Account gamble

Magic carpets

John Bull

Once again, following recommendations to buy Bond Worth Holdings and Carpets International in recent weeks, I am punting on a carpet share for the coming account.

Basically the attractions are the same as those of the preceding companies — namely the benefits from the relaxation of HP restrictions, the increase in consumer spending and the low rating of the shares. But also in the case of Stoddard Holdings there is the prospect of a sharp turnround from its recent murky past.

The company has come through a period of two near-crisis years when losses amounted to over £1 million. Now, however, the tables should have been turned and after good interim figures recording pre-tax profits of over £125,000, there should, be a fine recovery this year.

The figures are due in the first week of September and I am going for pre-tax profits to March 31, 1972 of £100,000. As there will be no tax charge — the losses in 1970 and 1971 take care of that — earnings will thus be around 30 per cent. At 50p, therefore, the shares are selling on a PE ratio of only 8.4.

Perhaps this in itself is not enough to get ecstatic about: but consider the current prospects. With conditions in the industry buoyant there is ample scope for a further step on Stoddard's path to recovery and I would be surprised if profits for the year to March 31, 1972, did not reach £500,000. On this basis the multiple falls to• little more than five.

Although the market has gone some way in appreciating the turnround I am sure there is still good scope for further increase in the share price.

It is worth noting that Stoddard is a firmly based company and recent reorganisation of both management and plant should help considerably in the future. Also Stoddard could well be a beneficiary of Britain's entry into the EEC. It already has an interest in a Dutch company and has a wide agency representation elsewhere on the Continent. Well backed by assets (of 84p per share) the time has come to punt on this recovery situation.

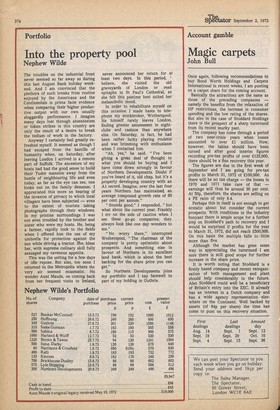

First Last Amount dealings dealings day Aug. 14 Sept. 1 Sept. 12 Sept. 18 Sept. 29 Oct. 10 Sept. 4 Sept. 15 Sept. 26

Previous page

Previous page