Investment Notes

By CUSTOS

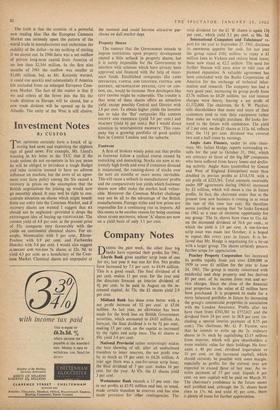

HE optimists certainly have a knack of ig- noring bad news and exploiting the slightest sign of good news. For example, Mr. Lloyd's warning in his letter to the TUC that if the trade unions do not co-operate in his pay pause he will be obliged to introduce a tough Budget and raise taxation seemed to have no adverse influence on markets, but the news of an agree- ment over farm policy among the Six caused a recovery in prices on the assumption that the British negotiations for joining up would now go smoothly ahead. It may well be right to con- centrate attention on shares which might benefit from our entry into the Common Market, and if recovery shares are wanted I suggest that lct should not be neglected-provided it drops the extravagant idea of buying up COURTAULDS. The current yield of 4.8 per cent. at the present price of 57s. compares very favourably with the yields on continental chemical shares. For ex- ample, Montecatini with 3 per cent., Rhone- Poulenc with 0.9 per cent. and Farbwerke Hoechst with 3.4 per cent. I would also suggest ALBRIGHT AND WILSON Ss. shares at 22s. 9d. to yield 4.3 per cent. as a beneficiary of the Com- mon Market. Chemical shares are unpopular at

the moment and could become attractive pur- chases on dull market days.

Property Shares The rumour that the Government intends to impose restrictions upon property development caused a little setback in property shares, but it is surely impossible for the Government to interfere with schemes which have already been approved and financed with the help of insur- ance funds. Established companies like LAND

SECURITIES, CAPITAL AND COUNTIES, CENTRAL AND DISTRICT, METROPOLITAN ESTATES, CITY OF LON- DON, etc., would be immune. New developers like CITY CENTRE might be vulnerable. The trouble is that none of these shares offers an attractive yield. except possibly Central and District with 2.8 per cent. To obtain higher yields the investor has to take the 'flat' companies like LONDON COUNTY AND FREEHOLD (yield 3.6 per cent.) and PEACHEY (yield 44 per cent.). But 1 would direct attention to WESTMINSTER PROPERTY. This com- pany has a growing portfolio of good quality flats in Central London and the suburbs.

Foot wear

A firm of brokers wisely point out that profits in footwear follow a cyclical course caused by restocking and destocking. Stocks are now at ex- tremely high levels and even if consumer demand is maintained, the running-down of stocks over the next six months or more seems inevitable. This will cause a setback in manufacturers' profits and the comparatively low yields which footwear shares now offer make the market look vulner- able. Moreover the Common Market challenge may not be all to the advantage of the British manufacturers. Foreign styles and low prices are responsible for a continuing rise in imports. All this seems to be another reason for being cautious about SEARS HOLDINGS, whose 'A' shares are now on a yield basis of only 3.1 per cent.

Previous page

Previous page