MONEY Mr Jenkins and the bulls

NICHOLAS DAVENPORT

Second thoughts about the Letter of Intent momentarily halted the Stock Exchange rally in equity shares but as I write the recovery in both government bonds and equities has been resumed. This suggests that those who think that the Letter of Intent is a lot of baloney are gaining the upper hand in the market. Their bullishness rests on the belief that we can maintain an interest rate level in this country which is below that of the mad outside world, that the gilt-edged market has therefore seen the worst, and that if Government bonds are a 'buy', then equity shares have a chance to recover.

I am in broad sympathy with this point of view. Life funds and pension funds are now on the feed for the unprecedented re- turns offered by both short-dated and long- dated bonds. (You can obtain 9.7 per cent from a 'short' and 9.4 per cent from a 'long' to 'gross' redemption). The more the public buys government bonds, the less the increase in the money supply. It is alleged

that Mr Schweitzer of the IMF got very angry when the Bank of England increased

the money supply last year by allowing the government broker to support the demor- alised gilt-edged market. The market is now self-supporting.

Incidentally the Chancellor has given the IMF his estimates, quarter by quarter, of the DCE (domestic credit expansion) and 'the

central government borrowing requirement within it', but he has refused to publish them because this would 'encourage specu- lation in a way that would make more dif- ficult the management of the gilt-edged market'. He need not have worried about that. The analysts will be busy working out the sums each quarter, which is not difficult.

The Chancellor has committed himself to a DCE of £100 million a quarter excluding the effect of the balance of payments. If the sums look good, there will be a great 'analyst'-led boom in the gilt-edged market. On the other hand, if the over-all budget surplus falls below the target he has fixed because the money squeeze has brought on a recession which adversely affects the rev- enue, then the Chancellor would have to squeeze the economy still tighter. Contrari- wise if the revenue went up because of in- flation he would have to squeeze less.

Which goes to show that the Letter of In- tent is, in fact, a lot of nonsense.

It is this question of an IMF-induced re- cession which could stop the recovery in equity shares dead in its tracks. The Chan- cellor said that he was reasonably optimis- tic about the future rate of growth and that the dangers of recession have been exagger- ated. We all hope that he is right but some unpleasant facts have to be faced. First, private housing starts in the first quarter of this year were down by 18 per cent and even with fine weather private sector house- building will be well below last year because of the high cost of money. Secondly, the home trade in motor-cars is so depressed that the 'big four' will soon have to curtail output, if they have not already done so by force majeure, unless the export trade takes up the gap. Thirdly, the escalating rate of interest is causing many companies to revise their investment programmes.

If the Treasury waits to see the actual signs of recession in its official statistics it will be too late to stop the rot. Having recently made a brief 'field' inquiry in the south Midlands I have been shocked by the pessimism of the traders in consumer dur- ables. One of them, a very intelligent 'with- it' distributor, said to me: 'I am just tick- ing over but as my customers cannot lay their hands on any money I can see my business grinding to a halt'. Is it possible that the people at the top in Great George Street take their views of domestic trade from the John Lewis Partnership? This, I see, is still breaking records for very special reasons not unconnected with Parkinson's law.

Of course, the balance of payments may come to the aid of Mr Jenkins. If the surplus of £300 milion in 1969/70 is reached, then the permitted increase in the money supply rises from £400 million to £700 milion, that is, an increase of 2-1- per cent to nearly 4+ per cent, which would allow for a growth rate of around 3+ per cent. But why was the capital account included with the cur- rent account in arriving at the target surplus of £300 million for the balance of pay- ments? The Chancellor cannot control the inflow of foreign capital for investment in this country although he may try to control the outflow of domestic capital for invest- ment abroad. Last year we had a large inflow of private capital from overseas which may not be repeated. Again we are bound to feel that the figures in the Letter of Intent are official nonsense.

I can imagine Mr Schweitzer writing this very personal reply to the Chancellor's 'Let- ter of Intent'. 'Dear Roy, Thank you for your official Letter of Intent. Of course you and I know that it is a lot of baloney, as

the Financial Correspondent of the SPECTA- TOR so rudely points out, but for the sake of appearances—and for the pacification of

these terrible econometricians—we have got to agree some figures to meet the fashion- able money supply craze. No government estimate has ever been realised, as we both know, but as long as it was honestly made no one is going to blame you. Your British market is far too valuable for world trade

ever to be allowed to collapse through the application of IMF "trigger" clauses. So don't

worry yourself. We won't let you down. We have got to keep the IMF machine working as well as your own. When it is all over we must meet and have a jolly good laugh. Best wishes. Yours, Pierre-Paul.'

In cutting down a lengthy story to a few lines last week my references to the IRC re- port on the NFFC may not have been alto- gether clear. My criticisms of the NFFC and British Lion related to events in the period before 1964, the year in which a consortium successfully bid to acquire the old British Lion from the Government. When the new British Lion Holdings went public Sir Mich- ael Balcon was chairman and in his auto- biography he tells the sad story of why he had to resign. Lord Goodman then took over the chair and has announced ambitious plans to revitalise the company's film pro- duction, the emphasis being on quality rather than quantity. As everyone knows, Lord Goodman had nothing to do with the old British Lion or with the NFFC but I merely thought that he ought to use his influence in persuading Mr Crosland to make the confidential inc report on the NFFC public.

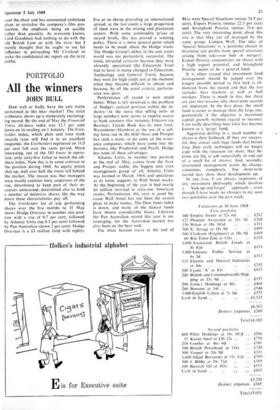

Previous page

Previous page