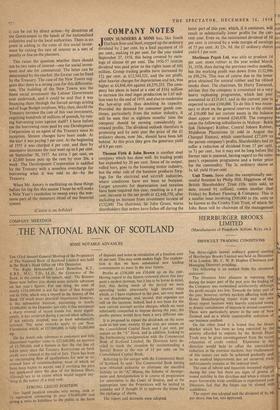

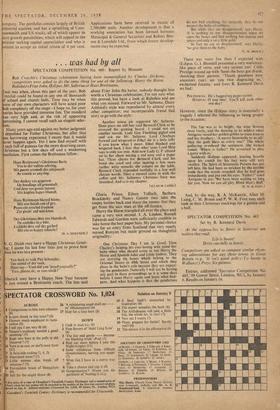

COMPANY NOTES

JOHN SUMMERS & SONS has, like South Durham Iron and Steel, stepped up the ordinary dividend by 2 per cent. by a final payment of 10 per cent.., making 16 per cent. for the year ended September 27, 1958, this being covered by earn-

ings of almost 60 per cent. The 1956-57 interim dividend was paid prior to the rights issue of £44 million. Group trading profits have increased by 121 per cent. at £12,544,521, and the net profit, after heavier charges for depreciation and tax, was higher at £4,848,404 against £4,259,253. The com- pany has plans in hand at a cost of £161 million to increase the steel ingot production to 1.65 mil- lion tons by the end of 1959, and also to modernise the hot-strip mill, thus doubling its capacity. Provided the demand for consumer goods con- tinues, particularly from the motor industry, it will be seen that in eighteen months' time the company should be earning considerably in- creased profits. The dividend outlook therefore is promising and by next year the price of the £1 ordinary shares, now 36s., should have been left behind. At this price they give the generous yield of 8.9 per cent.

Thomas Firth & John Brown is another steel company which has done well. Its trading profit has expanded by 20 per cent. Some of its output, rolled bars, goes to the booming motor industry, but the other side of the business produces forg- ings for the electrical and aircraft industries, where conditions have not been so buoyant. Larger amounts for depreciation and taxation have been required this year, resulting in a 6 per cent. increase in the net profit at £2,448,570, after including an increase from investment income of £132,000. The chairman, Sir John Green, warns shareholders. that orders have fallen off during the latter part of this year, which, if it continues, will result in substantially lower profits for the cur- rent year. Even so, the maintained dividend of 10 a per cent. is covered by a wide margin of earnings

of 55 per cent. At 23s. 9d. the £1 ordinary shares yield 8.3 per cent.

Merlimau Pegoh Ltd. was able to produce 14 per cent. more rubber in the year ended March 31, 1958, than during the previous twelve months, but the working profit was down from £132,996 to £98,256. This was of course due to the lower price obtained for natural rubber and for ribbed smoke sheet. The chairman, Sir Harry Townend, advises that the company is committed to a very heavy replanting programme, which last year amounted to £129,013, and in the current year is expected to cost £100,000. To do this it was neces- sary to draw on the general reserves to the extent of £50,000 but net current assets in the balance n sheet appear at around £248,058, The company owns the following subsidiaries in Malaya : Bukit Ijok (Selangor) Rubber, Central Johore Rubber, Middleton Plantations (it sold in August the Chimpul Estates), which contributed £27,699 to the parent company's profits. Shareholders had to suffer a reduction of dividend from 15 per cent. to 7+ per cent., but it may not be long before the former rate is restored, having regard to the com- pany's expansion programme and a better price for the commodity. The 2s. ordinary shares at Is. 6d. yield 10 per cent Unit Trusts. Soon after the exceptionally suc- cessful flotation by Philip Hill,-Higginson of the British Shareholders' Trust (10s. units sold, to date, exceed 91 million), comes another (last Friday) by Robert Fleming & Company. This is a smaller issue involving £500,000 in 10s, units to be known as the Crosby Unit Trust, of which Sir John Benn will be chairman of the management ompany. The portfolio consists largely of British dustrial equities, and has a sprinkling of Corn- onwealth and US stocks, all of which appear to ave growth possibilities, which will appeal to the vector seeking capital appreciation and who is ontcnt to accept an initial return of 4 per cent.

Applications have been received in excess of 2,500,000 units. Another development is that a working association has been formed between Municipal & General Securities and Robert Ben- son & Lonsdale Ltd., from which future develop- ments may be expected.

Previous page

Previous page