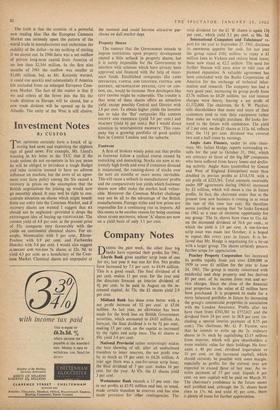

Company Notes

DURING the past week, the other four big banks have reported their profits for 1961. Lloyds Bank gives another scrip issue of one for six; last year it was one for five. Net profits have increased by 7.1 per cent. to £4.94 million. This is a good result. The final dividend of 6 per cent. makes 11 per cent. for the year and the directors forecast an interim dividend of 44 per cent. to be paid in August on the in- creased capital. At 75s. the £1 shares yield 2.9 per cent.

Midland Bank has done even better with a net profit increase of 12 per cent. at £5.04 million. As last year, no allowance has been made for the book loss on British Government securities, which amounted to £4.03 million. As forecast, the final dividend is to be 74 per cent., making 15 per cent. on the capital as increased by the rights and scrip issue. The £1 shares at 89s. yield 3.4 per cent.

National Provincial rather surprisingly makes the best showing of all; after all undisclosed transfers to inner reserves, the net profit rose by as much as 19 per cent. to £4.26 million. A year ago there was a one-for-seven scrip issue; the final dividend of 7 per cent. makes 14 per cent. for the year. At 93s. the £1 shares yield 3 per cent.

Westminster Bank records a 15 per cent, rise in net profits at £3.92 million and has, as usual, made certain transfers to reserves and has also made provision for other contingencies. The

total dividend for the £1 'B' shares is again 134 per cent., which yield 3.1 per cent. at 88s. 3d. International Computers and Tabulators' re- port for the year to September 27, 1961, discloses

its enormous appetite for cash, for last year the group raised £101 million to repay a f1 million loan to Vickers and reduce bank loans; these now stand at £2.2 million. The need for further finance will soon arise to take care of planned expansion. A valuable agreement has been concluded with the Radio Corporation of America for the exchange of technical infor- mation and research. The company has had a very good year, increasing its group profit from £3.76 million to £4.29 million; tax and interest charges were heavy, leaving a net profit of £1,572,000. The chairman, Sir E. W. Playfair, tells shareholders that more and more of their customers tend to rent their equipment rather than make an outright purchase. He looks for- ward to the future with confidence. The yield of 2 per cent. on the £1 shares at 112s. 6d. reflects this; the 1I# per cent. dividend was covered two and a half times by earnings.

Anglo Auto Finance, under its able chair- man, Mr. Julian Hodge, reports outstanding re- sults for the year to October 31, 1961, which are contrary to those of the big HP companies who have suffered from heavy losses and declin- ing activity. Anglo Auto (controlled by Gwent and West of England Enterprises) more than doubled its pre-tax profits at £318,570, with a net profit of £223,361. Total amounts receivable under HP agreements during 1960-61 increased by £2 million, which will mean a rise in future profits. In fact, the chairman states that at the present time new business is coming in at twice the rate of this time last year. He therefore seems justified in saying that 'he looks forward to 1962 as a year of immense opportunity for our group.' The Is. shares have risen to I Is. 6d. on the increased dividend of 36.6 per cent., at which the yield is 2.9 per cent. A one-for-ten scrip issue was made last October; it is hoped to repeat this every year in future. It is be- lieved that Mr. Hodge is negotiating for a tie-up with a larger group. The shares certainly possess further scope for appreciation.

Peachey Property Corporation has increased its profits rapidly from just over £200,000 in 1959 to over £1 million for the year to June 24, 1961. The group is mainly concerned with residential and shop property and has derived 85 per cent. of its income from rent and ser- vice charges. Since the close of the financial year properties to the value of £2 million have been purchased. It is proposed to make for a more balanced portfolio in future by increasing the group's commercial properties in association with the London Assurance. Profits after tax have risen from £343,501 to £552,023 and the dividend from 24 per cent. to 38.8 per cent. (in- cluding a special interim payment of 8.75 per cent.). The chairman, Mr. G. F. Farrow, says that he intends to write up the 2s. ordinary shares to 5s. each by capitalising £3.15 million from reserves, which will give shareholders a more realistic value for their holdings. He fore- casts a 40 per cent, dividend (equivalent to 16 per cent. on the increased capital), which should certainly be possible with some margin. especially as profits for the current year are expected to exceed those of last year. An in- terim payment of 15 per cent. (equals 6 per cent. on new capital) will be paid on March 31. The chairman's confidence in the future seems well justified and, although the 2s. shares have risen to 17s. 6d. and yield 41 per cent., there is plenty of room for further appreciation.

Previous page

Previous page