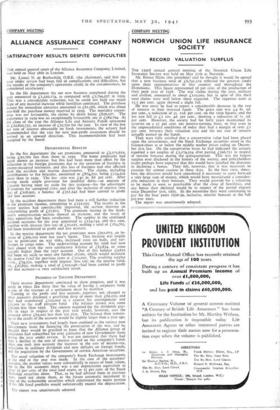

OMPANY MEETING

ALLIANCE ASSURANCE COMPANY

SATISFACTORY RESULTS DESPITE DIFFICULTIES THE annual general court of the Alliance Assurance Company, Limited, was held on May 28th in London.

Mr. Lionel N. de Rothschild, O.B.E. (the chairman), said that the year under review had been full of complications and difficulties, but the results of the company's operations could, in the circumstances, be considered satisfactory.

In the life department the net new business completed during the year amounted to £1,226,174, as compared with £2,794,227 in 1939. This was a considerable reduction, but he could not hold out much hope of any material increase while hostilities continued. The purchase money for immediate annuities amounted to £61,086, which was about one-half the purchase money received in 1939. The mortality experi- ence was not favourable, the claims by death being £826,027. The experience in 1939 was an exceptionally favourable one at £589,794. At the close of the year the Alliance Life and Annuity Funds amounted to £22,822,735, an increase of £35,700 for the year. In view of the low net rate of interest obtainable on fresh investments, the actuary had recommended that the rate for new non-profit assurances should be revised in an upward direction. This recommendation had been accepted by the board.

DEPARTMENTAL RESULTS

In the fire department the net premiums amounted to £2,175,619, being £20,789 less than those in 1939. The home premiums had again shown an increase, but this had been more than offset by the reduction in the foreign premiums due to the cessation of business in enemy-occupied territories, and this loss of business had also affected both the accident and marine departments. The claims, including contributions to fire brigades, amounted to £874,250, being £134,202 more than in 1939. The loss ratio was £40 3s. 8d per cent. After having made ample provision for doubtful debts—an amount of f,50,000 having been set aside for this purpose—for the adjustment of reserves for unexpired risks, and after the inclusion of interest (less tax) of £108,991, a balance of £351,342 had been carried to profit and loss account.

In the accident department there had been a still further reduction in the premium income, amounting to £122,095. The results in the motor section had considerably improved, the section showing an .underwriting profit of £27,811. The premium income in the work- men's compensation section showed an increase, and the result of their operations had been satisfactory. The surplus in the combined accident accounts for the year amounted to £134,744, and this sum, together with interest (less tax) of £50,021, making a total of £184,765, had been transferred to profit and loss account.

In the marine department the net premiums were £951,675, an in- crease of £369,103 over last year's figure. This increase was largely due to premiums on war risks, increased rates on hulls, and sur- :harges to cargo rates. The underwriting account for 1938 had now been closed with the very satisfactory balance of £83,834, or some (49,58I higher than the 1937 account. Out of this balance £9,610 had been set aside to meet any further claims, which would maintain the reserve fund for previous years at £300,000. The resulting surplus —viz., £74,233, together with interest (less tax) on the marine fund, viz., £27,823, making a total of D02,046—had been carried to profit and loss account—a very satisfactory result.

PROGRESS OF TRUSTEE DEPARTMENT Their trustee department continued to show progress, and it was surely in times like these that the value of having a corporate body as one of the trustees of a settlement must be manifest Turning to the profit and loss account, expenses not charged to other accounts disclosed a gratifying drop of more than £62,000, and they had transferred Doo,000 to a reserve for contingencies and (5o,000 to the staff pension fund. fhe balance shown was some 4:36,000 less than 1939. The amount required for the dividends pay- able in 1941 in respect of the past year would, however, cost the company about £63,000 less than last year. The balance then remain- ing to the credit of the account would be slightly larger than a year ago.

Their new investments had largely been confined to the various new Government loans for financing the prosecution of the war, and he thought they would be gratified to learn that the Alliance group of companies had subscribed for over £900,000 of new Government loans during the year under review. It was not unnatural that there had been a decline in the rate of interest earned on the company's funds then one took into account the increase in the rate of income-tax, :eduction in ordinary dividends and new defaults on foreign bonds, and the requisition by the Government of certain American securities.

The usual valuation of the company's Stock Exchange investments it the end of the year was made. In the case of the members' accounts, the market values were substantially in excess of book values, but in the life accounts there was a net depreciation equivalent to about 2i per cent. of the total land assets, or 31 per cent. of the Stock Exchange securities alone. That, as he had advised them in previous Years, need not alarm them, as the future automatic increment in :clue of the redeemable securities which constituted the major portion g the life fund portfolio would substantially exceed the depreciation.

The report was unanimously adopted.

Previous page

Previous page