Portfolio

Matters of discontent

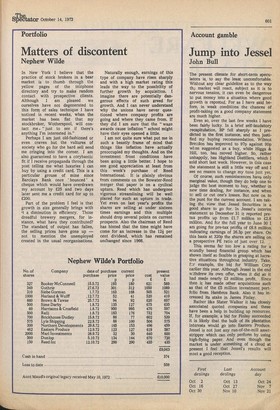

Nephew Wilde

In New York I believe that the practice of stock brokers in a bear market is to thumb through the yellow pages of the telephone directory and try to make random contact with prospective clients. Although I am pleased we ourselves have not degenerated to this form of sales technique I have noticed in recent weeks, when the market has been flat that my stockbroker, Wotherspool, will contact me. "just to see if there's anything I'm interested in."

Perhaps I am just old-fashioned or even craven but the vultures of society who go for the hard sell send me cringing into the corner. I am also guaranteed to have a corybantic fit if I receive propaganda through the post telling me what luxuries I can buy by using a credit card. This is a particular grouse of mine since Barclays Bank once ' bounced ' a cheque which would have overdrawn my account by £25 and two days later sent me a credit card for up to £200.

Part of the problem I feel is that growth in size generally brings with it a diminution in efficiency. Those dreadful brewery mergers, for instance, what have they contributed? The standard of output has fallen, the selling prices have gone up — not to mention the unemployed created in the usual reorganisations. Naturally enough, earnings of this type of company have risen sharply and with a high market rating this leads the way to the possibility of further growth by acquisition. I imagine there are potentially dangerous effects of such greed for growth. And I can never understand why the unions have never questioned where company profits are going and where they came from. If they did I am sure that the "wage awards cause inflation" school might have their eyes opened a little.

I am not quite sure what put me in such a beastly frame of mind that things like inflation have actually preoccupied my thoughts. And on the investment front conditions have been going a little better. I hope to see good appreciation at least from this week's purchase of Reed International. It is plainly obvious from comments on the Bowater-Reed merger that paper is on a cyclical upturn. Reed which has undergone vigorous streamlining will be well placed for such an upturn in trade. Yet even on last year's profits the shares are selling at under sixteen times earnings and this multiple should drop several points on current prospects. Also the chairman of Reed has hinted that the time might have come for an increase in the 12i per cent dividend, which has remained unChanged since 1966.

Previous page

Previous page