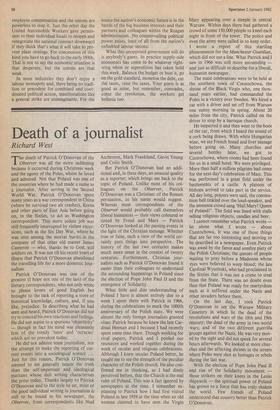

New year's diseases

Nicholas von Hoffman

Washington Statesman, businessmen and economists here continue to be worried about the penetration of American markets by Japanese with clever consumer goods. However, the United States does retain its lead in one area of invention, that of new diseases.

The big new American disease for 1982 is one that appears to hit homosexual men ex- clusively, to use an adverb they rather fancy for themselves. This disease is so new it doesn't yet have a name or a foundation to collect money for research to find a cure for it. But whatever it's called it is for real, and it apparently works by paralysing gays' im- mune system so that the poor devils die of diseases like the common cold.

The big disease in 1981 did have a name: bolimia, and there already is, unless I am mistaken, a Bolimia Foundation whaling away at finding relief for people smitten by this dread illness, which afflicts female heterosexuals exclusively. Bolimics, as they are called, suffer from the much discussed `binge-purge syndrome.' Your true bolimic will first binge, that is eat and eat and eat, and then purge by administering emetics or laxatives until all she has binged into her system has been purged out of it again. Hence if you catch yourself at the table eating a ten-pound smoked ham at one sitting and then regurgitating it, you are either a bolimic or a pig.

According to the growing medical literature on the subject, a person suffering from an advanced case can devour five to ten thousand calories an hour, although you'd never know it to look at them. Their weight is normal, unlike women suffering from anorexia nervosa, the 1979 disease of the year. They've been known to starve themselves to death, but not your common or garden variety bolimic who is rarely either skinny or fat. Some bolimics, nonetheless, are said to have $100-a-day habits. Financially, they'd be better off switching from binge-purge to heroin.

Unlike heroin addicts bolimics don't mug the pedestrians for their food money. Craz- ed women looking for their next binge- purge fix don't even sell their bodies, perhaps because their much abused gastro- intestinal tracts aren't up to any other new and quirky adventures. You might say that bolimia is at least a middle-class disease unknown to hookers and other members of the lesser orders. You have to have money to contract it. The National Institute of Health reports that the disorder is, for ex- ample, virtually unheard of in Bangladesh or Poland. It has been definitely categoris- ed as a disease of the First World.

You would think that one thing a nation which is fighting a bolimia epidemic wouldn't have to worry about is money. Not so. The bolimia situation is like the Christmas shopping situation. The stores which cater to the carriage trade — I. Magnin, Neiman Marcus or Sak's Fifth Avenue — did their usual rousing trade. The rich, after all, do ordinarily know how to stay rich, but the retail market selling to the middling sorts died. The recession, which until a few months ago gave the im- pression of confining itself to a few in- dustries, has busted loose and is metasticis- ing throughout the economy. Some business people are saying it's 'in a free fall'. It's too early for language like that, but the unemployment rate is up to about 8.5 per cent which translates into close to ten million out of work.

That's bearable as long as the jobless are receiving their unemployment compensa- tion which they get the first 26 weeks after being laid off. After that, families who need further help must switch over to the dole, and you can only get that kind of welfare money if you can pass a means, or more ac- curately speaking, a lack of means test. In past recessions the practice has been for the Federal government to extend the 26-week period but the Reaganists — bless their sweet supply-side hearts — are not disposed to such mollycoddling of the masses. The

attitude seems to be that if a family is forc- ed to sell its house or have it foreclosed by the bank because the monthly payments can't be met, well tant pis.

The foreclosure rates are reaching new post-Great Depression highs, but they're still far below the point that you can call them a major social problem. Ditto with the small business failures or the excruciating difficulties cattle ranchers and wheat and corn farmers are making their way through. At the same time the Administration is spending hundreds of millions to save insol- vent savings and loan banks that would otherwise go blub-blub, bubble-bubble in red ink. Only close readers of the financial press are aware of the dimensions of the bank bailouts, so there is no bellowing about the fairness of using the public's money to save some things rather than others.

The Administration's attitude is stay calm, everything will work itself out in its own sweet time. Maybe it will and maybe it won't. The policy seems to be one of doing everything possible to abet further unemployment. The guys who sat around the country club for years saying, 'What this country needs is a good recession,' are getting their prayers answered. In any event no one is suggesting that the thousands of local, state and Federal employees who are being let go thanks to the budget cuts might be kept on until the job situation looks a bit more cheery.

The effects of the Administration's new tax incentives to encourage industry to buy labour-saving machinery haven't yet been felt. However, the Carter administration was pursuing a similar policy and these ef- fects are already noticeable. Thus, for ex- ample, it is being bruited about in business circles that the newly installed automated equipment may save the automobile in- dustry, but at the cost of a third of its employees' jobs. Nor does the vaunted in- vestment for competitive productivity

always have the effects that supply-side theory predicts. Ecce the recent bankruptcy petition of America's I 1 th largest steel

manufacturer, the McLouth Corporation, a highly state-of-the-art producer. But being up-to-date in the steel business results in terrible per unit costs if you can't run the plant at near capacity. McLouth depends on the automobile industry for sales and, as they tailed off, the company found out too late that it is cheaper to make smaller amounts of steel with the outmoded equip- ment it no longer possesses.

The running together of these and other factors has caused the first serious wage cutting during a recession since the business turndown of 1948-49. All kinds of com- panies in all kinds of ways are cutting employee compensation and the unions are powerless to stop it. Just the other day the United Automobile Workers gave permis- sion to their individual locals to reopen and renegotiate the national contract downward if they think that's what it will take to pre- vent plant closings. For concessions of this kind you have to go back to the early 1930s. That is not to say the, economic situation is that desperate, but the unions are that weak.

In most industries they don't enjoy a labour monopoly and, there being no tradi- tion or precedent for combined and coor- dinated political action, manifestations like a general strike are unimaginable. For the nonce the nation's economic future is in the hands of the big business interests and their partners and colleagues within the Reagan administration. No countervailing political power exists, least of all from the nation's enfeebled labour unions.

What this unopposed government will do is anybody's guess, In practice supply-side economics has come to be whatever right- wing whim or superstition has taken hold this week. Balance the budget or bust it, go on the gold standard, monetise the debt, cut the taxes, raise the taxes. Your guess is as good as mine, but remember, comrades, come the revolution, the workers get bolimia too.

Previous page

Previous page