Jump into Jessel

John Bull

The present climate for short-Aterm speculators is, to say the least uncomfortable. Without any clear guideline as to the way tho market will react, subject as it is to nervous tension, it can even be dangerous to put money into a situation where good growth is reported. For as I have said before, in weak conditions the chances of profit-taking on a good company statement are much higher.

Even so, over the last few weeks I have been fairly lucky. In a brief self-laudatory recapitulation, BP fell sharply as I predicted in the first instance, and then justified my buying recommendation. Wilmot Breeden has improved to 9'7p against 90p when suggested as a buy, while Higgs & Hill, too, has moved higher. So, rather unhappily, has Highland Distillers, which I sold short last week. However, in Chis case the statement is still a little way off and I see no reason to change my tune just yet.

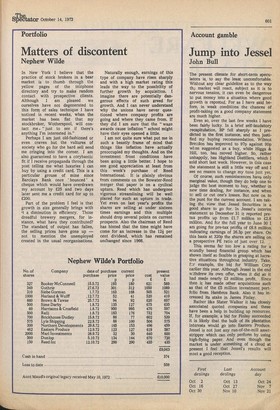

Of course, such reminiscences have only marginal value, though they do help one to judge the best moment to buy, whether in new time dealing, for instance, and when tc sell or cut one's losses. But now on to the punt for the current account. I am talking the view that Jessel Securities is a good share to go for. In Jessel's interim statement to December 31 it reported pretax profits up from £1.7 mililon to £2.8 million. And for the full year to June 30 I am going for pre-tax profits of £6.8 million indicating earnings of 26.3p per share. On this basis at 320p the shares are selling on a prospective PE ratio of just over 12.

This seems far too low a rating for a soundly based financial group which has shown itself so flexible in grasping at lucrative situations throughout industry. Take, f:r example, the bid for William Cory earlier this year. Although Jessel in the end W..thdrew its own offer, when it did so it had made nearly £3 million profit. Since then it has made other acquisitions such as that of the £5 million investment portfolio from Hambros Bank. Also it has increased its stake in James Finlay.

Rather like Slater Walker it has clOsely associated quoted companies and these have been a help in building up resources. If, for example, a bid for Finlay succeeded it is likely that the bulk of its plantation interests would go into Eastern Produce. Jessel is not just any run-of-the-mill assetstripper which can only perform by using high-flying paper. And even though the market is under something of a cloud at present I feel that Jessel's results will meet a good reception.

Previous page

Previous page