TAXATION AND SAVINGS

By NICHOLAS DAVENPORT IN a speech recently—whether post- / prandial or not I cannot remember —the Governor of the Bank kindly

informed us that the battle against in- flation had been only half won and then dropped the broadest hint that an austere Chancellor should aim at an over-all Budget surplus, imply- ing, of course, an increase in taxation. The latest Treasury bulletin seemed to support that pre- Posterous suggestion, for it ended an article on `the resurgence of personal saving' with the fol- lowing sinister sentence : 'If the additional invest- ment needed for higher living, standards in the future is to be secured without heavier Govern- ment saving through higher taxation, further Increases in personal saving are necessary.' I think the falsity of these sentiments needs exposing.

Mr. Thorneycroft budgeted, you may remem- ber, for an 'above-the-line' surplus of £462 million and an over-all deficit of £125 million, and it is expected that the final out-turn next month will hot be far short of his figures. It is rumoured that !VII% Amory is contemplating taking the loans to the nationalised industries out of the below-the- line accounts and putting them on to the market, Which. could result in an over-all surplus. If that is true the new Chancellor can fairly reduce taxa- tion without losing his financial respectability. But I cannot believe that he has ever considered increasing taxation, for everyone knows that more direct taxation would inflate personal expenditure incurred for the purpose of tax-saving or tax- dodging, while more indirect taxation would raise the cost of living and encourage more wage claims, thus speeding the wage-cost spiral. When the Treasury scribes talk of 'heavier Government saving through higher taxation' they are not only Using silly Whitehall jargon for 'forced public savings through a Budget surplus,' but they are creating the false impression that higher taxes Would necessarily result in a reduction in demand and a freeing of resources. They would not- necessarily—for we have reached the economic limits of taxation.

* * *

The Treasury bulletin for February might just as Well have admitted honestly that personal savings rise when Budget surpluses or forced savings de- cline. Between 1948 and 1951, when everyone was trying to refurbish his home and wardrobe after the stint of the war years, personal savings were very low, being about 2 per cent. of the nation's dis- posable income (i.e., after tax and NHI contribu- tions), while Government surpluses or forced savings were high. In 1952, however, personal savings sharply rose to 61 per cent., in 1955 to 8 per cent., in 1956 to 10 per cent. and in 1957 to about 11 per cent. up to the end of September. In this period—I952 to 1956—the budget sur- pluses of Government and local authorities were rather less than half those of 1948 to 1951. As the bulletin admits, a personal savings ratio of 10 per cent. to 11 per cent. is a high one. The rise in British personal savings compares with a fall in the American personal savings ratio over the same Years from 8 per cent. to 61 per cent. One can fairly animadvert on the spendthrift American and the very thrifty Britisher.

Looking at the other contributors to the national savings, you will find that in the 1948 to 1951 period personal savings were only 91 per cent. of the national total against 601 per cent. for companies and public corporations, and 30 per cent. for Government and local authorities. In 1956 they were 39f per cent. of the total against 48+ per cent. for companies and corporations, and only 12 per cent. for Government and local authorities. Expressing this in money you will discover that in the three years 1948 to 1950 Government and local authorities were creating 'forced savings' at the rate of £450 million a year, but in the five years 1952 to 1956 they were creat- ing no surpluses but a deficit of £220 million a year. In other words, the public authorities in that period were contributing nothing to the finance of investment at home. They should therefore re- move that sanctimonious smugness from the face of the Treasury bulletins and acknowledge the over-taxed, thrifty citizen as the real anti- inflationist.

The striking fact about this rise in personal savings has been the jump in contractual saving through life assurance and group pension schemes, which has had the stimulus of some extra tax relief. This form of saving increased by £362 mil- lion in 1952 and by £513 million in 1956. Small savings through the national savings movement are of much less importance, but they increased by £87 million in 1956 (against £40 million in the previous year) and were rising strongly up to the middle of 1957—no doubt because of the raising of the rate of interest on defence bonds and savings certificates and the popularity of the premium bonds. However, there has been a marked falling-off in 'national savings' since then and in the last three months withdrawals have exceeded new investments in every medium except the premium bonds. If the Chancellor wants to stimulate small savings he should raise the rate of interest on deposits in the Post Office Savings Bank and double the tax-free limit, i.e., from £15 to £30 interest, per annum. It is absurd in these dear money times for the Savings Bank interest to remain fixed at 21 per cent. When will thz. Treasury ever discover that people will save more money when it taxes them less?

Previous page

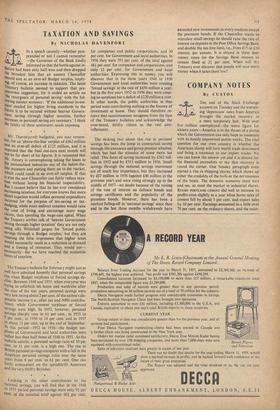

Previous page