FINANCE

INVESTING IN THE DOMINIONS— AUSTRALIA Ir would probably not be far from the mark if it were reckoned that something over L'500,000,000 is at the present time invested in Australian securities, and, as elsewhere, some- thing besides present prosperity and cheap money must be held accountable for the rise which has taken place in Austra- lian Loans during recent years. Some six years ago Austra- lian credit was at its lowest point, a circumstance which was due not only to the severe exchange crisis through which the country was passing, but also to fears of defaults on certain of the State Loans. These apprehensions—which fortu- nately proved to be unfounded—were quickened, how- ever, by agitation on the part of certain of the extremists of the Labour Party in Australia for an actual default. At no time, however, was there any manifestation on the part of the people of Australia as a whole to do other than meet all engagements connected with the service of the external debt, and ample evidence of this determination was afforded later by the readiness of the Authorities to part with practically the whole of the country's gold reserve in order that sterling engagements here might be met. Not only so, but the same spirit was subsequently displayed by the people of Australia as a whole when they voluntarily consented to a conversion of their internal debts on terms involving considerable sacrifice to the holders, but a corresponding advantage to the position of the national finances. And as we all know now, Australia has emerged from her crisis triumphantly, and is reaping the reward both for her proved integrity and the courage with which the Australian people as a whole faced the years of difficulty. The great rise which has since taken place in Australian securities has, of course, been helped by the cheapness of money which has raised prices of all high- class securities, but the schemes for converting Australian debt on terms most advantageous to that country would have been inxpossible but for her credit having been strengthened by the experiences of the years of crisis.

A GREAT RECOVERY.

Today the contrast with years of depiession is a very striking one, but from -the point of view of the investor it -is well to remember that in an agricultural country such as Australia, where good prices of all exportable commodities are vital in view of the heavy external indebtedness, it is unwise to allow conditions of prosperity to _obscure a recollection of the years of adversity. Thus, when noting the improved accounts of the Commonwealth of Australia and the various States for the year 1936-37, when the CommonWealth achieved a surplus of L1,276,000, it may be well to *note that the States of New South Wales and Victoria have balanced their budgets for the first time since the Depression. The only States now with deficits are Queensland and Western Australia, where the public finances have been adversely affected by drought conditions. After making provision for sinking funds, which it may be noted amount to the very large total of L9,000,000, the net surplus on the Common- wealth and States budgets for 1936-37 is just under £1,000,000. The latest figures of trade are also excellent, the favourable balance for the year just mentioned, including the net gold exports, being estimated at about k35,60o,000, compared with k22,600,00o for the previous 'year and, after allowing for all commitments, including interest on the Public Debt, there is a substantial surplus to add to the reserves in London. Moreover, preliminary estimates for Wool and Wheat suggest that the volume of export production will be maintained during the coming season.

LOOKING BACKWARD.

Now greatly this recovery in the budgetary position of Australia was needed may be gathered from the fact that, going back a few years the deficits were very serious, when the State as well as the Commonwealth budgets are taken into consideration. So far as the Commonwealth is concerned, there have been continuous surpluses for the past six years, but in the year of extreme depression there was a material deficit. On the other hand, if budgets of the Common- wealth and the various States are taken together, the position is very different—a surplus was established for the first time for some years in 1935-36 ; for the previous year there was a deficit of just over £3,000,000 ; for the two preceding years there were deficits in each year. of about £4,5oo,000, whilst for the years 1931-32 and 193o-31 the deficit was as much as £19,489,000 and £26,223,000 re spectively. From these figures it will be seen how greatly the budgetary position in AusCralia can be affected either by price movements in commodities or by droughts con-. trolling the volume and value of exports.

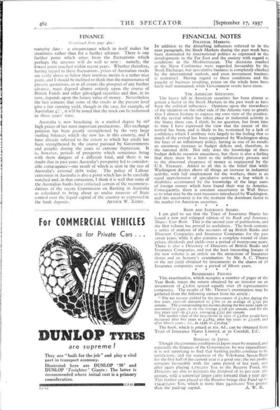

And that these fluctuations in commodity. price movements and the consequent variations in conditions of 'prosperity find their reflection in Government securities may be gathered: from the following short table, giving the highest and lowest prices of some of the representative securities over a period of ten years, though it will be seen that the actual Common- wealth Loans which have only been issued within recent years have displayed remarkable steadiness.

Australia 41% (1940-60)

,, 5% (1945-75) . • • • • Commonwealth 3% Debentures (1939-41)

New South Wales 4% (1942-62) ..

3, 5% (1945-65) • • 5i% (1947-57) • - New Zealand 3% (1945) • • Queensland 3i% (1945) • • 31% (1950-70) • - S. Australia 4% (1940-6o) .. W. Australia 3}% (1940-6o)

Present Highest. Lowest. price.

1071 51 103 117+ 58 108

103} 991 Ion

1051 - 30 tor 115+ 47 103

1201 50 III

1021 63 951

5031 45 110

103} 431. 95

105+ 45 !or

1031 45 59 From the foregoing it will be seen that most of the securities are not very far from the highest points touched, though there has been a reaction from the peak points similar to that which has taken place in British Government securities. It will also be noted that some of the loans are not very far from their (CO2.2timi,4 02: page 482.) FINANCE

(Continued from page 480.)

maturity date : a circumstance .which in itself makes for steadiness rather than for a further advance. There is one further point which arises from the fluctuations which perhaps the investor will do well to note : namely, the lowest point touched within recent years. Whether therefore, having regard to these fluctuations, prices of Australian stocks are really above or below their intrinsic merits is a rather nice point, and I should be inclined to think that the maintenance of present quotations, or at all events the prospect of any further advance, must depend almost entirely upon the course of British Funds and other gilt-edged securities and that, in its turn, depends upon the future value of money. Nevertheless the fact remains that some of the stocks at the present level give a fair running yield, though in the case, for example, of Australian 411" it will be noted that the stock can be redeemed in three years' time.

Australia is now benefiting in a marked degree by the high prices of her most important productions. Her exchange position has been greatly strengthened by the very large sterling balances .which she now has in this country, and I have already referred to the extent to which her credit has been strengthened by the course pursued by Governments and peoples during the years of extreme depression. It is, however, periods of prosperity which sometimes bring with them dangers of a different kind, and there is no doubt that in past years Australia's prosperity led to consider- able extravagance—one result of which is seen in the size of Australia's external debt today. The policy of Labour extremists in Australia is also a point which has to be carefully watched and, in that connexion, I think it is well that some of the Australian banks have criticised certain of the recommen- dations of the recent Commission on Banking in Australia as calculated to bring about an undue measure of State control over the liquid capital of the country as expressed in

•

Previous page

Previous page