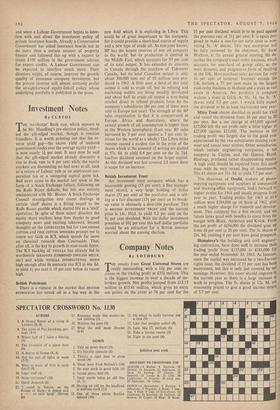

Investment Notes

By CUSTOS THE 'no-change' Bank rate, which appears to he Mr. Maudling's pre-election policy, stead- ied the gilt-edged market, though it remains friendless. It is worth pointing out that the re- verse yield gap-the excess yield of undated government stocks over the average equity yield- is now nearly If per cent. It may now be said that the gilt-edged market already discounts a rise in Bank rate to 6 per cent while the equity markets are discounting no bad news at all, such as a return of Labour rule or an unpleasant cor- poration tax or a swingeing capital gains tax. Bad news came to the market last week in the form of a Stock Exchange failure, following on the Rolls Razor debacle, but this was entirely unconnected with Mr. Bloom. A Stock Exchange Council investigation into recent dealings in certain 'shell' shares is a fitting sequel to the Rolls Razor gamble which started life as a 'shell' operation. In spite of these minor disasters the equity share markets keep firm thanks to good company news and exciting takeovers. Second thoughts on the COURTAULDS bid for LANCASHIRE COTTON and FINE COTTON SPINNERS prompt me to renew my faith in ICI, which spends far more on chemical research than Courtaulds. That, after all, is the key to growth in man-made fibres. The ICI backing of VIYELLA has already led to worthwhile takeovers (COMBINED ENGLISH MILLS, etc.) and while VIYELLA INTERNATIONAL seems high enough after its meteoric rise ICI at 44s. 6d. to yield 41 per cent is 10 per cent below its recent high.

British Petroleum

There is a rumour in the market that BRITISH PETROLEUM has struck oil in a big way in the

new field which it is exploring in Libya. This could be of great importance to the company, for it could provide a short-haul source of supply and a new type of crude oil. As everyone knows, BP has the largest reserves of any oil company in the world, but its production is centred in the Middle East, which accounts for 97 per cent of its total output. It has extended its interests in Canada through the purchase of Tidewater Canada, but its total Canadian output is only about 300,000 tons out of 93 million tons pro- duced in 1963. A little over a third of this total output is sold as crude oil, but its refining and marketing outlets are being steadily developed and about half its crude oil output is now being retailed direct in refined products form by the company's subsidiaries (86 per cent of these were sold in Europe last year). The strength of the BP sales organisation is that it is concentrated in Europe, Africa and Australasia, where the annual growth of oil consumption is higher than in the Western hemisphere. (Last year BP sales increased by 9 per cent against a 7 per cent in- crease for the world as a whole.) The Libya strike rumour caused a modest rise in the price of the shares which at the moment of writing are quoted at 57s. 6d. to yield 6.4 per cent on the 2s. 2fd. tax-free dividend assumed on the larger capital. As this dividend was last covered 2.8 times there is scope for an increase.

British Investment Trust

An investment trust company which has a reasonable gearing (15 per cent), a fine manage- ment record, a very large holding of dollar shares (52 per cent of the portfolio) and is sell- ing at a fair discount (13/ per cent) on its break- up value is obviously a desirable purchase. This is BRITISH INVESTMENT TRUST and the current price is 14s. 101d. to yield 3.2 per cent on the 9/ per cent dividend. With the dollar investment premium at 10f per cent this half-dollar portfolio should be an attraction for a British investor worried about the coming election.

Previous page

Previous page