Hope with spice

Nephew Wilde

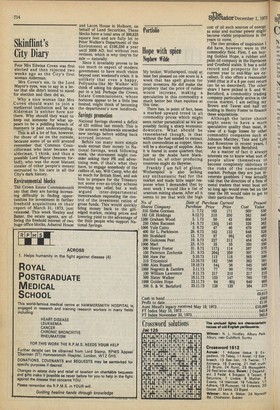

My broker, Wotherspool, could at least feel pleased on one score in it week that has spelt gloom for most investors. He did make the prophecy that the price of rubber would increase, making a speculation in this commodity a much better bet than equities at this time. There has, in point of fact, been a marked upward trend in all commodity prices which might seem rather paradoxical as we are possibly facing a sharp economic downturn. What should be remembered though, is that without the fuel needed to extract such commodities as copper, there will be a shortage of supplies. Also it is feared in some quarters that just as the Arabs have blackmailed us, sd other producing countries might do likewise. Frankly I am full of gloom. Wotherspool is also lacking any enthusiastic feel for the market and made little eager response when I demanded that by next week I would like a list of uranium mining shares. After all it seems to me that with the high

SpeCtatOr 'December 1, 1973

cost of oil such sources of energy as solar and nuclear power might become viable propositions in the years to come. The two strokes of inspiration I did have, however, were in the commodity field. First, I am buying Golden Hope, a rubber and palm oil company in the Han-isons

and Crosfield stable. It has a solid record and prospects for the

current year to end-May are ex cellent. It also offers a reasonable yield (that is if a 6 per cent return

can be so described). The other

share I have picked is S. and W. Berisford, a commodity trading company particularly active in the cocoa market. I am selling mY Brown and Tawse and half mY holding in Henry Foster to finance these acquisitions. Although the latter choice might seem to have a more speculative quality than most, in view of a huge losses by other commodity companies such as

Johnson Matthey, Tate and Lyle and Rowntree in recent years, I have no fears with Berisford.

As a matter of fact it always interests me to know what sort of people allow themselves to become completely oblivious to the risks of the commoditY market. Perhaps they are just in veterate gamblers. I was actually told that the directors of a firm of metal traders that went bust not so long ago would even bet on the time the lift would take to get to their particular floor.

Previous page

Previous page