ARTS

Conservation

Taxed out of existence

It is nearly 20 years since the Destruction of the Country House exhibition at the V & A, and yet the sorry tale continues. Michael Sayer, an antiquarian Norfolk landowner, and Hugh Montgomery Mass- ingberd (who needs no introduction to Spectator readers) have just completed a three-year survey commissioned by the His- toric Houses Association (The Disintegra- tion of a Heritage: Country Houses and their Collections 1979-1992). It charts the con- tinuing dissipation of historic houses, their estates and art collections, aided and abet- ted by the flippant cynicism and lack of concern of consecutive 'Conservative' gov- ernments.

The quoted statements of assorted minis- ters from Michael Heseltine to Nicholas Ridley along the lines of 'There have to be some opportunities for today's nouveaux riches so I am not impressed by the case for anciens pauvres' make the blood run cold. In reply to this sort of drivel the compilers have the grim satisfaction of spelling out the sorry sagas of Asil Nadir's degradation of Baggrave and Burley-on-the-Hill, and Abdul al-Ghazzi's of Heveningham, the lat- ter illustrated with detailed photographs of the vandalism to the incomparable Wyatt rooms.

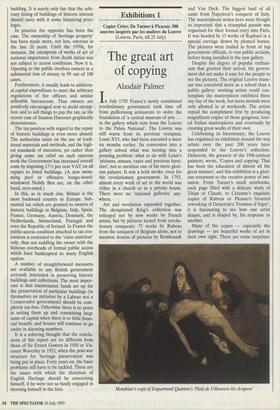

The owners of country houses face com- plex problems, social and economic as well as political. Not all of these are easily solu- ble. But there can be little doubt that the burden of owning a listed building could be eased (at little public expense) by some sensible government action. As it is, owners have had all sorts of additional responsibili- ties and costs piled on to them with no commensurate concessions. In general, a listed building costs 50 per cent more to insure and to repair than a non-listed Brympton d'Evercy in Somerset, family seat of the Clive-Ponsonby-Fanes, which the Gowers Committee on the Preservation of Historic Houses in 1950 singled out as precisely the sort of house it most wished to keep in private ownership. Yet 40 years on, in 1992, the Clive- Ponsonby-Fane family, who had opened the house to the public, found themselves obliged to sell it because of the burden of repair and maintenance costs. The new owner has no plans to re-open it to the public. building. It is surely only fair that the arbi- trary listing of buildings of historic interest should carry with it some balancing privi- leges.

In practice the opposite has been the case. The ownership of 'heritage property' has been made more, not less, onerous in the last 20 years. Until the 1970s, for instance, the exemption of works of art of national importance from death duties was not subject to access conditions. Now it is. Opening to the public involves owners in a substantial loss of money in 99 out of 100 cases.

Furthermore, it usually leads to addition- al capital expenditure to meet the arbitrary regulations of fire officers and similar inflexible bureaucrats. Thus owners are positively encouraged now to avoid exemp- tion and to sell things to pay the tax, as the recent case of Stanton Harcourt graphically demonstrates.

The tax position with regard to the repair of historic buildings is even more absurd. The authorities insist on the use of tradi- tional materials and methods, and the high- est standards of execution, yet rather than giving some tax relief on such onerous work the Government has increased overall costs by imposing 171/2 per cent VAT on all repairs to listed buildings. (A new swim- ming pool or offensive bongo-wood- windowed Noddy Box are, on the other hand, zero-rated.)

In this, as in much else, Britain is the most backward country in Europe. Sub- stantial tax reliefs are granted to owners of historic buildings in Belgium, Italy, Spain, France, Germany, Austria, Denmark, the Netherlands, Switzerland, Portugal and even the Republic of Ireland. In France the public-access condition attached to tax con- cessions is restricted to the 'visite exterieue only, thus not saddling the owner with the hideous overheads of formal public access which have bankrupted so many English squires.

A number of straightforward measures are available to any British government seriously interested in preserving historic buildings and collections. The most impor- tant is that maintenance funds set up for the preservation of particular buildings (in themselves an initiative by a Labour not a Conservative government) should be com- pletely tax-free. Otherwise there is no point in setting them up and committing large sums of capital when there is so little finan- cial benefit, and houses will continue to go under in alarming numbers.

It is a sobering thought that the conclu- sions of this report are no different from those of Sir Ernest Gowers in 1950 or Vis- count Waverley in 1952, when the post-war structure for 'heritage preservation' was being put in place. Forty years on, the basic problems still have to be tackled. These are the issues with which the chairman of English Heritage should be concerning himself, if he were not so busily engaged in shooting himself in the foot.

Previous page

Previous page