Home Truths for Central Bankers

By NICHOLAS DAVENPORT IT is perhaps a relief to turn from the foibles of politicians

to the stupidities of central bankers. The annual report of the Bank for International Settlements is full of the most archaic mumbo-jumbo. The burden of it is that expansion- ism as practised by the Western industrial nations has gone too far, that economic priority should now be given not to expansion but to the correction of payments deficits, that the European countries should pay more attention to their domestic problems of cost inflation— even to the point of restricting demand and slowing down their growth—and that the pay- ments problem is not one of liquidity but of disequilibrium.

Oh, Lord, bow long? When will central bankers acquire some elementary political sense? They should be aware by this time that the Western industrial oemocracies are not authoritarian governments which can order their workers to labour each week at a prescribed rate of pay and for a prescribed number of hours. Not even General de Gaulle is authori- tarian enough for that. Incomes policies cannot be forced down the throat of the trade unions; they can only .be put into practice with the consent of the workers and that consent is not likely to be obtained if growth is to be aban- doned and more unemployment is to be created through harsh deflationary budgets. What is the good of portentously proclaiming: 'If success is not obtained (by incomes policies) the authorities will be obliged to consider more general measures of demand restraint'? Surely it is obvious that any Western government which forcefully applied general measures of demand restraint would quickly be thrown out of office. Prime Minister Macmillan got rid of Mr. Thorneycroft and sacked Mr. Selwyn Lloyd for this very reason. Crass deflationary Chan- cellors are more dangerous for Conservative polls than an inflationary erotic Minister of War.

One of the silliest animadversions in this central bankers' report was directed at Great Britain. `There is as yet no assurance,' they write, 'that the existing system of wage deter- mination [in the UK] will allow the necessary gains in competitiveness to be achieved. When account is taken of these developments the occasional pressure on sterling in the exchange markets is understandable.' This is sheer non- sense. First, we have gained rather than lost is competitiveness since sage-costs have been rising faster on the Continent. Secondly, the attacks which have been made on sterling this year have had nothing to do with foreign nervousness about our competitive position. The last quarterly bulletin of the Bank of England gives the lie to this bankers' scare. The first attack on sterling came with the break- down of the Brussels negotiations; the second followed on the revision of the European Monetary Agreement which limited the gold guarantee for certain sterling deposits of European central banks. On neither occasion was there any sign of loss of confidence in the British balance of payments which was, the Bank says, probably improving at the time.

Here let me take this opportunity of telling

these central bankers a few home truths about sterling. No foreigner in his senses holds sterling as a standard of value. The overseas sterling countries hold their monetary reserves in Lon- don because they are in the sterling boat and have no option. Foreign monetary institutions hold some of their reserves in sterling for trade convenience, not as a store of value. The only so-called 'reserve' currency which is sometimes regarded as a store of value is the dollar, having been expressed in terms of gold in the Bretton Woods monetary agreement, but even the dollar is now looked upon with suspicion because of the continued heavy deficits in the American balance of payments. Sterling has a fixed rate of exchange with the gold dollar but having been devalued unilaterally in 1949 it can no longer be regarded as a safe standard of value. The reason why sterling is used as a `reserve' currency—and why over a third of the world's trade is conducted in sterling— is partly because London is the monetary centre of the 'sterling area' and partly because the City offers unique facilities as an international trading centre. A foreign merchant or manu- facturer dispatching goods to any part of the world can arrange in the City, that is, if be has a good name, his shipping, his insurance and his finance by way of bills through any of the well-known agents and he knows that a word on the telephone is regarded in the City of London as a bond. In other words, he uses sterling because it is extremely convenient for

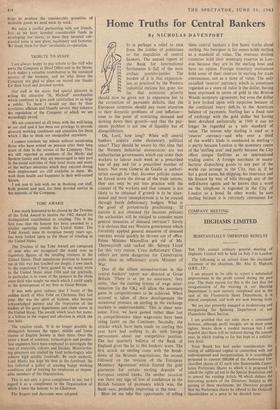

his trading purposes. And that explains why monetary institutions of non-.sterling countries keep a small part of their reserves in sterling (less than 10 per cent). One can see the decline in overseas holdings of sterling in the revised set of tables which the Bank of England has just published: UK External Liabilities an-1 Claims in Sterling In £ millions. End March, 1963

CKer,cas Non- Sterling Sterling International Grand

Countries Countries Organisations I (Nal

(a)

(b) (a) (b)

Liabilities .• 1,815 896 41" 6I4 608 4,345

Claims • •

14 357 17 504

892

Net Liabilities

1,801 539 395 110 608 3.453 (a) Central Monetary Institutions, Others

It will be seen that net foreign (non-sterling) holdings of sterling are now comparatively small, being only £505 million, cf which the central monetary institutions account for £395 million and private traders only £110 million. These figures do not include direct overseas deposits in finance houses and with the local authorities, which were estimated at the end of 1962 at £175 million, but as £100 million of these came from the overseas sterling area they do not • Upset my argument that the sterling holdings of non-sterling countries are relatively unimportant. How absurd (and how impudent) of foreign central bankers to suggest that the economic Policy of the British Government must be directed not to maintaining the growth of the .economy, not to securing full employment for its people, but to preserving the present exchange .value of sterling for the reassurance of only k505 million worth of deposits by non-sterling eountries!- I cannot understand why the Treasury tries to attract foreign (hot) money to London with high short-term interest rates for the defence 01 sterling when it could easily insure foreign traders against exchange depreciation by running its own insurance scheme. This, together with. a modest surplus on the UK balance of payniants and the support of the IMF and others in emar- gencies, are all that foreign traders need for their continued use of sterling as a 'reserve' currency.

Previous page

Previous page