. Austrian Bonds, 5 per cent. 118399 Holanos, Brazilian Bonds, 5 per cent. 56; 57 Colombian,

Buenos Ayres 6 Cent. United Mexican, 11/.10s. 12/. 10s.

Previous page

Previous page